When hospice reverts to the lowest common denominator and leaders obsess about metrics, it's time to speak. Self-inflated leaders assume clinicians give until their backs break, given no raises for years. A clinical ladder is a rainbow’s pot of gold. Others have a sorrier job and must be motivated by money. Abysmal leaders dangle extrinsic rewards for admission, hiring and EDBITA targets. “Sign on” bonuses entice people into a poor work environment. Employees’ voice equals their raise, zero.

Sunday, January 31, 2016

Executive Message on Kindred Jobs

StrangeTony,

A Kindred employment banner states "Not all jobs are created equal." That sums it up for many Gentiva folks, who've seen benefits deteriorate and pay continue to stagnate. Cash flow is off to a good start under the combined companies and employees can see who is getting much of the proceeds. Senior management spoke truth with their jobs statement. It's fitting caregivers are pictured as unequal. We couldn't be more lowly in their eyes.

Anonymous (from Kindred, where executives make themselves at home)

Monday, January 25, 2016

Kindred Covers CFO Conflict with Money Shower

StrangeTony,

A division of Kindred recently purchased the home from CFO Stephen Farber due to conflicts with his neighbors over a shared driveway. A Louisville newspaper chronicled the series of skirmishes.

In a dispute that eight attorneys from three law firms have been unable to resolve, three business titans in Glenview, one of America’s richest cities, have fought over a driveway that for decades had been peaceably shared.The biggest casualty of the Battle of Glenview Avenue is a grove of majestic trees that were cut down and bulldozed last month, to the chagrin of neighbors, who say about 40 trees and 2,000 years of growth were destroyed.“At a time in which Louisville is trying to amplify its tree canopy, this kind of evisceration is sad and upsetting,” said Jay McGowan, the president of Bellarmine University, who lives next door in a mansion donated to the school.“You would hope that adults could do better,” he added.

On Dec. 18, the Farbers sold their house and property for $2.15 million to a company owned by his employer, Kindred.

Eleven days later, the trees came down at the company’s direction.Kindred and its spokeswoman, Susan Moss, declined to respond to emails, but the company apparently decided it had to build a new drive to the home so it could be sold to a future purchaser.

The article described Farber as "the $910,000-a-year executive vice president and chief financial officer of Kindred Healthcare." It also cited "massive” renovation of the Farbers' $1.7 million home." Zillow indicated the home last sold for $1.7 million on April 1st, 2014. A building permit indicated a $150,000 renovation for 2,100 square feet of the 6,000 square foot home.

A Kindred company paid $300,000 more than $1.85 million Farber spent to buy and renovate their home. The purchase came in December, after Kindred gave Farber a one time $250,000 payment to aid in his relocation. There was no SEC filing on the company buying his house at a significant premium just weeks later.

Apparently boards finance multiple moves as Farber, the recipient of nearly $1.9 in executive pay in 2014, received $110,000 of that amount for relocation expenses.

Did this topic arise in the question and answer session at J. P. Morgan's recent healthcare conference. If so, did any analysts ask how much Kindred got for the lumber?

Did this topic arise in the question and answer session at J. P. Morgan's recent healthcare conference. If so, did any analysts ask how much Kindred got for the lumber?

Anonymous (from Kindredful)

Friday, January 22, 2016

Kindred Best Practice: Executive Enrichment at Employee Expense

StrangeTony,

Thought you might be interested in Kindred's recent presentation at the J.P. Morgan Healthcare Conference. Kindred President Ben Breier began with an overview of the company. In that segment he said, "We now have over 100,000 teammates across the country, most of those are front line caregivers." He said these caregivers and Kindred's culture focuses on caring for patients, providers, referral sources and family

Kindred's capital structure is strong with over $300 million in operating cash flow and $150 million in free cash flow. You might think this is great news for employees, many of whom have gone years without raises.

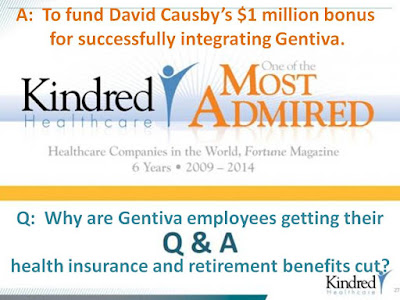

Nope. It's hard to believe Kindred's executives could take more from employees than Gentiva's mendacious lot. Kindred's Chief Peephole Officer promised a robust choice of health insurance plans to legacy Gentiva employees. He failed to mention not one plan had a physician co-pay benefit. There was no coaching from Kindred leaders on how employees should plan to keep seeing any specialty physicians.

