When hospice reverts to the lowest common denominator and leaders obsess about metrics, it's time to speak. Self-inflated leaders assume clinicians give until their backs break, given no raises for years. A clinical ladder is a rainbow’s pot of gold. Others have a sorrier job and must be motivated by money. Abysmal leaders dangle extrinsic rewards for admission, hiring and EDBITA targets. “Sign on” bonuses entice people into a poor work environment. Employees’ voice equals their raise, zero.

Saturday, May 26, 2018

Kindred to Squeeze Hospice Division into Curo

Strange Tony,

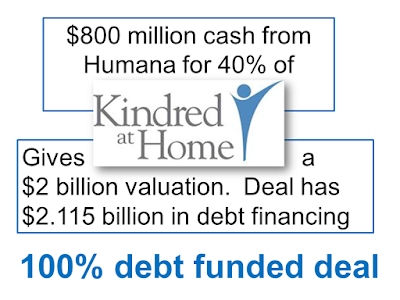

Kindred at Home's new owners, Humana and two financial rapscallions, plan to combine its hospice division with Curo Health Services, another hospice acquisition. The bigger hospice entity will be put under the smaller. Curo has more hospice sites but Kindred's do more than twice the work as reflected by revenue numbers.

Curo has been owned by two different financial rapscallions. Curo management knows the language and needs of greedy owners. They skillfully met their owner's needs for cash and return. This bodes ill for hospice employees with a calling to do good work in this world.

Both Curo and Kindred are highly levered, i.e. each has a big mortgage to pay with lots of interest expense.

Kindred even cited high leverage as a reason to sellout.

Oddly Kindred at Home will tackle its leverage problem by nearly doubling the amount of debt associated with the deal.

So many aspects of Kindred's sellout make no sense under God's laws or timeless business principles. We are but a bet by greedy leaders that they can dance on the edge of a financial razor blade and be enriched beyond all measure. Judgement will come, maybe not on this earth or in our time, but it will come. Lord, help us all.

Anonymous

Subscribe to:

Post Comments (Atom)

The amount of debt for the deal is now well north of $2.1 billion. It's rated less than investment grade.

ReplyDeleteFinal borrowings were $3 billion. This could end badly.

ReplyDelete