When hospice reverts to the lowest common denominator and leaders obsess about metrics, it's time to speak. Self-inflated leaders assume clinicians give until their backs break, given no raises for years. A clinical ladder is a rainbow’s pot of gold. Others have a sorrier job and must be motivated by money. Abysmal leaders dangle extrinsic rewards for admission, hiring and EDBITA targets. “Sign on” bonuses entice people into a poor work environment. Employees’ voice equals their raise, zero.

Tuesday, March 31, 2015

Today Triggers $6 million for Kindred CEO

StrangeTony,

Within two weeks Kindred CEO Paul Diaz will receive a check for $6 million. I consider it his bounty for bagging Gentiva. This comes after Kindred wrote a check to David Causby for $1 million. It's the Louisville Lottery but only senior managers can win. You retired in the nick of time.

Between his recent stock sales with $1.3 million in proceeds and Diaz' $6 million check Kindred's CEO could easily retire. He won't give up completely, but Paul is taking up the Board Vice Chairman role for Kindred. The vice part seems to fit.

Anonymous (from Gentiva)

Monday, March 16, 2015

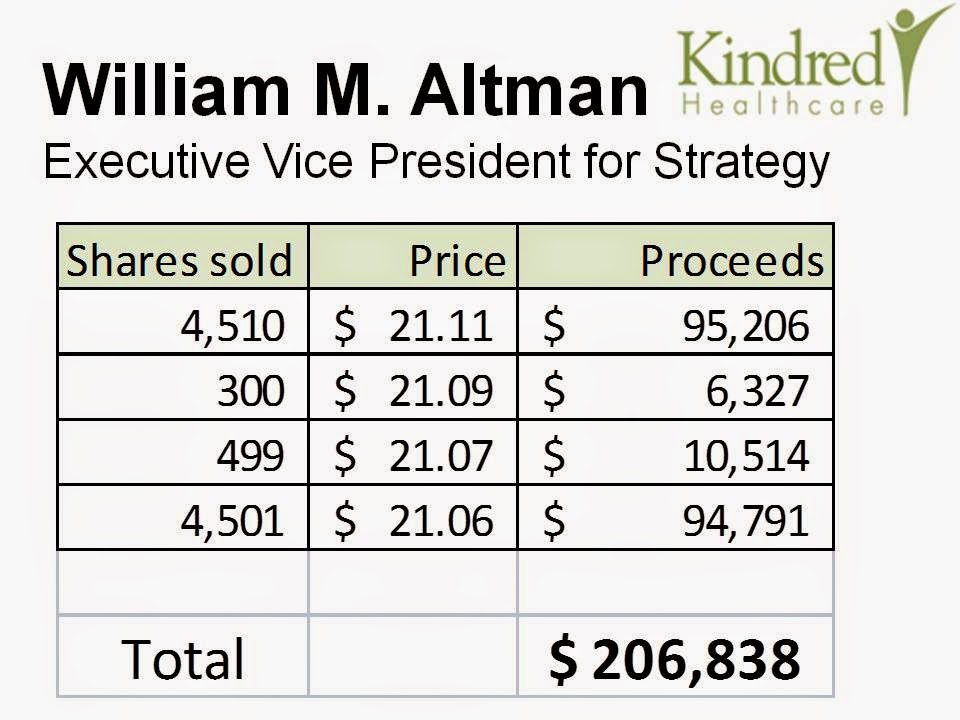

Kindred VP's Strategic Stock Sale

Wednesday, March 11, 2015

KND Earnings Call Puts Gentiva in Spotlight

Kindred CEO Paul Diaz and his lieutenants spoke frequently of Gentiva during their Q1 earnings call.

We’re also very pleased with Gentiva’s strong results in the fourth quarter and for the full year of 2014, which reaffirms our confidence in the combination.

Strong results is clearly overstating the case. Gentiva ended 2014 well below expectations generated when Gentiva purchased Harden Healthcare's hospices and home health agencies.

On a pro-forma basis the company should be able to generate revenues between $2.1 and $2.2 billion, while adjusted EBITDA should come in between $210 and $220 million, excluding share-based compensation.

My take on the expectation shortfall:

Gentiva financially engineered much of Harden's value into thin air in 2014, evaporating $16 to $26 million in adjusted EBITDA and $110 to $210 million in expected revenues

This could be restated as:

"After underperforming financially for eight months of 2014, the management team rallied to produce an acceptable number. We didn't mention human resources or customer service losses because finance is all that matters."

Kindred issued the same refrain for its purchase of Gentiva:

The addition of Gentiva will support and enhance our financial performance and will create significant value for our patients and shareholders.

