StrangeTony,

Kindred's board loaded up senior management's stock coffers one last time before the big sellout. Kindred President Ben Breier received $500,000 in stock as the buyout nears. Kindred at Home's David Causby got $250,000. Employees have to wait until corporate vultures take over to learn whether a raise is in the works. Many at our hospice site have gone years without a bump up in pay. I'm confident TPG and WCAS have the ability to take the heart out of hospice.

Anonymous (from Kingly Kindred where executives dine royally)

When hospice reverts to the lowest common denominator and leaders obsess about metrics, it's time to speak. Self-inflated leaders assume clinicians give until their backs break, given no raises for years. A clinical ladder is a rainbow’s pot of gold. Others have a sorrier job and must be motivated by money. Abysmal leaders dangle extrinsic rewards for admission, hiring and EDBITA targets. “Sign on” bonuses entice people into a poor work environment. Employees’ voice equals their raise, zero.

Wednesday, February 21, 2018

Monday, February 12, 2018

Raining Riches for Kindred Executives

Strange Tony,

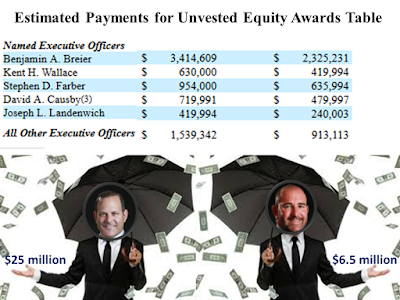

Thought you and Former Gentiva CEO Tony Strange would be interested in these tables from Kindred filings with the Securities and Exchange Commission. They show how much Kindred executives make by selling the company on the cheap to Humana and two private equity firms.

Kindred President Ben Breier will be enriched by nearly $25 million and David Causby by over $6.5 million under the deal provisions. Each man could garner more from the $10 million retention bonus pool.

The Executive Team gets a king's ransom for selling out after consistently missing performance expectations. What's wrong with this picture?

Anonymous (inside the now absurd Kindredful)

Saturday, February 10, 2018

Q3 Earnings Call Flashback

Strange Tony,

Kindred executives spoke to Wall Street analysts about Q3 earnings on November 12, 2017. At that point the company was deep in buyout discussions with the consortium of Humana and private equity firms TPG Capital and Welsh, Carson, Anderson and Stowe. November 13-14, 2017 saw Humana's Bruce Broussard meeting with Kindred at Home President David Causby to discuss his role in general with the company.

Kindred executives indicated expected 2018 EBITDA in the Q3 earnings call. This number is important as the Humana/TPG/WCAS buyout has been expressed as a multiple of this number, 8 times EBITDA.

For the third quarter of 2017, we had core EBITDA of $84 million; and for 2018, we expect core EBITDA to be in the range of $500 million to $530 million, with $515 million at the midpoint.

As we've discussed previously, given our significant balance of NOLs, which we expect to be $550 million to $600 million at the end of this year, we expect our cash income tax payments to be less than 10% of core book tax liability for some time to come.

Oddly TPG and WCAS will be paid 10.5 to 11.5 EBITDA by Humana under their put/call arrangement. It's not clear how three years of majority private equity ownership increases the value of the company by 31 to 44%, but those are the deal elements.

Kindred's Ben Brier and other executives were pleased with labor costs in the Q3 earnings call.

Labor cost improvement in Kindred at Home and some of these other items that we've been talking about, we have maybe a quarter or two quarters of it under our belt and you'll see that continue to drive it up to baseline as we annualize.

We made significant progress on our labor cost for our home health business, despite a challenging labor market. Our direct labor cost per visit for this business was down 3.7% from prior year. If you recall, this is an area that had been a significant challenge for us

On the hospice side of the business, core EBITDAR grew 11%, driven by strong revenue per patient day growth of 2.7%, effective cost controls through tight labor management and an ongoing optimization of our branch network.

In communications with employees on the buyout Breier punted benefit and wage changes to summer 2018 and new owners. He hasn't said a word about negotiations regarding compensation and treatment of employees. Breier shared that information with the board five days before the announced buyout.

On December 14, 2017 Mr. Breier provided an update on developments in the negotiations relating to compensation and treatment of employees, and updated the Board that, as previously authorized by the Board, both he and David Causby were negotiating term sheets for their future employment with HospitalCo and HomecareCo, respectively.

