StrangeTony,

Kindred's Chief People Officer spoke the usual nice words in his pre-enrollment employee benefit presentation. He said benefits have become "very strategic" for companies and that Kindred will spend over $250 million on benefits in 2016. That $250 million is spread over 100,000 employees, roughly $2,500 per employee.

The Chief People Officer said benefits can "distinguish an employer." He went on to talk about the new benefits platform that would supposedly look familiar to Gentiva employees. He said legacy Gentiva would experience a similar platform, process and providers.

Kindred went to bid with 50,000 covered lives, which means the company provides health insurance to less than half of their employees (as the 50,000 includes dependents).

Kindred hired Mercer to run their health exchange in order to "leverage scale to drive cost, quality and choice." He noted Kindred's history of passing reduced benefit costs to employees and the company's bearing the lion's share of any cost increases.

He did not speak to Gentiva's benefit history of doing the opposite by taking savings and passing increases to employees. Over the last two years the company cut its contribution to employee health insurance 17%. Employee contributions increased 18% from 2012 to 2014.

Dental insurance painted a similar picture. Employee costs for dental rose 21%, while the company cut its contribution by 3%.

Kindred's Chief People Officer did not address Gentiva's going long periods of time with no raises.

Gentiva employees, with our mostly stagnant wages, entered Kindred's benefit renewal having picked up the lion's share of cost increases and gotten no medical or dental savings. Gentiva executives pocketed the windfall in the corporate vault, which likely upped executive pay.

Gentiva employees know Rod Windley, Tony Strange, Eric Slusser, Jeff Shaner and Charlotte Weaver took their change in control money and ran. Given Gentiva COO David Causby is now President of Kindred at Home continued benefit reductions are likely the order of the day.

Acquired Gentiva employees experienced open enrollment only to find lesser insurance. The company omitted office visit copays for both primary care and specialty physician visits. Dental insurance looks to nearly double for lesser coverage. It's clear benefits are strategic to Kindred in a Gentiva-like manner. However, Kindred is sneakier than Gentiva executives in that they won't reveal the company's benefit contributions on the paystub.

I believe the man who spoke to legacy Gentiva employees should be re-titled Chief Peephole Officer. His peephole peers into Kindred's corporate vault, where even more buyout synergies will accumulate courtesy of employees paying a greater share of 2016 benefit costs. Kindred's dash for benefit cash hit directly in the pocketbook. How big will the savings be for the company?

Anonymous (from executive enriching Gentiva-Kindred)

When hospice reverts to the lowest common denominator and leaders obsess about metrics, it's time to speak. Self-inflated leaders assume clinicians give until their backs break, given no raises for years. A clinical ladder is a rainbow’s pot of gold. Others have a sorrier job and must be motivated by money. Abysmal leaders dangle extrinsic rewards for admission, hiring and EDBITA targets. “Sign on” bonuses entice people into a poor work environment. Employees’ voice equals their raise, zero.

Saturday, December 12, 2015

Sunday, November 29, 2015

Thankful for Retirement

Anonymous,

Before I retired I'd noticed the disconnect between language used by executives and their actions toward hospice employees. Generic Hospice employees suffered similar injustices as you've experienced under Gentiva, now Kindred. Although I must say Generic Hospice executives lacked the complete tone deafness of Kindred's leaders. Who gets $110,000 in relocation reimbursement and deserves another $250,000 for moving nearly two years after the hire? It's not a lowly hospice employee.

I noticed a Kindred subsidiary will pay the $250,000. It would be mildly interesting to know which one. It would be sad if it were the hospice division with staff burdened by health insurance cuts.

Our longtime medical director, a very talented hospice physician, advised executives to take care of their people with good pay, benefits, openness and respect. He'd seen properly treated staff provide great hospice care with little turnover. Last I heard he is widely ignored by Generic executives and turnover is through the roof. What does he know with decades of hospice experience?

Healthcare has become bizarre with the over-enrichment of management to the detriment of staff. The obsession of corporate profits over service is similarly distressing. These two pipers will be paid. I don't know how or when but it will happen. Just observing from my rocker,

StrangeTony

Before I retired I'd noticed the disconnect between language used by executives and their actions toward hospice employees. Generic Hospice employees suffered similar injustices as you've experienced under Gentiva, now Kindred. Although I must say Generic Hospice executives lacked the complete tone deafness of Kindred's leaders. Who gets $110,000 in relocation reimbursement and deserves another $250,000 for moving nearly two years after the hire? It's not a lowly hospice employee.

I noticed a Kindred subsidiary will pay the $250,000. It would be mildly interesting to know which one. It would be sad if it were the hospice division with staff burdened by health insurance cuts.

Our longtime medical director, a very talented hospice physician, advised executives to take care of their people with good pay, benefits, openness and respect. He'd seen properly treated staff provide great hospice care with little turnover. Last I heard he is widely ignored by Generic executives and turnover is through the roof. What does he know with decades of hospice experience?

Healthcare has become bizarre with the over-enrichment of management to the detriment of staff. The obsession of corporate profits over service is similarly distressing. These two pipers will be paid. I don't know how or when but it will happen. Just observing from my rocker,

StrangeTony

Thursday, November 26, 2015

Kindred Executive's Deep Appreciation

StrangeTony.

On this Thanksgiving it's important for Kindred/Gentiva employees to show our appreciation for the kind words executives share during quarterly earnings analyst calls. This comes from the August Q2 earnings call.

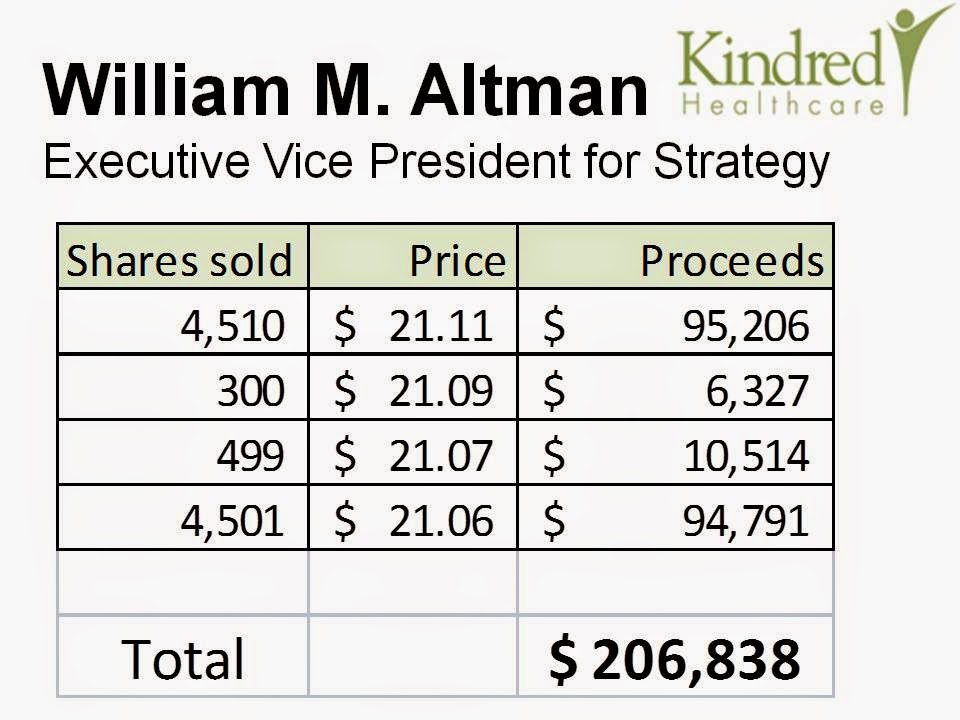

A recent SEC filing shows who benefits from the direct result of more than 100,000 teammates.

The extra $250,000 smells like a way to push money to a fellow member of the executive team, which actually got a raise in 2014:.

How can they appreciate us so deeply without knowing the slightest thing about us? It's a shallow form of appreciation, akin to happiness from profiting off the backs of "teammates." It's a one sided engagement.