Referral sources and employees were not mentioned in the equation. as neither is of considerable value. Customers spoke loudly the last six months and few bragged about our financial performance or value for shareholders.

Gentiva's David Causby stands to gain as President of Kindred at Home from meeting budget and cost saving targets. Diaz continued on the earnings call:

Gentiva, I think has been and will continue to be one of, if not the best run home health companies in the country. There’s obviously been a number of struggles on the hospice side coming off of a number of years post Odyssey, but I think their team has a great handle on what’s happening in that business as well, with a lot of changes that we’ve made there.

Gentiva proved they don't understand hospice in countless ways, from high pressure sales tactics to ignoring and reducing benefits for employees. After Gentiva leaders realized they couldn't run hospice effectively, they intermingled it with home health though its OneGentiva initiative.

OneGentiva drove away a significant chunk of Harden's revenue. What will happen under the next David Causby led integration? .

There are some systems integration around payroll and benefits and some things that we’ll have to work on into 2016. But to tell you Chad, I mean our goal is really to do our best to stay out of the way of what is really a great group and a great team with some really sophisticated systems, a great sales pipeline and sales process, a group that’s executing extremely well. They have good processes in place and we’re just trying to let them continue to be who they are.

Gentiva's leaders excel at one thing, micromanaging dollars. That's it. Earnings call language indicates Kindred is cut from the same cloth. This came from the SEC filing:

On August 13, 2014, Gentiva management and its financial advisors met with Kindred to address preliminary due diligence questions raised by Kindred and its advisors.

Gentiva slashed jobs in late August 2014 while Kindred conducted due diligence in Atlanta. These actions caused our hospice's customer service scores to plummet. This should not have been a surprise. Staff shared patient complaints in weekly meetings.

Gentiva executives and underlings consistently turned their back to the consequences of their actions. Shooting the messenger remains alive and well. Image must be maintained, even if it has no basis in reality.

Kindred has clear expectations of beating $35 million in cost savings and $20-$30 million in revenue synergies by year end.

A lot of that is front ended and we have a great planning process to - let me just say, we have a high degree of confidence on our ability to achieve the $35 million of realized. There will be a big portion of that obviously that will come earlier than later, but it’s all of the above than what you described. It’s people, process, systems, redundancies, not running two public companies, there is a lot of things out there that we’re continuing to work on and that, as I said, we have a high confidence we’ll achieve it before the end of the year.

Hospice discord arises from running a team enterprise in a non-collaborative manner. This "great planning process" never expressed at our site under prior corporate ownership. Every major change the last few years provided no opportunity for employee input. Zero. It appears Kindred will continue this sad trend.

Our new capital structure will carry interest costs totaling roughly $230 million.

Kindred's interest expense for 2013 was $108 million, while Gentiva incurred $113 million for the same year. That $9 million increase must come from somewhere.

We expect our maintenance CapEx, or what we call routine CapEx to be approximately $120 million to $130 million for the year. This includes $100 million to $110 million per year of CapEx that has been traditional for Kindred, plus roughly $20 million for Gentiva.

This amounts to $5 million on a quarterly basis, higher than Gentiva's traditional $3 to $3.5 million per quarter. For Gentiva's 46,000 employees, as listed in a Kindred-Gentiva combination presentation, the $20 million in capital expenditures equals $435 per employee. That doesn't sound like enough money to fund an electronic medical record system.

Q1 2015 is around the corner. The Kindred-Gentiva story will have more chapters written. We'll see if Kindred understands hospice any better than Gentiva. The Magic 8 Ball is skeptical.

Thursday, March 5, 2015

Kindred at Home: Causby's Compensation

StrangeTony,

You picked a great time to retire. I ran across this document outlining pay and benefits for David Causby, President of Kindred At Home (formerly Gentiva).

A base salary (“Base Salary”) of $550,000 per year payable in equal installments in accordance with the Company’s normal payroll procedures. Executive may receive increases in his Base Salary from time to time, as approved by the Board.

(b) In addition to Base Salary, Executive shall be entitled to receive bonuses and other incentive compensation as the Board may approve from time to time, including participation in the Company’s annual short-term incentive compensation plan and long-term incentive compensation plan, in accordance with the terms and conditions of such plans as may be in effect from time to time, subject to the following:(1) For 2015, the Executive’s target bonus under the short-term incentive plan shall be 60% of Base Salary and his maximum bonus under the short-term incentive plan shall be 101.25% of Base Salary;

(2) For 2015, the Executive’s target bonus under the long-term incentive plan shall be 50% of Base Salary and his maximum bonus under the long-term incentive plan shall be 100% of Base Salary.