The Q3 earnings call indicated Kindred plans to have 1.5 million more shares of stock in 2018.

Moving now to share count, as previously disclosed, we expect fully diluted weighted average share count for 2017 of roughly 88.5 million shares and our 2018 outlook anticipates a weighted average share count of approximately 90 million shares.

I expect board members and executives to garner most of the additional 1.5 million shares.

Here's a nod to the developing Humana deal.

As the managed care and Medicare Advantage environment grows, you'll continue to see us take more Medicare Advantage episodically paid patients.

Medicare Advantage plans are big business for Humana. And the buyout is big money for Ben Breier (nearly $25 million) and David Causby (over $6.5 million). Employees not taken out in the pretakeover culling will find our "big money" after summer 2018.

Anonymous (from continuously executive enriched Kindred)

Thursday, February 8, 2018

Kindred Sells on the Cheap

Strange Tony,

Kindred executives and board began exploring the sale of the company to private equity firms in Spring 2016. Kindred purchased Gentiva and Centerre in early 2015 in order to become America's premier post acute care company. Just over a year later they began a sale process that will result in the fracturing of the company's core strategy.

Kindred executives had the gall to use Wall Street analyst comments as support for their sellout

"There still isn't a clear strategy here other than survival."--Mizuho Securities 11-7-2017

That statement is rather damning to senior executives and the board as they are responsible for corporate strategy.

"Even after the SNF business sale, KND remains highly leveraged" -- Bank of America/Merrill Lynch 11-7-2017

Leverage soared because of the botched sale of the nursing home division. Dumping the SNF business on the cheap hurt Kindred's balance sheet. Kindred executives and the board loaded the company with debt. The irony is they will sell a levered Kindred to private equity firms who utilize even higher leverage.

The buyout process was marked by an unusual development. The longer the bidding went on the lower the offers became. They ticked up slightly at the very end.

The consortium is buying Kindred for 8x projected 2018 EBITDA. When Humana goes to buyout the 60% owned by TPG and WCAS it will pay 10.5 to 11.5 EBITDA. Should EBITDA remain stable the two private equity firms will garner a premium of 31 to 44% relative to their initial investment. How much cash will the consortium have pulled out of Kindred prior to the parties exercising their put/call option?

Kindred employees have been told there is no raise again this year and the new owners will be exploring benefits and compensation. Gentiva employees experienced a significant benefit reduction prior to joining Kindred. Kindred's core value is taking care of their people, but that does not seem to include employees.

Humana CEO Bruce Broussard said Kindred's cash would be used for acquisitions.

On the home side, we'll continue to build out geographic presence over time. It's not an urgency for us today, but we would do it through the Kindred platform. They, traditionally, as you probably know, have always been in the market of buying smaller agencies and being able to expand their geographic coverage. And so we would do it through the capital that would be coming from the cash flow of the Kindred and use it from that particular capital base.

Also, the consortium will set aside up to $10 million for retention bonuses to entice Kindred leaders to stay until the end of 2018. Rest assured this pot of money will be targeted toward the executive suite, which will be richly rewarded in the buyout. But that's for another post.

Anonymous (hoping for a Humana like raise and bonus)

Monday, February 5, 2018

Less Likely Kindred Bid Will Increase

Strange Tony,

Kindred Healthcare's stock price closed at $9.05 today, just above the takeout price of $9 per share announced December 19, 2017. Over the last six weeks the stock rose as high as $9.825, roughly 10% above the deal price. At that point the buyers were betting on someone offering a higher bid or the current consortium sweetening their price. This sentiment waned in the last week.

It's not clear how much shopping the Kindred board did before signing the deal with Humana, private equity players TPG Capital and WCAS, and a Canadian pension firm to sell Kindred for $810 million.

Curiously, seven Kindred board members have ties to private equity. They are intimately familiar with private equity's desire to buy undervalued companies on the cheap. That means greater profits on the flip.

Kindred board members know how private equity incentivizes executives and board members who bring them a favorable deal. Board member Sharad Mansukani, M. D., is a senior advisor for TPG Capital since 2005. He joined the Kindred board in October 2015. While he abstained from voting on the sellout it's not clear what role he played on either side of the deal as it developed, as well as what role he will play for TPG post closing.