Anonymous (from Gendred)

On this Thanksgiving it's important for Kindred/Gentiva employees to show our appreciation for the kind words executives share during quarterly earnings analyst calls. This comes from the August Q2 earnings call.

Let me start as I usually do by extending my deep appreciation on behalf of the entire leadership team to our more than 100,000 teammates across the country. Each day, our partners at Kindred work hard to improve the lives of the more than 1 million patients we care for. The excellent care delivery and clinical outcomes we generate are the direct result of their efforts.Here's the most recent Q3 call from early November:

Let me start as I usually do by extending my deep appreciation on behalf of the entire leadership team to our more than 100,000 team mates across the country. Each day our partners at Kindred work hard to improve the lives of the more than 1 million patients we care for annually. The excellent care, delivery and clinical outcomes we generate are the direct results of their efforts.Those employees finished enrolling in benefits for 2016 and many found worse health insurance and diminished paid time off benefits in the newly integrated Kindred. Is this what Kindred President Ben Breier meant when he spoke to analysts in August?

But we just received back our employee engagement surveys last week. We do an employee engagement survey on the whole company, and I would say it's a good time to be at Kindred. The culture is very strong here and we'll continue to make sure that we keep our ear to the ground and do right by our employees.Oddly, he didn't bring up the survey in the November call. The survey is a faded memory at our hospice site. All the talk of doing better has been followed by virtually no action.

A recent SEC filing shows who benefits from the direct result of more than 100,000 teammates.

On November 25, 2015, a subsidiary of Kindred Healthcare, Inc. (the “Company”) entered into an Agreement with Mr. Stephen D. Farber, the Company’s Executive Vice President and Chief Financial Officer, pursuant to which Mr. Farber will receive a one-time payment of $250,000 to offset relocation and other costs incurred by Mr. Farber in connection with his relocation to Louisville, Kentucky.Mr. Farber served as CFO for Rural/Metro, an ambulance company that entered bankruptcy in August 2013. The private equity arm of Warburg Pincus purchased Rural/Metro in March 2011. Farber served as CFO for serial ethics abuser Tenet Healthcare until 2005 when he left to start an analytics company focused on collecting hospital bills. Kindred hired Farber in February 2014.

Kindred Healthcare, Inc. (“Kindred” or the “Company”) (NYSE:KND) today announced the appointment of Stephen D. Farber as Executive Vice President, Chief Financial Officer, effective February 3, 2014.Who waits twenty months to come up with a moving package, especially as the company already had a contract with Mr. Farber?

• The Committee entered into a new employment agreement with Mr. Farber, the Company’s new Chief Financial Officer, to complete the succession plan from the Company’s previous chief financial officer.Farber's contract resulted in $1,889,389 in executive compensation for 2014, with over $110,000 in "relocation reimbursement."

The extra $250,000 smells like a way to push money to a fellow member of the executive team, which actually got a raise in 2014:.

• The Committee approved base salary increases and equity awards for the executive officers to maintain competitive total direct compensation generally within the 25th to 50th percentile of the Company’s peers; andKindred at Home President David Causby has a potential $1 million bonus based on achieving integration cost savings:

The integration of Gentiva in Kindred at Home continues to proceed extremely well. I'm very pleased to announce that we're on track to exceed our previously stated goal for synergy realization this year by approximately $10 million. We now expect to realize synergies of roughly $45 million during 2015 and we also believe that we're on track to exceed our stated goal of $70 million in synergies by the end of 2016 and we'll provide more specifics on our next quarterly conference call.We'll see if the color on 2016 includes benefit savings, experienced as reductions by the more than 100,000 team mates. Many people in our office have not seen a raise in years and are struggling to deal with rising healthcare expenses.

How can they appreciate us so deeply without knowing the slightest thing about us? It's a shallow form of appreciation, akin to happiness from profiting off the backs of "teammates." It's a one sided engagement.

Anonymous (from Gendred)

Saturday, November 14, 2015

Kindred Slashes Coverage for Many Gentiva Employees

StrangeTony,

Courting comes with such lofty words. Consider these from a December 2014 edition of "Better Together".

The corporate marriage was consummated in February 2015. Kindred's Chief People Officer promised a smattering of plans for employees to choose from and informed Gentiva employees the health insurance marketplace would be familiar to them. He assured California employees they would continue to have access to their HMO, which ensures physician access through a primary care gatekeeper.

The marketplace I viewed bore no resemblance to Gentiva 2015, which had at least two levels of insurance coverage higher than anything Kindred is offering for 2016. I searched for coverage for physician visits like my current plan, $X copay for a primary care visit and $XX for a specialist visit.

I could not find one plan with this basic feature. Kindred omitted the "ro" and has a bust of a benefits package available to many employees, especially those outside California.

Anonymous (from Gendred)

Courting comes with such lofty words. Consider these from a December 2014 edition of "Better Together".

We know that many of you have questions specific to what benefits – including insurance, 401(k), and PTO– will look like for the combined company, and we want to reassure you that our Integration teams are hard at work to address these issues. We are committed to providing a robust benefits package for our teammates within the combined company, and as soon as we have a better idea of what that will look like, we will share a comprehensive communication with you.

The corporate marriage was consummated in February 2015. Kindred's Chief People Officer promised a smattering of plans for employees to choose from and informed Gentiva employees the health insurance marketplace would be familiar to them. He assured California employees they would continue to have access to their HMO, which ensures physician access through a primary care gatekeeper.

The marketplace I viewed bore no resemblance to Gentiva 2015, which had at least two levels of insurance coverage higher than anything Kindred is offering for 2016. I searched for coverage for physician visits like my current plan, $X copay for a primary care visit and $XX for a specialist visit.

I could not find one plan with this basic feature. Kindred omitted the "ro" and has a bust of a benefits package available to many employees, especially those outside California.

Anonymous (from Gendred)

Wednesday, November 4, 2015

DOJ Settlement Looms

StrangeTony,

After hours news revealed:

Anonymous (from Kindred)

After hours news revealed:

Kindred Healthcare confirmed it is engaged in active discussions with the DOJ in an effort to find a mutually acceptable resolution to the investigation of RehabCare Group (KND) :The skeleton dances with renewed vigor.

Based on the progress of continuing settlement discussions through October 2015, the Company, in accordance with GAAP, recorded an additional $30 million loss provision in the third quarter of 2015 (for a total loss reserve of $125 million) related to this matter. The Company recorded a $95 million loss reserve for this matter in the first quarter of 2015 and disclosed an estimated settlement range of $95 million to $125 million. The Company accrued the estimated loss contingency in the first quarter of 2015 at the minimum of the estimated range in accordance with GAAP as no amount within that range was a better estimate than any other amount. These continuing settlement discussions also indicate that a corporate integrity agreement will likely be required as part of any final settlement related to this matter.

The discussions are ongoing, and until they are concluded, there can be no certainty about the timing or likelihood of a definitive resolution, the scope of any potential restrictions that may be agreed upon in connection with a settlement or the cost of a final settlement.

Anonymous (from Kindred)

Sunday, November 1, 2015

Earnings Call & New Board Member

StrangeTony,

Thank you for your words of wisdom to render unto Caesar that which is Caesar's. This week looks like rendering time with third quarter earnings scheduled for after hours release on November 4th and Kindred's earnings call the next morning.

We may need the other mourning for Kindred's new board member. YahooFinance reported:

Dr. Mansukani worked for Health & Human Services, specifically on the new prescription drug benefit which became known as Medicare Part D and Medicare Advantage health plans. Private equity companies have mined both arenas for huge profits.

Consider this blast from the past, which shows how Mansukani navigated both sides of health care public policy for big profits, corporate and personal.

Speaking of re-branding one has to wonder how name changes for Gentiva sites are impacting volumes? Gentiva trashed much of the value of Harden Healthcare's hospice and home health sites with its botched re-branding. Might Kindred make a similar mistake?

Thursday's earnings call may shed some color on that. Will it be red or black? Dr. Mansukani is off to a strong personal financial start with over 11,000 restricted shares of Kindred stock. That will help him continue to speak the language of business in the boardroom. It's definitely not the language of quality.