Here's the scary part for Gentiva's long time employees, especially given customer service scores are nowhere to be found.:

1. Bonus of $500,000 for leadership of a successful integration of Gentiva into Parent;

2. Bonus of $250,000 for achievement of one-year synergies expected to be achieved in connection with the Merger

3. Bonus of $250,000 for attainment of 2015 Gentiva budget targets.

It's all budgets and cost cutting. I expect service cuts to negatively impact revenue, just as when Gentiva integrated Harden and later when the company enacted cuts for the last four months of 2014.

Plotting to garner Mr. Causby his $1 million in bonus money is likely in high gear as I write. This comes after Kindred put $1 million cash in Causby's pocket on February 2nd.

In consideration for the provisions relating to non-competition, non-solicitation and confidentiality set forth in Sections 12, 13 and 14 of this Agreement, upon the Effective Date, Executive shall be entitled to a one-time, non-refundable lump-sum cash payment of One Million Dollars ($1,000,000) which shall be paid by the Company within thirty (30) days following the Effective Date. Kindred Healthcare, Inc. hereby guarantees the Company’s obligation to pay Executive this One Million Dollar ($1,000,000) payment, and in the event the Company fails to pay within thirty (30) days of the Effective Date, Kindred Healthcare, Inc. shall make the payment to Executive within five (5) business days.There's much more to Mr. Causby's compensation. For those with a strong stomach I offer:

a one-time grant to Executive of 135,940 restricted stock units of Kindred Healthcare, Inc., with such grant to be effective on the Effective Date (February 2nd)The above totals roughly $7 million to $7.5 million. How many Gentiva employees need to be squeezed down or out to pay an incentivized Causby?

a grant of an equity stock award to Executive with a grant date fair value, as reasonably determined by the Executive Compensation Committee, of 150% of Base Salary, which shall be in the form of fifty percent (50%) restricted stock units and fifty percent (50%) performance stock units

Employee satisfaction and customer service have always been in the rear seat at Gentiva. Like the Jeff Gordon commercial Gentiva employees are the poor schlep in the back seat of David Causby's runaway cab. Kindred took away our seatbelt. Causby's on a mission and hospice service be damned.

Anonymous (from Gentiva)

Wednesday, March 4, 2015

Generic Retirement: Any Gifts?

Strange Tony,

Congratulations on your retirement. What did Generic Hospice give you for decades of quality performance? Was it a gold watch, a fancy pen, maybe a 19 gun salute? More likely it was a security escort from the building while you hauled your box of memorabilia. To honor your character the guard searched your belongings for any potential booty that might cause great financial harm to Generic. Can't harm those executive bonuses.

My new company cast stock upon the waters for Kindred executives on February 23rd. Paul Diaz received $1 million in stock. His $6 million check will trigger for payment on March 31. That's $7 million in five weeks. Gentiva's David Causby already has $1 million in Kindred stock (at today's stock close).

Good thing you didn't steal any ink cartridges, reams of paper or file folders. Otherwise that security escort becomes a one gun apprehension. Stay safe, my friend. Please write when you get the opportunity.

Anonymous (from Gentiva)

Monday, March 2, 2015

Strange Tony Retires

Gentiva's Anonymous,

I have announced my retirement from Generic Hospice, as our service has become mere dressing on an edifice of profitability. Senior executives wax on about quality customer service whilst decimating the very same. Service has succumbed to the corporate obsession of finance. Everything else takes a back seat.

I am retiring with funds I saved through our 403(b) and what is left of Social Security. Should I need palliative care I will call my former coworkers, scattered across the plethora of hospices in our town. Surely, one of these great nurses who once brightened Generic Hospice's door will still have their love for patients should I need care. There are some things corporations cannot destroy, even with their over reliance on judgement and manipulations.

Here's my wish for you and all who work in hospice:

May your light shine on your patients.

May your ear be sound and strong.

May you journey with others as needed,

walking in both heights and depths

and as long as hospice hearts exists,

a glimpse of God's love will be available.

May your boss know how to listen.

May your coworkers have your back.

May your eyes shine love to all around;

your tears fall soft upon the ground

and until we write again,

may God hold you in the center of his infinite love.

There is a fight to retain the heart and soul of hospice. Otherwise it is but a dressed up version of home health. In my retirement I bequeath you this blog. Godspeed,

Strange Tony (I lived hospice at its best)

Subscribe to:

Posts (Atom)