Kindred directors are familiar with the practice of investing minimal equity for maximum returns. It's not clear how much of the $810 million will be from cash vs. debt. Buyers will need to refinance Kindred's $3.2 billion in debt. Oddly, Kindred will give Ventas an extra 10% on rent and an additional $5 million to keep quiet and not challenge the merger.

Investor Brigade Capital believes the deal significantly undervalues Kindred based on management's representations in the Q3 earnings call. The problem is Kindred executives consistently failed to meet their EBITDAR promises to Wall Street since buying Gentiva and Centerre. Executives talked growth while they shrank the company.

Moody's placed Kindred debt under review when the deal was announced. Their analysis cited Kindred's "free cash flow of around $150 million and substantial cash balances, which Moody's anticipates will exceed $250 million by the end of 2017."

By the end of 2018 that amounts to $400 million in cash, nearly half of the $810 million purchase price. Kindred's strong cash position makes the sale price even cheaper for acquiring firms.

Kindred executives drove down the value of the company from $1.7 billion (equity at end of 2016) to a mere $410 million (the buyout price less cash and 2018 cash flow). How does a competent board reward an executive team that drove down equity by 76% so corporate raiders could take out the company at a deep discount? It's visionary mismanagement.

Anonymous (still waiting for crumbs to fall from Kindred executives' table)

Sunday, February 4, 2018

Dark Times Ahead

Strange Tony,

Kindred at Home executives will likely impose cuts in the coming months. New owners prefer painful measures occur before they take over.

This happened to our hospice when Kindred aggressively pursued Gentiva in 2014. Gentiva executives undertook a number of initiatives to optimize financials. A few cost cutting measures harmed employees but most damaged patient care. Kindred undid many of these absurd moves after taking over in February 2015, but it kept in place employee benefit cuts.

Our new Kindred AVP heard feedback from hospice staff and deduced Kindred at Home President David Causby must be an a--hole. That was his exact word. The VP said they'd never met Causby but based on what they'd heard from employees that statement must be true. Gentiva COO Causby rose to Kindred at Home President and will remain in that role under the majority private equity owned consortium.

In July 2014 a former founder of a for-profit hospice shared his concerns about hospice private equity ownership:

“I don’t think the entrance of venture capital and private equity into the hospice world in a very aggressive way is good for what hospice is about and tries to do,” he said. “I think it’s a threat.”Generic Hospice wrote about the same threat in November 2014. Kindred's home health, hospice and community care division will be 60% owned by private equity firms and Humana will hold 40%.

He saw investor groups eyeing hospices not as he did—“it’s my life’s work”—but strictly for short-term gains: “Programs have been started so they can run for a year and be sold, so somebody can make money flipping them and go to the next place and start again.”

TPG Capital and Welsh, Carson, Anderson and Stowe expect to make significant money from their Kindred stake. Humana can acquire all of Kindred over a five year period.

Kindred employees may see Humana as the most benevolent party in the ownership group. That may not be true. Humana cut nearly 6% of its workforce (2,700 employees) in the third quarter of 2017. The company took a $124 million restructuring charge in the third quarter. They did so in a period of exceptional financial results. I'm sure the eliminated Humana employees felt differently about the company's outperformance.

In December 2017 Humana announced a $3 billion stock buyback through 2020. The amount increased from $2.25 billion.

In mid January 2018 Humana announced bonuses and raises of an unspecified amount for an unspecified number of its employees.

News reports say Humana is also considering passing cash back to shareholders via a special dividend. The Louisville newspaper reported cash engorged Humana is looking for acquisitions. It cited the Humana-Kindred deal which creates a transformative clinical model serving Humana's members in the home.

If Humana is flush with cash why did it partner with two private equity firms to buy Kindred at Home? Why would it take a minority stake and engineer a complex five year buyout scenario for a critical corporate strategy? It doesn't make sense.

The future of our hospice darkens under majority private equity ownership. There are no signs of 2018 raises, much less bonuses. Kindred currently has $250 million in cash that will likely go to executives, board members and our new majority private equity owners.

Hospice employees hold on. The ride could turn rough soon.

Anonymous (still waiting for a crumb from the executive table)

Subscribe to:

Comments (Atom)