Anonymous (from the re-branded Gentiva)

Thank you for your words of wisdom to render unto Caesar that which is Caesar's. This week looks like rendering time with third quarter earnings scheduled for after hours release on November 4th and Kindred's earnings call the next morning.

We may need the other mourning for Kindred's new board member. YahooFinance reported:

Kindred Healthcare, Inc. (“Kindred” or the “Company”) (KND) today announced that its Board of Directors has appointed Dr. Sharad Mansukani to the Board effective immediately.Kindred already has a COO from private equity. Now it's adding a board member from a company that makes money from buying and selling companies. This is not a good sign, given private equity's propensity to put their profits over everything else. Mansukani isn't new to private equity. He's been with TPG since March 2005. That's over a decade and reflects allegiance to the private equity model and all its management distortions..

Dr. Mansukani serves as a Senior Advisor to TPG (formerly Texas Pacific Group), a global private equity investment firm with a capital portfolio of over $74 billion, and as Strategic Advisor to the Board of Directors of Cigna Corp.

Dr. Mansukani worked for Health & Human Services, specifically on the new prescription drug benefit which became known as Medicare Part D and Medicare Advantage health plans. Private equity companies have mined both arenas for huge profits.

Consider this blast from the past, which shows how Mansukani navigated both sides of health care public policy for big profits, corporate and personal.

However, to succeed Medicare prescription drug plans (PDPs) need a lot more. Enter NationsHealth (NASDQ: NHRX, NHRXW, NXRXU). This nimble, fast-growing player demonstrated its chops by successfully enrolling and servicing over two million seniors in Medicare drug discount cards. No small feat. Sharad Mansukani, MD, NationsHealth's new chief strategic officer and a business-savvy authority on Part D, was most recently a senior advisor to Medicare Administrator Mark B. McClellan, MD, PhD.Revolving door Mansukani did a fellowship in quality management at Wharton Business School. Apparently he missed the part where leveraged buyout organizations, since re-branded private equity, are anathema to quality. The world's greatest quality guru spoke those very words.

By teaming with NationsHealth, the folks at CIGNA are showing the market they understand the critical importance of having a enrollment and customer service infrastructure that is flexible, scalable, AND Medicare savvy.

Speaking of re-branding one has to wonder how name changes for Gentiva sites are impacting volumes? Gentiva trashed much of the value of Harden Healthcare's hospice and home health sites with its botched re-branding. Might Kindred make a similar mistake?

Thursday's earnings call may shed some color on that. Will it be red or black? Dr. Mansukani is off to a strong personal financial start with over 11,000 restricted shares of Kindred stock. That will help him continue to speak the language of business in the boardroom. It's definitely not the language of quality.

Anonymous (from the re-branded Gentiva)

Wednesday, October 14, 2015

It's Time to Return to the Eternal

Anonymous,

Hospice workers know what material possessions we carry into the next world. None, nada, zip. We've seen and experienced people who chose to right relationships while they could, apologized for past transgressions, told friends and family they love them and made the most of each and every moment. People who followed their heart, spreading love, reconciliation and joy, often spoke of incredible visions as death neared. They experienced beautiful scenes with loved ones who'd gone before.

Yet most of us work for hospice companies that obsess over the material, collapse everything into money and measures, where management practices reveal an underlying distrust, even disgust, of employees and palpable ignorance of intrinsic human motivation.

What are hospice workers to do? Render unto Caesar that which is Caesar's. Caesar's taxes and head counts are an older version of Gentiva/Kindred's productivity measures and EBITDAR targets. The corporate outcome-obsession steamrolls shiny mission statements and values that might actually inspire in a two way relationship. Top executives issue double bind decrees, no-win situations the little people must do their best to interpret and follow. They are damned if they do and damned if they don't. It's a sick spirit.

Unrealistic executive orders, that ultimately finger employees for failure, must be rendered back to the ugly senior management that spouted them. It's their ball, the only one to which they train their senses. Management's eyes sport dollar-sign shaped pupils. Their ears are steel drums which resonate solely with management exhortations delivered at a cadence only they can hear.

It is a time for prayer, for each of us to ask for God's protection of people who continue to live the heart of hospice inside a corporate Skinner box.

StrangeTony

Hospice workers know what material possessions we carry into the next world. None, nada, zip. We've seen and experienced people who chose to right relationships while they could, apologized for past transgressions, told friends and family they love them and made the most of each and every moment. People who followed their heart, spreading love, reconciliation and joy, often spoke of incredible visions as death neared. They experienced beautiful scenes with loved ones who'd gone before.

Yet most of us work for hospice companies that obsess over the material, collapse everything into money and measures, where management practices reveal an underlying distrust, even disgust, of employees and palpable ignorance of intrinsic human motivation.

What are hospice workers to do? Render unto Caesar that which is Caesar's. Caesar's taxes and head counts are an older version of Gentiva/Kindred's productivity measures and EBITDAR targets. The corporate outcome-obsession steamrolls shiny mission statements and values that might actually inspire in a two way relationship. Top executives issue double bind decrees, no-win situations the little people must do their best to interpret and follow. They are damned if they do and damned if they don't. It's a sick spirit.

Unrealistic executive orders, that ultimately finger employees for failure, must be rendered back to the ugly senior management that spouted them. It's their ball, the only one to which they train their senses. Management's eyes sport dollar-sign shaped pupils. Their ears are steel drums which resonate solely with management exhortations delivered at a cadence only they can hear.

It is a time for prayer, for each of us to ask for God's protection of people who continue to live the heart of hospice inside a corporate Skinner box.

Lord help us set aside management discounts, manipulations and pursuit of surface images for real relationships, ones with depth and hearing, compassion and caring. Let us feed one another in ways that respect, honor and nurture. Give us the strength to do this in the midst of chaos driven by management inattention to eternal things. For all who lead hospice organizations change the focus of their eyes and tone of their hearing to align with and support the realization of your will. Help us create glimpses of heaven on earth with our words and actions, our thoughts and touch.May you be feed with eternal things such that you can help others.

StrangeTony

Sunday, October 4, 2015

Paul Diaz Gives Away Roughly 25% of his KND Stock

StrangeTony,

Speaking of the lottery. Longtime Kindred President Paul Diaz stepped away from day to day responsibilities in March, elevating to Vice Chairman of Kindred's Board. Last week Diaz gave away over 100,000 of his 400,000 shares of Kindred stock to an unknown entity. On September 25th the gift was worth over $1.9 million. The filing did not indicate if Diaz gave the stock to a relative or a nonprofit, like the University of Louisville where Diaz sits on the Board of Trustees.

The timing may be coincidental but two top Kindred leaders sold or gave away millions in stock in the last few weeks. Kindred's stock happened to take a beating over this period, down some 25%. Trading volume soared as well as the third quarter came to a close. We live in interesting times.

Anonymous (from Gendred, a Gentiva-Kindred company)

Speaking of the lottery. Longtime Kindred President Paul Diaz stepped away from day to day responsibilities in March, elevating to Vice Chairman of Kindred's Board. Last week Diaz gave away over 100,000 of his 400,000 shares of Kindred stock to an unknown entity. On September 25th the gift was worth over $1.9 million. The filing did not indicate if Diaz gave the stock to a relative or a nonprofit, like the University of Louisville where Diaz sits on the Board of Trustees.

The timing may be coincidental but two top Kindred leaders sold or gave away millions in stock in the last few weeks. Kindred's stock happened to take a beating over this period, down some 25%. Trading volume soared as well as the third quarter came to a close. We live in interesting times.

Anonymous (from Gendred, a Gentiva-Kindred company)

Sunday, September 27, 2015

Corporate Toxins

Anonymous,

Retirement remains wonderful. I was surprised by the time it took to detoxify from Generic Hospice. It wasn't physically demanding like drug withdrawal but it took weeks to a full month for my body to expel Generic's corporate toxins. I realized their poisons arose from company psychopathy, characterized by a corporate brain hyper-sensitive to reward and under-sensitive to the suffering of others. I venture that's what you're experiencing at your hospice site.

Beware. The corporate psychopathic brain is vengeful, hypersensitive to punishing those it views as being in opposition. It is both emotional and logical, given opposers could hurt their chances for reward.

