Strange Tony,

Employees received a "Moving Forward" communication last December. It said:

Q. What should I do during the transition?Leaders cut five critical office positions under the ruse that technology would fill the gap created by their absence. Unstable cloud technology and a home health medical record system created gobs of scheduling work that did not exist previously. The company obstructed the delivery of compassionate care to the point that talented, dedicated, long-term employees are talking of leaving.

A. It is business as usual for all of us at Kindred and your responsibilities will not change. Please continue to act with the same dedication and focus that you always have as you deliver compassionate care to your patients and support your fellow colleagues.

Our local director shared our owners Humana/WCAS/TPG cut our holidays 25% for 2019. We no longer have an Employee Appreciation Day or our Floating Holiday. Curo pays straight time, not time and a half, for holidays. That change would mean a 33% holiday pay cut in addition to the 25% decrease in the number of paid holidays.

Last December executives informed employees:

Q. What changes will Kindred employees experience?Little to no change turned into decimating our hospice. Co-workers learned other sites are experiencing the same destruction in service levels. As stated above our leaders and new owners determined these changes which cause suffering for patients, families and employees.

A. At the field level, we expect there will be little to no change. At this early stage we do not yet know the effect on support-level positions, but we expect that the separation into two new companies will create exciting opportunities for many of our employees. A team consisting of members of Kindred leadership as well as leaders from our other partners in this transaction is hard at work to determine how best to position these two new companies for success.

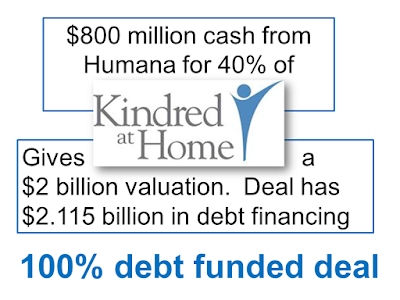

Our leaders hold significant equity positions in our company. Disturbingly, they will be enriched by the harm they have inflicted. Cutting two benefit days and paying straight time on holidays will save the company at least $12 million. That will flow to the bottom line as measured by EBITDA.

Humana will buy the rest of our company (60%) by paying a multiple of EBITDA. The holiday benefit cut will add $100 million to Humana's purchase price. C Suite executives will get a chunk of that.

Humana, WCAS, TPG and our executives inflicted employee pain for their earthly gain. The cuts come after years with no raises. Recent Kindred/Curo/Humana corporate moves indicate more cuts are likely.

Humana's new Chief Strategy Officer comes from another financial rapscallion, The Carlyle Group.

In the role of Chief Strategy and Corporate Development Officer, Agrawal will report directly to Humana President and CEO Bruce Broussard, and will serve as a member of Humana’s Management Team. Agrawal will be responsible for advancing the company’s strategic insights and planning process, establishing direction for merger, acquisition and joint venture activities, while maximizing capabilities to create competitive advantage.In the same press release Humana announced that CFO Brian Kane, originally from Goldman Sachs, would lead Humana's Care Delivery efforts, likely the future home of Kindred at Home should Humana eventually buy the remainder of our company.

Agrawal brings more than 20 years of experience in planning and implementing strategies to drive growth and performance improvement across publicly traded and privately held health care organizations. He comes to Humana from The Carlyle Group, a Washington, D.C.-based financial services and investment firm, where he served as Senior Advisor.

Previously, Agrawal oversaw strategy for Ciox Health, a health care information management company, as President and Chief Growth Officer. Agrawal has also served as President of Harris Healthcare Solutions and Partner at McKinsey and Company.

Humana's buyout brought staff cuts, worse health insurance and holiday benefit cuts which stand to further enrich our senior executives. Employees are clearly moving backwards. Those with standards will fight back or leave. Our employees want to work for a local hospice that provides outstanding care. It's a shame we have to look outside our company to find one.

Anonymous (from a once great hospice site with lots of heartbroken staff)