I'll venture most Legacy Gentiva employees have no idea what is happening with their 401(k) other than it shifted from Milliman to T. Rowe Price. Apparently Kindred's harmonizing of benefits involves treating the information as if it belongs in Fort Knox. Kindred does not talk about reductions in health insurance or retirement benefits for acquired Gentiva employees. Workers have to stumble over it when they try to get healthcare or struggle to set aside money for retirement.

Contrast Kindred's practice of not being up front with benefit changes and why they are needed with this:

Kindred's benefit cuts and corresponding silence don't fit with admiration. It feels like dishonesty with a dash of condescension.

The presentation listed a Q&A session, often held in a different room at the event site. The replay lacked this often critical and informative piece. So we don't know if any analysts asked about the Justice Department settlement. I'm sure none of them asked how Kindred takes care of its people.

Kindred pursues the lowest bar in its treatment of legacy Gentiva employees. We endured the unjust enrichment of Gentiva's senior leaders as former CEO Tony Strange praised "employees for creating the company's value." Kindred's crop of C-Suiters wants to ride us harder.

Kindred senior leaders behave much like the sorry Gentiva lot. Breier failed to mention how employees should respond to questions about Kindred's recent $125 million settlement with the Justice Department for improper therapy billing through its RehabCare division.

When Kindred bought out Gentiva proforma revenues for the combined company stood at $7.2 billion. That's now down to $7.1 billion (estimated for 2015). Actual 2015 revenue ended up $7.05 billion. It brings back Gentiva's revenue destructing integration of Harden.

Big bonuses for under-performing: It's a mutual best practice for leaders no longer admired.

Anonymous (from Gendred)

Thought you might be interested in Kindred's recent presentation at the J.P. Morgan Healthcare Conference. Kindred President Ben Breier began with an overview of the company. In that segment he said, "We now have over 100,000 teammates across the country, most of those are front line caregivers." He said these caregivers and Kindred's culture focuses on caring for patients, providers, referral sources and family

Kindred's capital structure is strong with over $300 million in operating cash flow and $150 million in free cash flow. You might think this is great news for employees, many of whom have gone years without raises.

Nope. It's hard to believe Kindred's executives could take more from employees than Gentiva's mendacious lot. Kindred's Chief Peephole Officer promised a robust choice of health insurance plans to legacy Gentiva employees. He failed to mention not one plan had a physician co-pay benefit. There was no coaching from Kindred leaders on how employees should plan to keep seeing any specialty physicians.

I'll venture most Legacy Gentiva employees have no idea what is happening with their 401(k) other than it shifted from Milliman to T. Rowe Price. Apparently Kindred's harmonizing of benefits involves treating the information as if it belongs in Fort Knox. Kindred does not talk about reductions in health insurance or retirement benefits for acquired Gentiva employees. Workers have to stumble over it when they try to get healthcare or struggle to set aside money for retirement.

Contrast Kindred's practice of not being up front with benefit changes and why they are needed with this:

"We admire the hard work and dedication you have put into making Gentiva an outstanding organization and want to share our mutual best practices as we become an even stronger organization."

Kindred's benefit cuts and corresponding silence don't fit with admiration. It feels like dishonesty with a dash of condescension.

The presentation listed a Q&A session, often held in a different room at the event site. The replay lacked this often critical and informative piece. So we don't know if any analysts asked about the Justice Department settlement. I'm sure none of them asked how Kindred takes care of its people.

Kindred pursues the lowest bar in its treatment of legacy Gentiva employees. We endured the unjust enrichment of Gentiva's senior leaders as former CEO Tony Strange praised "employees for creating the company's value." Kindred's crop of C-Suiters wants to ride us harder.

Kindred senior leaders behave much like the sorry Gentiva lot. Breier failed to mention how employees should respond to questions about Kindred's recent $125 million settlement with the Justice Department for improper therapy billing through its RehabCare division.