You think you're making points that thoughtful leaders would explore. Their myopia sees their career or the company at risk. It also underlies what you describe as Gentiva executives' penchant for personalizing issues (shooting the messenger) and retaliating.

I imagine it's a very dangerous time in the life of Gentiva-Kindred employees. A shiny, new corporate image must be upheld and merger promises must be met, thus ensuring top leaders get their out-sized rewards. The pyschopathic corporation does not play fair and it knows no bounds. Everything is permissible as long as management wins for themselves. I hope you win the lottery and can join me in retirement.

StrangeTony

Retirement remains wonderful. I was surprised by the time it took to detoxify from Generic Hospice. It wasn't physically demanding like drug withdrawal but it took weeks to a full month for my body to expel Generic's corporate toxins. I realized their poisons arose from company psychopathy, characterized by a corporate brain hyper-sensitive to reward and under-sensitive to the suffering of others. I venture that's what you're experiencing at your hospice site.

Beware. The corporate psychopathic brain is vengeful, hypersensitive to punishing those it views as being in opposition. It is both emotional and logical, given opposers could hurt their chances for reward.

You think you're making points that thoughtful leaders would explore. Their myopia sees their career or the company at risk. It also underlies what you describe as Gentiva executives' penchant for personalizing issues (shooting the messenger) and retaliating.

I imagine it's a very dangerous time in the life of Gentiva-Kindred employees. A shiny, new corporate image must be upheld and merger promises must be met, thus ensuring top leaders get their out-sized rewards. The pyschopathic corporation does not play fair and it knows no bounds. Everything is permissible as long as management wins for themselves. I hope you win the lottery and can join me in retirement.

StrangeTony

Kindred Endorses Gentiva's Abusive Management

StrangeTony,

I receive e-mails from fellow employees sharing their stories of management malfeasance. I'd love to share them but Gentiva's leaders are so vengeful I can't risk doing so. We all have to earn a living and many of us choose to ignore our limited bosses to help patients in our community or simply to make a living..

I have good friends in HR, thankfully not with Gentiva. They were shocked when I told them some of the things management has said to our staff. It's consistently weird, like they have one hand open inviting us to speak our thoughts and the other hand cocked, ready to beat whoever says the wrong thing.

The wrong thing is any truth that conflicts with the company's dictates. It matters not if the truth comes from patients or employees. Both are easily discounted and cast aside. Heaven forbid anyone disturb the illusion that the company can have it all. Where in Kindred's or Gentiva's mission, vision or values does it state management should be enriched beyond measure? Nowhere, but that's clearly the top priority.

I had a modicum of hope Kindred would bring sanity to Gentiva's management absurdities but that has not been the case. Fortunately, we have intrinsically motivated staff who support one another. We've learned not to expect much from our limited leaders and to vigorously shower after prolonged contact. Retirement, it's a nice long term vision. How's yours?

Anonymous (from Gendred, a Gentiva-Kindred company)

I receive e-mails from fellow employees sharing their stories of management malfeasance. I'd love to share them but Gentiva's leaders are so vengeful I can't risk doing so. We all have to earn a living and many of us choose to ignore our limited bosses to help patients in our community or simply to make a living..

I have good friends in HR, thankfully not with Gentiva. They were shocked when I told them some of the things management has said to our staff. It's consistently weird, like they have one hand open inviting us to speak our thoughts and the other hand cocked, ready to beat whoever says the wrong thing.

The wrong thing is any truth that conflicts with the company's dictates. It matters not if the truth comes from patients or employees. Both are easily discounted and cast aside. Heaven forbid anyone disturb the illusion that the company can have it all. Where in Kindred's or Gentiva's mission, vision or values does it state management should be enriched beyond measure? Nowhere, but that's clearly the top priority.

I had a modicum of hope Kindred would bring sanity to Gentiva's management absurdities but that has not been the case. Fortunately, we have intrinsically motivated staff who support one another. We've learned not to expect much from our limited leaders and to vigorously shower after prolonged contact. Retirement, it's a nice long term vision. How's yours?

Anonymous (from Gendred, a Gentiva-Kindred company)

Tuesday, September 22, 2015

Breier's 122,625 Share Stock Sale

StrangeTony,

Kindred's President Ben Breier disposed of 122,625 shares for $19.15 per share on September 20, 2015. That represented 22% of Breir's total shares of Kindred. The reason for his sale of nearly $2,350,000 in stock is:

If $2.3 million is his tax liability Breier is getting a monster vesting. When will it hit?

Anonymous (from Gendred, a Gentiva-Kindred company)

Kindred's President Ben Breier disposed of 122,625 shares for $19.15 per share on September 20, 2015. That represented 22% of Breir's total shares of Kindred. The reason for his sale of nearly $2,350,000 in stock is:

F — Payment of exercise price or tax liability by delivering or withholding securities incident to the receipt, exercise or vesting of a security issued in accordance with Rule 16b-3

If $2.3 million is his tax liability Breier is getting a monster vesting. When will it hit?

Anonymous (from Gendred, a Gentiva-Kindred company)

Monday, September 21, 2015

Survey Says Management Doesn't Care to Know

StrangeTony,

The employee survey showed management does not communicate with staff, management does not support or show appreciation to staff, and employees have gone long periods without raises and feel underpaid. Management's response is "we don't really know who employees are talking about and what their specific issues are in each area. Thus, we don't know how to respond."

They can't stick their heads out of their office door and ask the seventy something clinicians and support staff for clarification? The survey group hasn't gone anywhere and are readily available to explore the results. Management doesn't want to know, which reinforces that they don't care. I'll be shocked if anyone fills out the survey next year. It's Dilbert in action at our hospice site.

Anonymous (from Gendred, a Gentiva-Kindred company)

The employee survey showed management does not communicate with staff, management does not support or show appreciation to staff, and employees have gone long periods without raises and feel underpaid. Management's response is "we don't really know who employees are talking about and what their specific issues are in each area. Thus, we don't know how to respond."

They can't stick their heads out of their office door and ask the seventy something clinicians and support staff for clarification? The survey group hasn't gone anywhere and are readily available to explore the results. Management doesn't want to know, which reinforces that they don't care. I'll be shocked if anyone fills out the survey next year. It's Dilbert in action at our hospice site.

Anonymous (from Gendred, a Gentiva-Kindred company)

Tuesday, September 15, 2015

Kindred's Skeleton Dance

StrangeTony,

It seems Gentiva's new owners have yet more skeletons in their closet:

PharMerica Corp. and Kindred Healthcare have agreed in principle to out-of-court settlements in a whistleblower suit that implicated the companies in alleged massive kickback schemes involving a popular anemia treatment medicine.

Amgen paid kickbacks to PharMerica, the second-largest pharmacy services company in long-term care, and Kindred Healthcare Inc., an operator of hospitals, LTAC hospitals, nursing homes and more, to induce providers and pharmacists to switch patients from the drug Procrit to Amgen's drug Aranesp.

Settlement details are expected with 45 days. The second story could produce skeltons at a Kindred hospital in California:

The striking nurses say working without a contract is not helping when it comes to patient care. Management has delayed an agreement for 20 months and during that time, the poor conditions that led us to organize in the first place, have continued to erode," says Janet Williams, an RN in the Medical/Surgical Unit who has worked there for more than 14 years, says in a union statement. "We feel we have no choice but to strike to ensure that these issues are addressed so we can deliver the highest quality of care for our patients all year long."

The last potential skeleton arose from a man who settled with Medicare for $1.7 billion for his company's fraudulent activities:

On Aug. 3, Florida Governor Rick Scott ordered audits on 29 hospitals that failed to meet an Aug. 1 deadline for the requested information. All the Kindred Hospitals were part of that list, including one in Ocala. Shands Live Oak Regional Medical Center in Suwannee County and Lake Butler Hospital in Union County also were on that first list.

Gentiva is now a Kindred company. Apparently, the buyer is as corrupt as Gentiva's former senior management team.

