Strange Tony,

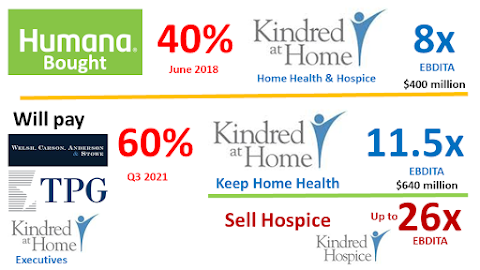

Our hospice will become part of a leveraged sale after Humana buys the rest of Kindred at Home from financial rapscallions TPG and WCAS. Consider what the last leveraged buyout did to our company.

Kindred at Home had 46,000 employees and Curo Health had 10,000 for a combined 56,000 when the deal closed summer 2018. By February 2019 headcount shrank to 50,000. It's now 43,000. That's a reduction of 13,000 positions or 23%.

Management scores itself via a stacked financial measure, earnings before depreciation, interest, taxes and amortization (EBDITA). Personnel is the largest expense. Our hospice staffing was cut in half after Curo installed its crappy, expensive, time wasting technology. Customer service scores plummeted, horrifying staff. Management didn't care. Financial measures mattered. Patient care did not.

In addition management robbed employees of fair pay for hours worked by making nurses salaried, cut holidays 33% and reduced holiday pay, and only paid employees mileage for the outbound trip to the patients home. Getting fair reimbursement for miles driven took too much time for busy hospice professionals trying to meet patient/family needs while understaffed. Employees threw up their hands trying to get fair mileage pay. The bottom line grew to the benefit of executives.

When the deal closed EBDITA was just over $400 million. It's now $645 million, up almost 60%. This is the measure producing the outrageous purchase price ($8.1 billion) and enriching already super wealthy executives. Revenues remained stagnant, around $3 billion annually.

With every buyout, Gentiva, Kindred and Humana executives profited handsomely. Employees got lip service and nothing else. Humana and its financial rapscallion partners paid 6x EBDITA for Kindred at Home, then planned to transfer the rest at 10 to 11.5x EBDITA. That's nearly a double for greedy financiers and KAH executives. Job cuts and wage/benefit theft added even more to the final purchase price, of which executives get a piece.

Our hospice does not need another leveraged buyout. We need and deserve an employee owned company. It is our blood, sweat and tears that kept the company operating on a daily basis. Instead Humana CEO Bruce Broussard and CFO Brian Kane will sell our hospice yet again and keep us under CEO David Causby. .

Executives repeated proved they don't value employees. This greedy group values their pocketbook. A pox on their abodes. They might value hospice if they have to get end of life care.

Anonymous