When Kindred bought out Gentiva proforma revenues for the combined company stood at $7.2 billion. That's now down to $7.1 billion (estimated for 2015). Actual 2015 revenue ended up $7.05 billion. It brings back Gentiva's revenue destructing integration of Harden.

Big bonuses for under-performing: It's a mutual best practice for leaders no longer admired.

Anonymous (from Gendred)

Tuesday, January 12, 2016

Kindred Settles with Justice Department for $125 million

StrangeTony,

Kindred's presentation at the J.P. Morgan Healthcare Conference could be more interesting, given the company's announcement of a $125 million settlement with the federal government over fraudulent billing practices by its RehabCare division.

The questionable billing/kickback practices occurred from January 1, 2009 to September 30, 2013. Kindred bought RehabCare on June 1, 2011.

And this bigger reimbursement did what to the Kindred manager's pay? Herein lies the evil in healthcare today where pay for performance becomes pay for distortion (or extortion in the case of Kindred).

I doubt Kindred executives talk much at all about the settlement, calling it yesterday's news. That news caused a new 52 week low of $9.23 in the company's stock price. Will the J.P. Morgan investor presentation stem the freefall in Kindred's stock price from a high of $24.66?

Anonymous from Kindred

Kindred's presentation at the J.P. Morgan Healthcare Conference could be more interesting, given the company's announcement of a $125 million settlement with the federal government over fraudulent billing practices by its RehabCare division.

The questionable billing/kickback practices occurred from January 1, 2009 to September 30, 2013. Kindred bought RehabCare on June 1, 2011.

The Justice Department alleged Kindred presumptively placed patients in the ultrahigh category, which requires 720 minutes of therapy a week. They said Kindred reported therapy minutes had been provided when patients were sleeping or unable to benefit from the treatment, among other allegations.

Sometimes managers pressured therapists to provide more services, according to court records.

According to a therapist’s note filed in the suit, the therapist wanted to discharge a patient on April 10, 2011. But, a RehabCare manager instructed the therapist to keep the patient an extra couple of days because the facility “needed to have the minutes so that they would get a ‘bigger reimbursement,’” the note said.

And this bigger reimbursement did what to the Kindred manager's pay? Herein lies the evil in healthcare today where pay for performance becomes pay for distortion (or extortion in the case of Kindred).

I doubt Kindred executives talk much at all about the settlement, calling it yesterday's news. That news caused a new 52 week low of $9.23 in the company's stock price. Will the J.P. Morgan investor presentation stem the freefall in Kindred's stock price from a high of $24.66?

Anonymous from Kindred

Wednesday, January 6, 2016

Stock Granted to Kindred Executives

StrangeTony,

Two Kindred executives received thousands of shares of company stock for free according to SEC filings dated January 4, 2016.

Both stock grants came in early 2016, the new year that brought many Kindred employees greatly decreased health insurance benefits. Executives at the top pretend to value employees but there is very little evidence of that at the local level. They couldn't be honest with staff about the necessity for big changes and how to best minimize the impact.

Kindred announced a presentation next week at the JP Morgan Healthcare Conference. The press release offered:

Pure hogwash. These executives, like the Gentiva lot before them, serve themselves. They do so handsomely.

Anonymous (from Kentiva)

Two Kindred executives received thousands of shares of company stock for free according to SEC filings dated January 4, 2016.

LANDENWICH JOSEPH L

Received 20,000 shares of KND common stock for a price of $0.00. Landenwich is Kindred's Corporate Counsel and General Secretary.

KALMEY PETE K

Received 10,000 shares of KND common stock for a price of $0.00. Kalmey is President of Kindred's Hospital Division.

Both stock grants came in early 2016, the new year that brought many Kindred employees greatly decreased health insurance benefits. Executives at the top pretend to value employees but there is very little evidence of that at the local level. They couldn't be honest with staff about the necessity for big changes and how to best minimize the impact.

Kindred announced a presentation next week at the JP Morgan Healthcare Conference. The press release offered:

Kindred’s mission is to promote healing, provide hope, preserve dignity and produce value for each patient, resident, family member, customer, employee and shareholder we serve.

Pure hogwash. These executives, like the Gentiva lot before them, serve themselves. They do so handsomely.

Anonymous (from Kentiva)

Subscribe to:

Posts (Atom)