Anonymous (from Gendred, a Gentiva-Kindred company)

Saturday, August 29, 2015

Making Sense of Performance Nonsense

StrangeTony,

I received my performance review yesterday. It was plain and simple a character assassination, crudely crafted with no supporting information. The harshest of words were not spoken but planted like a cluster bomblet to come across later. A year's worth of hard work had been effectively reduced to two sentences.

"You are to check your mind at the door. Your thoughts, opinions, knowledge and experience are expressly not wanted here."

Later that day a co-worker sent me a handwritten note. It said:

"I received your thank-you note and words of appreciation. Very thoughtful and kind of you, so freely given. It is yet another example of the difference between Law and Spirit. When extrinsic Law is twisted or absent, Spirit can still work its magic, welling up from within.

You are the one deserving of thanks, for noticing a need and building another bridge to facilitate the addressing of that need. To me the process you fostered is the true supervision, the "epi-scopos" of early Christian communities. It was to be a service, not a dominion. As we've discussed many times, our society's companies are drunk on authoritarian pyramid which uses money and dismissal as its shackles and lashes. All the more insidious today in its sheep's clothing of shiny websites and hollow mission statements.

Thank you for taking the lonely path of the Hero. It doesn't matter whether it holds you in hospice or leads you elsewhere; it's golden and God-breathed, and it's in your blood and bones. Peace, friend!"

My true performance feedback arose from someone I work alongside in the service of others. That I will treasure in contrast to the nonsense from the person I report to in the organizational chart. I cut their's into perforated strips with segments sized roughly four inches by four inches. That way I can properly recycle the material.

Anonymous (from Gentiva a Kindred company)

Sunday, August 9, 2015

Uninspiring Leadership Highlights Business of Hospice

StrangeTony,

In case you miss the language of business being used to describe hospice, here's what Kindred executives said in last week's earnings call with Wall Street analysts:

Frank Morgan - RBC Capital Markets

Okay. And then you called out certainly how the hospice business is improving and we're certainly seeing a lot of other companies talk about that as well. But any high level thoughts on really what's driving this recovery that most people seem to be experiencing today?

Frank Morgan - RBC Capital MarketsOkay, and just one final one on the Hospice business, you mentioned the U-shaped curve, what's your assessment right now in terms of if you look at your length of stays, median length of stays, how do you think the U-shaped curve will impact that business in and ad hoc? Thank you.

Frank Morgan - RBC Capital MarketsOkay. Thanks.

Josh Rashkin - Barclays

Hey. Thanks. First question just on the hospice segment; it sounds like, Ben; you're obviously excited about that. I'm curious what your perspectives are if and when the hospice benefit actually moves into Medicare Advantage. Clearly, currently not part of that. Do you think that's a risk in the sense that the health plans manage those patients to a lower length of stay, or do you think potentially there's an opportunity because MA's been avoiding hospice costs because obviously they don't manage it right now. So I'm just curious what your perspectives are, if that actually occurs?

Josh Rashkin - BarclaysYeah. No. I mean, you've seen a lot of this movement towards slower side of care and clearly hospice is cheaper than any of the inpatient options. So I get that. I'm just – it's just you always worry about the way they manage the patient I guess. Second question around these duals moving into Managed Care on the hospital division, is there a way to contract? I mean have you guys reached out to some of these Medicaid health plans, particularly in California that are getting all of these duals assigned and try and be sort of proactive around the contracting and seeing how you can help and maybe get a case rate to your point as opposed to length of stay mattering, et cetera?

Josh Rashkin - BarclaysOkay. And then just last question on M&A and I know you guys have had a particularly busy year. But I'm curious what the appetite is today to continue to roll up sort of tuck ins in your markets and then maybe which segments are most attractive. And maybe lastly, how do you weigh that against debt repayment?

Unidentified Analyst

Hi, this is Frank on for Chris. Thanks for taking my question. I see you touched on this a bit earlier, but it looks like there was some lumpiness in the Hospice segment in the quarter. Can you just provide a little more color about how we should think about stabilization in that business going forward? Thanks a lot.

Nope. I hung up long ago.

Anonymous (from Gentiva: a Kindred at Home company)

In case you miss the language of business being used to describe hospice, here's what Kindred executives said in last week's earnings call with Wall Street analysts:

Moving now to Kindred at Home, which comprises our Home Health, Hospice, Community Care and Home-Based Primary Care businesses, we've had a terrific quarter. The leadership team in this division has really come together over the last six months, led by David Causby, the Division President. Revenue increased to $606 million this quarter and core EBITDAR contribution increased to $101 million. The integration of Gentiva and Kindred continues to proceed faster than our initial expectations and we remain on track to achieve our goal of $35 million of realized synergies in 2015.Several analysts asked questions about Kindred's hospice segment.

For our Home Health operations, total episodic admissions grew 6.5% and revenue increased 7.6%, both over prior-year quarter on a pro forma basis. For the Hospice segment, ADC improved 2.3% sequentially over the first quarter of 2015. We believe we have successfully stabilized our census over the past several months and are returning this Hospice segment to growth in light of recent policy changes by CMS, providing more clarity on the importance of the hospice benefit to Medicare beneficiaries, our continued focus on highly-effective palliative care programs and a deep belief that hospice save the Medicare system money while aiding greatly with end-of-life care, we are bullish on the growth potential of this segment over the next few years.

Frank Morgan - RBC Capital Markets

Okay. And then you called out certainly how the hospice business is improving and we're certainly seeing a lot of other companies talk about that as well. But any high level thoughts on really what's driving this recovery that most people seem to be experiencing today?

Benjamin Breier - President and Chief Executive OfficerI think if you listen, Frank, to what's coming out of policy makers in Washington, as I said in prepared remarks, I think that there is this growing parallel path that started to come together on two specific ideas. On the one hand, I think that – and for anybody on the call and lots of Americans out there who have gone through the path of having a loved one who's had to deal with and received some form of palliative care hospice card – as a qualitative benefit at end of life, it really is, I think, one of the most powerful things societally that we can give to our loved ones around caring for them at end of life. So on the one hand there's this undebatable qualitative nature to it.

And on the other hand, Frank, I think what policy makers are seeing on the reimbursement side of the world is that what is clear is that if you can have discussions earlier with family members and loved ones about end of life care and if you can make some decisions on where those loved ones are around end of life treatment, there is the potential, if I may, to talk about significant savings to the Medicare system if you use these services appropriately.

And so here you have a qualitative issue with a financial issue coming together and I think policy makers at CMS and others have looked at this and finally said, you know, this is a benefit that we probably ought to think about expanding, not contracting, and if you see some of the recent comments that came out of CMS around Medicare beneficiaries who are going to have the opportunity to participate in hospice at an earlier stage than what they might otherwise have been able to do, if you see what came out in the new payment policy around this U-shaped curve of – in terms of the way we manage hospice patients, and if we just watch ourselves what's happening from a patient day admission ADC trend, I think you have to be nothing but pretty bullish on what the future of the hospice delivery is and for us, we have almost a $700 million, $800 million Hospice business here at Kindred. It was, I think, one of the hidden jewels if you will, as part of the Gentiva integration and acquisition.

We're running the business very well and we're, as I said earlier, we're pretty bullish about our growth prospects in line.

Frank Morgan - RBC Capital MarketsOkay, and just one final one on the Hospice business, you mentioned the U-shaped curve, what's your assessment right now in terms of if you look at your length of stays, median length of stays, how do you think the U-shaped curve will impact that business in and ad hoc? Thank you.

Benjamin Breier - President and Chief Executive OfficerOur length of stay has historically been a little bit higher than others mostly because we're like 98%, 99% into the Routine Care business. We don't do much inpatient or continuous hospice care in our Hospice branches. I would say we're starting to see our lengths of stay come down slightly, irrespective of any payment changes that are happening and my general comment to the U-shaped curve is it will be net-neutral to slightly positive for us, although I would not be surprised if, Frank to your question specifically, lengths of stay come down a bit.

Frank Morgan - RBC Capital MarketsOkay. Thanks.

