Strange Tony,

Kindred Hospice executives continued cutting positions at our hospice. I couldn't see how they could elimiate any more, given the number of people they've reduced since financial rapscallions and Humana bought us two years ago.

Moody's had this to say about Kindred at Home (Gentiva New) in their June 2020 review of the company's debt.

KAH will continue to have elevated debt/EBITDA in 2020 due in part to volume declines from the coronavirus pandemic. Home health saw approximately 20% volume declines in the last week of March 2020, whereas hospice experienced about 15% declines.

Executives have no patience. Volume down, headcount cut. Moody's mentions our garbage-in/garbage-out hospice computer program, Homecare Homebase. It underpaid staff for hours worked and miles driven.

KAH has identified about $138 million in synergies, of which around $93 million has already been achieved. KAH has performed well since completing the spin off from Kindred and acquiring Curo in 2018, however there has been some delay in realizing the last of the synergies particularly related to cost savings benefits from procurement and the shift to Homecare Homebase. We expect the remaining $45 million synergies to be realized by the end of 2020, and will include some newly identified savings related to insourcing the call center and improvements to the IT platform. We believe that increased centralization will lead to opportunities for additional cost savings, including improvements to KAH's IT infrastructure, as well as the centralization of purchasing which will continue to provide benefits throughout 2020.

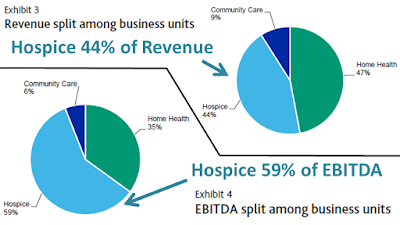

My coworkers will be disturbed to know more synergies loom. Hospice provided the lion's share of earnings within the company for Q1 2020.

Laid off staff might be upset to learn the company took federal funds while cutting jobs.

KAH had $315 million of cash as of May 2020, which includes about $150 million of cash from the CARES ACT for grants, about $89 million of advanced accelerated payments, and about $10 million of the approximately $60 million estimated for fiscal year 2020 of deferred employer social security taxes. KAH continues to evaluate guidance from the Department of Health & Human Services with respect to the use of funds and has not made a final decision if it will be keeping any or all of the CARES Act funds. KAH plans to fully repay the accelerated payments in June of 2020, given their solid liquidity, which is 2 months ahead of schedule per federal guidelines.

Flush with federal cash Kindred Hospice jettisoned valuable, loyal co-workers. Humana, TPG and Welsh Carson trashed a great hospice after they bought us in July 2018. There's no end in sight to their carnage. A giant executive payday awaits. For that we suffer.

Anonymous