Josh Rashkin - Barclays

Hey. Thanks. First question just on the hospice segment; it sounds like, Ben; you're obviously excited about that. I'm curious what your perspectives are if and when the hospice benefit actually moves into Medicare Advantage. Clearly, currently not part of that. Do you think that's a risk in the sense that the health plans manage those patients to a lower length of stay, or do you think potentially there's an opportunity because MA's been avoiding hospice costs because obviously they don't manage it right now. So I'm just curious what your perspectives are, if that actually occurs?

Benjamin Breier - President and Chief Executive OfficerWell, I'll go back to my thesis, and or my hypothesis I guess, back to what I was talking about a few minutes ago. I understand your question and I think you're right to be – and all of us are right to be a little bit curious and concerned as patient benefits move from Medicare fee-for-service to Medicare Advantage, primarily because the MA plans have different thoughts in terms of how they manage utilizations. But Josh, if you go back to my hypothesis, which I think is right, that the hospice benefit is actually a net saver to the Medicare beneficiary and to the payer. I actually think that smart companies like Medicare Advantage that are looking to both be qualitative to their patients and their customers and managed costs, I think they're going to run to the hospice benefit, not away from it. I think.

Josh Rashkin - BarclaysYeah. No. I mean, you've seen a lot of this movement towards slower side of care and clearly hospice is cheaper than any of the inpatient options. So I get that. I'm just – it's just you always worry about the way they manage the patient I guess. Second question around these duals moving into Managed Care on the hospital division, is there a way to contract? I mean have you guys reached out to some of these Medicaid health plans, particularly in California that are getting all of these duals assigned and try and be sort of proactive around the contracting and seeing how you can help and maybe get a case rate to your point as opposed to length of stay mattering, et cetera?

Benjamin Breier - President and Chief Executive OfficerOh, absolutely, Josh. You should know. I mean, for the last 18 months as we were heading towards these demonstrations in California, as the state of California was picking who their Medicaid providers were going to be, our Managed Care folks, Franke Elliott, whose our Chief Managed Care Officer and his team of provider relations and contracting folks, I think we have something like 65 full time Managed Care folks now in our organization. They've worked collectively very hard to garner contract participation with; I think virtually all of the Medicaid managed providers out there, including negotiated rates, including a very good relationship with those payers in the state of California. And I think one of the reasons why we've been able to achieve so much of the movement into the Medicaid managed population is because of the work and the foundation we laid.

Provider relations and contract relations is always sort of an ongoing effort. You have to continually go back and talk about your value proposition, why rates should be what they should be. I think having the diverse market offering that we have in Southern California helps us in that regard. So we're on it. We're on it in a very meaningful way and we'll continue to pursue every path towards having good relationships with those payers as we can.

Josh Rashkin - BarclaysOkay. And then just last question on M&A and I know you guys have had a particularly busy year. But I'm curious what the appetite is today to continue to roll up sort of tuck ins in your markets and then maybe which segments are most attractive. And maybe lastly, how do you weigh that against debt repayment?

Benjamin Breier - President and Chief Executive OfficerWell, I think we're always trying to be opportunistic as we manage our investor's capital and as we think about our balance sheet. De-levering this company and paying down debt remains our number one priority. We have said that and focused on the idea that we want to integrate Gentiva. We want to gain all of the synergies that we think are available in that integration and acquisition. As Stephen mentioned, we're off to a great start this year, and we think that we'll meet and, we hope, exceed the expectations of what $70 million-plus that we laid out. Nothing helps de-lever our company more than getting those synergies and driving EBITDAR higher. So that's our first focus.

But I think, Josh, to your question more broadly, there are a lot of markets, particularly our integrated markets, where there are tuck-in opportunities and we have to continue to remain nimble and opportunistic. We have markets for instance where we might have a very significant home health presence and there may be a hospice branch that may be for sale. We'll certainly be on top of that.

Unidentified Analyst

Hi, this is Frank on for Chris. Thanks for taking my question. I see you touched on this a bit earlier, but it looks like there was some lumpiness in the Hospice segment in the quarter. Can you just provide a little more color about how we should think about stabilization in that business going forward? Thanks a lot.

Benjamin Breier - President and Chief Executive OfficerWell, I think – as I've commented a couple times, I think we've seen now five – I think it's five consecutive months or five out of the last six months, we've seen patient day and admission growth in this business. The trend after sort of stabilizing and flattening, I think, towards the back half of 2014, has really been the arrow I think pointing up.

Our operations are well intact, our sales teams are well intact, I think we have a really good sense of how we're managing the hospice patients. I think having some stability now in what the reimbursement environment looks like is going to be very helpful, and there is a little bit of seasonality in the Hospice business. I mean, certainly you'll see Hospice trends probably continue to go up, then flatten and probably a little bit down in Q4 before they return back to growth in Q1 of next year. But I would just generally say, the arrow, as I've said now a couple of times, is clearly pointed up in this business, and we remain very confident that we'll continue to show incremental performance there. Thank you.

Valued hospice employee, are you still there?

Nope. I hung up long ago.

Anonymous (from Gentiva: a Kindred at Home company)

Wednesday, August 5, 2015

Kindred Continues Crushing Heart of Hospice

StrangeTony,

Kindred's failed to turn Gentiva's tide of sick management, instead bolstering local leaders who don't listen, don't plan, don't communicate and don't improve. There's no word yet on the PwC employee survey. Rumors at our site suggest staff hammered the company and it's sorry leadership.

The very trends you felt before you retired have not abated. I'll venture tomorrow's earnings call will scream the language of finance, but it will be heartless. EBITDAR and leverage ratios will be the altar that Wall Street analysts worship.

You retired having experienced Generic Hospice's decimation of much that was good in hospice leadership. I'm not sure I will get that luxury. Kindred is at home with abysmal management, taking great offense at anyone who dare point out the simplest of management inabilities. The reaction, in many cases vastly overemphasized, reveals an underlying insecurity, damage, limited ability to see and/or hear.

Kindred's propensity is to rely on local leaders it can micromanage. Therefore, it will have to micromanage them. That leaves everyone in a precarious spot, as decisions will be made on partial information by leaders without knowledge of their site, it's history, it's local market and people who've come and gone from the site. One arbitrary move from layers above and careers are jeopardized. Spin rules while truths told go unheard. Truth's messenger is however eviscerated.

Anonymous (from Gentiva-a Kindred at Home company)

Kindred's failed to turn Gentiva's tide of sick management, instead bolstering local leaders who don't listen, don't plan, don't communicate and don't improve. There's no word yet on the PwC employee survey. Rumors at our site suggest staff hammered the company and it's sorry leadership.

The very trends you felt before you retired have not abated. I'll venture tomorrow's earnings call will scream the language of finance, but it will be heartless. EBITDAR and leverage ratios will be the altar that Wall Street analysts worship.

You retired having experienced Generic Hospice's decimation of much that was good in hospice leadership. I'm not sure I will get that luxury. Kindred is at home with abysmal management, taking great offense at anyone who dare point out the simplest of management inabilities. The reaction, in many cases vastly overemphasized, reveals an underlying insecurity, damage, limited ability to see and/or hear.

Kindred's propensity is to rely on local leaders it can micromanage. Therefore, it will have to micromanage them. That leaves everyone in a precarious spot, as decisions will be made on partial information by leaders without knowledge of their site, it's history, it's local market and people who've come and gone from the site. One arbitrary move from layers above and careers are jeopardized. Spin rules while truths told go unheard. Truth's messenger is however eviscerated.

Anonymous (from Gentiva-a Kindred at Home company)

Saturday, July 18, 2015

ALS Patient's Sad Situation at Vitas Hospice

Atlanta media reported contention between Vitas Hospice and ALS patient Hector Torres. AJC's article offered:

An Atlanta man battling ALS is fighting a hospice care facility to keep machines he needs to live. Hector Torres has to live his life hooked up to two machines that help keep him alive. "I'm dying. I'm suffocating, because I can't breathe," Torres said. He suffers from ALS, a disease that affects nerve cells in his brain and spinal cord.

ALS patients face a certain outcome, death. When the diaphragm weakens patients are unable to expel carbon dioxide in their lungs.

Torres told Channel 2's Tyisha Fernandes he needs two machines to breath, a ventilator and another to supply oxygen.

Vitas Hospice's medical team determined Torres needed assistance expelling carbon dioxide from his lungs and would benefit from prescribing oxygen.

Vitas Hospice officials were letting him use the machines in his home, but now that the location is under new management the hospice is taking back one of the machines.

The machines were prescribed as part of Mr. Torres hospice treatment, provided by Vitas, likely through a contract arrangement. New management should have nothing to do with giving Mr. Torres what he needs to treat his symptoms and keep him comfortable. The article gave this response from Vitas:

"They have to meet a criteria of having a life expectancy of less than six months. When a patient no longer meets that criteria, no hospice provider can offer them hospice services."

Frankly, this is a bizarre response. If Mr. Torres no longer meets hospice criteria Vitas must discharge him and arrange for other providers to pick up his care. Too much information is missing from this piece to understand what is going on.

1) What did the Interdisciplinary Hospice Team decide regarding Mr. Torres care?

2) Testing the impact of stopping one machine or the other can be done in the home without removing either machine. Was this done and what was learned?

3) What is new management charged with that impacted Mr. Torres' case? Was the charge to reduce durable medical equipment costs by a certain amount/percent?

4) Did Vitas staff inform Mr.Torres that he can rapidly switch hospices if he is not happy with his current hospice provider?

Unfortunately ALS patients have one path and hospice is the route. Reporters cannot know the nuances of care provision and the toxic nature of management obsessed with money and measures. They likely intertwine in this story, but there's more to learn. That said there's nothing innovative about not giving patients what they need to die free of pain and with dignity.

P.S. A Vitas hospice patient made the news again, but this time the police and courts were the bad guys.

Sunday, June 28, 2015

Listening Means Suspending Judgment

Anonymous,

I pondered your question about management not listening and offer the following: For one to listen they must stop talking, verbally and non-verbally. That includes suspending whatever agenda, perceptions, preconceived notions, desires, repulsions or judgements they may have. Their aim should be to fully and completely understand the person. Any notion of helping or problem solving should come after communication has been completed.

You also asked for "advice for hospice employees working for managers who say they believe in teamwork but act autocratically, who say they're open to input but never seek it, who hold it against employees finally fed up enough to take the risk to speak out." I offer several observations for those who must find their way in such circumstances.

There are ways of managing that appreciate the depth and complexity of life, that honor whole people in the workplace, that focus on the most important things (which is not numbers or money), that foster teamwork, trust and achieving great things. This cannot be done by control from above, whether it be edicts from senior executives, regional managers or local site leaders. "Doing to" people may achieve the illusion of success on shallow measures. This is as fleeting as the house built on sand.

"Doing with" is the only way to achieve success over time. Your company and site leader are limited in their vision. They obsess over measures that are not primary. They are not able to suspend their talking to hear.

People experiencing this form of management obtuseness and control are naturally frustrated. Yet, this is an opportunity for growth. I encourage you to observe that which is going on. Try to observe the whole room, including your reactions as situations unfold. What is being triggered in me? Why do I have this reaction at this time? If you can monitor and learn from your self-talk you can become a better listener.

The challenge is for you to become a better listener. What you learn from yourself and others will guide your future.

StrangeTony (from retirement)

I pondered your question about management not listening and offer the following: For one to listen they must stop talking, verbally and non-verbally. That includes suspending whatever agenda, perceptions, preconceived notions, desires, repulsions or judgements they may have. Their aim should be to fully and completely understand the person. Any notion of helping or problem solving should come after communication has been completed.

You also asked for "advice for hospice employees working for managers who say they believe in teamwork but act autocratically, who say they're open to input but never seek it, who hold it against employees finally fed up enough to take the risk to speak out." I offer several observations for those who must find their way in such circumstances.

There are ways of managing that appreciate the depth and complexity of life, that honor whole people in the workplace, that focus on the most important things (which is not numbers or money), that foster teamwork, trust and achieving great things. This cannot be done by control from above, whether it be edicts from senior executives, regional managers or local site leaders. "Doing to" people may achieve the illusion of success on shallow measures. This is as fleeting as the house built on sand.

"Doing with" is the only way to achieve success over time. Your company and site leader are limited in their vision. They obsess over measures that are not primary. They are not able to suspend their talking to hear.

People experiencing this form of management obtuseness and control are naturally frustrated. Yet, this is an opportunity for growth. I encourage you to observe that which is going on. Try to observe the whole room, including your reactions as situations unfold. What is being triggered in me? Why do I have this reaction at this time? If you can monitor and learn from your self-talk you can become a better listener.

The challenge is for you to become a better listener. What you learn from yourself and others will guide your future.

StrangeTony (from retirement)

Sunday, June 21, 2015

Anti-Teamwork: Management Doesn't Listen

StrangeTony,

Do you have any advice for hospice employees working for managers who say they believe in teamwork but act autocratically, who say they're open to input but never seek it, who hold it against employees finally fed up enough to take the risk to speak out?

This is all the more jarring in hospice with its interdisciplinary team emphasis. How can hospice be a team when management views us as a collection of individual parts that must be controlled, directed,, externally motivated, kept in the dark, even micromanaged?

My company lets anything go management wise as long as census and admissions are fine. They believe our Branch Manager is solely responsible for good volumes and positive budget performance, as opposed to the sixty seven non-management employees busting their backside to provide great service on a daily basis.

Should volumes drop our Branch Manager delegates blame to anyone but them. Corporate nits suddenly start hovering around looking for who to pressure, reduce or eliminate. They offer exhortations like "pick up the pace."

A wise physician's message to corporate types: Take care of patients and employees and census will follow. Nobody's listening.

Anonymous (from Gentiva, a Kindred at Home company)

Friday, June 5, 2015

Kindred Registers 200,000 Shares for Directors

StrangeTony,

Swirl this around in your mint julep. Kindred filed a stock registration with the SEC for 200,000 shares to be used in non-employee Board member compensation. Kindred employees lack a stock purchase plan, something Gentiva employees once had as a benefit. It's better together for Board members. For employees, no evidence yet.

Anonymous (from Gentiva, rebranded Kindred at Home)

Swirl this around in your mint julep. Kindred filed a stock registration with the SEC for 200,000 shares to be used in non-employee Board member compensation. Kindred employees lack a stock purchase plan, something Gentiva employees once had as a benefit. It's better together for Board members. For employees, no evidence yet.

Anonymous (from Gentiva, rebranded Kindred at Home)

Monday, May 18, 2015

Retirement at Home

StrangeTony,

Thank you for your back porch update and reminiscing about your experiences with new corporate owners. We're still learning what Kindred is about. Unfortunately, communication seems no better than before. My method of listening to quarterly earnings calls for executive strategy didn't work so well with Kindred.

Hospice was but a minor part of the conversation. The language sounded something like, "hospice volumes are stabilizing, even making slight headway in Q1. The company is positioning hospice for a return to sequential growth."

However Kindred's recent quarterly report had several interesting statements:

Later on in the same document:

What's $300,000 between corporate friends? This could be a typo or an accounting discrepancy. With executive communications it's hard to know. It's newsworthy to Gentiva sites who've had their assets impaired by past trade name changes, some multiple times.

Thank you for your back porch update and reminiscing about your experiences with new corporate owners. We're still learning what Kindred is about. Unfortunately, communication seems no better than before. My method of listening to quarterly earnings calls for executive strategy didn't work so well with Kindred.

Hospice was but a minor part of the conversation. The language sounded something like, "hospice volumes are stabilizing, even making slight headway in Q1. The company is positioning hospice for a return to sequential growth."

However Kindred's recent quarterly report had several interesting statements:

During the three months ended March 31, 2015, the Company recorded an asset impairment charge of $6.7 million related to previously acquired home health and hospice trade names after the decision in the first quarter of 2015 to rebrand to the Kindred at Home trade name.

Later on in the same document:

During the three months ended March 31, 2015, the Company recorded an asset impairment charge of $7 million related to previously acquired home health and hospice trade names after the decision in the first quarter of 2015 to rebrand to the Kindred at Home trade name.

What's $300,000 between corporate friends? This could be a typo or an accounting discrepancy. With executive communications it's hard to know. It's newsworthy to Gentiva sites who've had their assets impaired by past trade name changes, some multiple times.

Saturday, May 16, 2015

Buyout Memories

Anonymous from Gentiva,

Retirement is great. Every now and then a bad memory of a former Generic Hospice buyout invades my brain as I sit on back porch sipping mint juleps. There are flashes of false promises, vacuous language, image obsessed people in suits and a widespread, shallow excitement over all the money the company would save or make under the new combination. This dull energy, like excrement, urine and water, flows downhill. Our site was to spend less and make more for the company. Customer needs, service levels and employee concerns (heaven forbid) were not in the equation.

What did we get? A ceaseless rotation of corporate "leaders" who were supposed to support our site. They delivered handcuffs in the form of "no overtime" and other absurd corporate edicts The amount of work to be done didn't matter. We had staff doing the work of 2.5 full timers. There was no concern of burnout for loyal, dedicated employees. Our abusive branch manager was a hero for getting this level of productivity. They were lionized in the company's eyes when they should have been vilified.

After one buyout, the new company wanted to hear from employees. Corporate sent a human resources person to gauge the pulse of our site under our horrific branch manager. They heard from most people, directly in one-on-one sessions. The line of people shared their individual stories of how this leader had dashed our site's historically low turnover and high employee morale, achieving soaring turnover and plummeting morale. After processing this feedback Human Resources invited anyone who didn't like it to leave.

Six months later they administered an anonymous employee survey. If they didn't care about our plight when informed directly by dozens of loyal, dedicated employees what difference would a survey make? A few new employees penciled in their rankings on a variety of measures. Most of the rest of us trashed it, just as the company had trashed our verbally shared concerns.

I scribbled comments on each question, ignoring the rankings. I simply edited the survey based on my experience. In my attempt to recreate a few of those I offer:

My colleagues support one another in spite of local and executive management.Good luck with the survey. Enjoy the honeymoon while it lasts. When the union settles in Kindred's true face will be revealed.

My branch manager creates unnecessary conflict

My branch manager serially picks people for micromanagement and abuse

Human Resources aids our branch manager's abusive counseling

My colleagues are chronically underpaid and not appreciated.

Senior management has never visited our site.

StrangeTony

Saturday, April 18, 2015

Gentiva Wants to Hear Employees: Five Year Wait

StrangeTony,

President of Kindred at Home David Causby,, former Gentiva Chief Operating Officer, wants to hear from employees for the first time since Gentiva acquired Odyssey Hospice in 2010. Causby announced Kindred at Home will conduct an employee survey.

I expect they will get an earful, given Gentiva's abusive management practices and years with no raises, interrupted by an occasional pittance of an increase.

This survey will be the baseline for most former Odyssey Hospice employees. How does one take five years of horrific management and distill it in one survey instrument? That will be the challenge for many.

There's also the question of how the survey fits within Causby's series of special bonus opportunities, one $500,000 and two $250,000 chances? If the results are less than flattering what consequences await those who share their longstanding concerns? Gentiva leaders are well known for retaliation, as evidenced by many comments on Generic Hospice and GlassDoor

Anyone raising concerns are labelled troublemakers, negative and are encouraged to leave, if not fired. A survey is coming from a man whose history showed he couldn't care less about employees. Kindred acquired a company with entrenched Human Abuse practices. Will they dismantle this sick culture or reinforce it? It will be interesting to see.

Anonymous (from Gentiva Hospice, now owned by Kindred)

President of Kindred at Home David Causby,, former Gentiva Chief Operating Officer, wants to hear from employees for the first time since Gentiva acquired Odyssey Hospice in 2010. Causby announced Kindred at Home will conduct an employee survey.

I expect they will get an earful, given Gentiva's abusive management practices and years with no raises, interrupted by an occasional pittance of an increase.

This survey will be the baseline for most former Odyssey Hospice employees. How does one take five years of horrific management and distill it in one survey instrument? That will be the challenge for many.

There's also the question of how the survey fits within Causby's series of special bonus opportunities, one $500,000 and two $250,000 chances? If the results are less than flattering what consequences await those who share their longstanding concerns? Gentiva leaders are well known for retaliation, as evidenced by many comments on Generic Hospice and GlassDoor

Anyone raising concerns are labelled troublemakers, negative and are encouraged to leave, if not fired. A survey is coming from a man whose history showed he couldn't care less about employees. Kindred acquired a company with entrenched Human Abuse practices. Will they dismantle this sick culture or reinforce it? It will be interesting to see.

Anonymous (from Gentiva Hospice, now owned by Kindred)

Monday, April 13, 2015

2014 Good Year for Kindred Executive Raises

StrangeTony,

Kindred's definitive proxy statement revealed 2014 to have been a good, frankly great year for executive pay as it increased an average of 27%. Did Generic Hospice give you a raise anytime in the last five years? Gentiva was particularly stingy in this arena, frequently refusing to adjust pay while increasing workload and job responsibilities. It may be good news that Kindred purchased Gentiva. Their pay pockets appear to be looser.

Anonymous (from Gentiva - a Kindred company)

Tuesday, March 31, 2015

Today Triggers $6 million for Kindred CEO

StrangeTony,

Within two weeks Kindred CEO Paul Diaz will receive a check for $6 million. I consider it his bounty for bagging Gentiva. This comes after Kindred wrote a check to David Causby for $1 million. It's the Louisville Lottery but only senior managers can win. You retired in the nick of time.

Between his recent stock sales with $1.3 million in proceeds and Diaz' $6 million check Kindred's CEO could easily retire. He won't give up completely, but Paul is taking up the Board Vice Chairman role for Kindred. The vice part seems to fit.

Anonymous (from Gentiva)

Monday, March 16, 2015

Kindred VP's Strategic Stock Sale

Wednesday, March 11, 2015

KND Earnings Call Puts Gentiva in Spotlight

Kindred CEO Paul Diaz and his lieutenants spoke frequently of Gentiva during their Q1 earnings call.

We’re also very pleased with Gentiva’s strong results in the fourth quarter and for the full year of 2014, which reaffirms our confidence in the combination.

Strong results is clearly overstating the case. Gentiva ended 2014 well below expectations generated when Gentiva purchased Harden Healthcare's hospices and home health agencies.

On a pro-forma basis the company should be able to generate revenues between $2.1 and $2.2 billion, while adjusted EBITDA should come in between $210 and $220 million, excluding share-based compensation.

My take on the expectation shortfall:

Gentiva financially engineered much of Harden's value into thin air in 2014, evaporating $16 to $26 million in adjusted EBITDA and $110 to $210 million in expected revenues

This could be restated as:

"After underperforming financially for eight months of 2014, the management team rallied to produce an acceptable number. We didn't mention human resources or customer service losses because finance is all that matters."

Kindred issued the same refrain for its purchase of Gentiva:

The addition of Gentiva will support and enhance our financial performance and will create significant value for our patients and shareholders.

Referral sources and employees were not mentioned in the equation. as neither is of considerable value. Customers spoke loudly the last six months and few bragged about our financial performance or value for shareholders.

Gentiva's David Causby stands to gain as President of Kindred at Home from meeting budget and cost saving targets. Diaz continued on the earnings call:

Gentiva, I think has been and will continue to be one of, if not the best run home health companies in the country. There’s obviously been a number of struggles on the hospice side coming off of a number of years post Odyssey, but I think their team has a great handle on what’s happening in that business as well, with a lot of changes that we’ve made there.

Gentiva proved they don't understand hospice in countless ways, from high pressure sales tactics to ignoring and reducing benefits for employees. After Gentiva leaders realized they couldn't run hospice effectively, they intermingled it with home health though its OneGentiva initiative.

OneGentiva drove away a significant chunk of Harden's revenue. What will happen under the next David Causby led integration? .

There are some systems integration around payroll and benefits and some things that we’ll have to work on into 2016. But to tell you Chad, I mean our goal is really to do our best to stay out of the way of what is really a great group and a great team with some really sophisticated systems, a great sales pipeline and sales process, a group that’s executing extremely well. They have good processes in place and we’re just trying to let them continue to be who they are.