StrangeTony,

The story of Kindred Healthcare's unusual 2015 benefit for CFO Stephen Farber may soon come to an end with the sale of the former Farber home for an asking price of $2.4 million. Kindred purchased the home because three well off Kentucky men couldn't get along while sharing a common driveway. One could expect a lecture from Jacob Marley to these men about the chains they forged by their selfish and greedy actions.

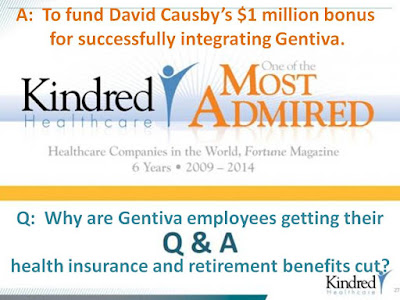

The same executives who purchased the Farber home eliminated legacy Gentiva employees' miserly retirement match come January 1, 2017. How many tiny Tims are in the homes of Kindred employees struggling to get by today? How much harder will their lives be later in life so Presidents Ben Breier and David Causby can squeeze out a few million more dollars in synergies?

When hospice reverts to the lowest common denominator and leaders obsess about metrics, it's time to speak. Self-inflated leaders assume clinicians give until their backs break, given no raises for years. A clinical ladder is a rainbow’s pot of gold. Others have a sorrier job and must be motivated by money. Abysmal leaders dangle extrinsic rewards for admission, hiring and EDBITA targets. “Sign on” bonuses entice people into a poor work environment. Employees’ voice equals their raise, zero.

Friday, December 23, 2016

Sunday, November 20, 2016

Breier Flattens Gentiva Employee Retirement Match

Strange Tony,

Kindred struck the deal with Gentiva expecting to save and make more money. Two years ago Kindred President Ben Breier set the expectation. "Synergies expected to be north of $70 million at the end of year two of the transaction will be immediate — will be meaningfully accretive to our earnings."

Breier announced in his recent earnings call "on the Gentiva deal, we achieved $91 million of synergies, a savings at the high end of our already aggressive expectations."

That aggression completely wiped out Gentiva employees 401k match for 2017. How much will executive bonuses rise from stiffing employees? That information will be available in April.

If anyone feels run over this Thanksgiving it might have been Ben Breier on his Synergy bulldozer.

Anonymous (from Kindredful)

Friday, November 11, 2016

Kindred's Hollow Promises to Keep Teammates Informed

Strange Tony,

Kindred President Ben Breier opened Kindred's Q3 earnings call with his usual remark : "Let me start as I usually do by extending my deep appreciation on behalf of the entire leadership team to our more than 100,000 teammates across the country. Each day our partners at Kindred work hard to improve the lives of more than 1 million patients we care for annually. The excellent care delivery and clinical outcomes we generate are the direct results of their efforts."

Later in the call he said, "the most important thing for us was that when we made this announcement yesterday, we wanted our employees, our teammates, our partners to be the first ones to hear it, not anybody else. So in terms of process and things that have become public, it was very important to me, and to our Board, and to the rest of our management team that we treat our employees the right way by making sure that they knew what was happening before anybody else did. And we're going through that process here internally at Kindred, and our folks are working their way through that."

How many of Kindred's 100,000 teammates heard about the company's strategic shift and dismal financial results from Ben Breier? I read the release Monday evening and am still waiting for any internal news from my employer. Wall Street analysts heard long before our local group of Kindred employees.

One could say why would hospice or home health employees need to know? Answer: Staff at our site have already been asked about the news by area nursing home companies. Kindred employees could look informed or ignorant. It was up to us to be informed. Management delivered our staff a goose egg of information.

As for communication there was one telling interchange between an analyst and Breier. The analyst asked how Breier or the company would define a mutually beneficial outcome for the nursing home division sale. Breier replied, "Kindred's shareholders will have to respond to what that definition of mutually beneficial for us is." Sadly, Breier may have a career in politics.

For the first time Breier spoke about premium pay rates for RN's across Kindred's business lines. That's a new development, not at our site, but in the conversation with Wall Street's finest. Brier's opening pander to employees is not new. Neither is the hollow promise to keep employees informed of key executive decisions. The lesson is employees will have to listen to quarterly earnings calls to actually hear strategic information from Kindred's C-Suite. Otherwise we're kept in the dark.

Anonymous (from Kindredful Q3)

Wednesday, November 9, 2016

New Kindred Board Member's Stock Award

Strange Tony,

Kindred announced a new board member. Dr. Lynn Simon is a C Suite occupant with Community Health Systems, a for-profit hospital company. Kindred loaded Dr. Simon's pocketbook with nearly $150,000 in restricted stock. She only has to last a year for that stock to vest.

Dr. Simon joined Community Health Systems in November 2010 when the company's stock price stood at $32 per share. It's now $5.50. CHS expanded via buyouts and borrowings the last few decades. A downturn in business sent CHS' finances reeling. Healthcare has become unaffordable even for many with health insurance.

CHS is trying to retrench by selling off assets (hospitals and other affiliates) to reduce debt. Kindred shed unprofitable LTACs a few months ago. Rumors have it more shedding is on the way. It's not clear if it's facilities, headcount or both.

What percent of Kindred at Home employees make $141,000 a year? How many former Gentiva employees have no retirement match for 2017 under Kindred? How many Kindred at Home employees will have their pittance of a raise eaten up by increased benefits cost/reduced benefits coverage?

It's a bifurcated world where people at the top can only "perform" if there are massive incentive structures in place, while people at the bottom are "thanked" for their hard work only to learn later executives took away another important benefit with no explanation. Gentiva did this with a silent PTO reduction. Kindred made it darn near impossible for Gentiva employees to know if they had a retirement match at all in 2016, before ditching the benefit altogether for 2017.

Dr. Simon's nearly $150,000 prize will come available on 11-2-2017 after Kindred at Home President David Causby's $1 million bonus is excreted on 8-1-2017. Who knew staying employed until a specific day was a marker of outstanding performance? How many employee retirement matches would $1.15 million fund? That's a question this board crew won't be asking.

Anonymous from Executive Enriching Kindred

Monday, November 7, 2016

Kindred Stock Plummets after Q3 Earnings Announcement

StrangeTony,

Kindred announced a major strategic shift and associated write downs which resulted in a GAAP loss from continuing operations of $671 million for the third quarter. The company plans to exit its nursing home business. Kindred said it would exit its skilled nursing facilities due to "labor cost challenges." I guess those people aren't willing to work for peanuts.

Kindred President Ben Breier said, "We expect approximately half of Kindred’s earnings before interest and income taxes (“EBIT”) to come from Kindred at Home, the nation’s largest home health, hospice and community care provider."

As for enhancing shareholder value Kindred's stock is down over 50% from April. This cannot be good for long suffering Gentiva employees who've been responsible for a third of Kindred's EBITDAR. More top management attention is not what hospice employees or the people we serve need.

What future benefit cuts await for 2017? What micro-raises, if any, can employees expect for the coming year? I have a funny feeling my fellow hospice employees are waking up to our one sided relationship with Kindred. I wonder how many will exit soon?

Anonymous (from Kindredful)

Saturday, October 8, 2016

Kindred's "Optimize" Means Sell at a Loss

StrangeTony,

Kindred sold twelve long term acute care hospitals to Curahealth for $27.5 million in an optimatization move. The company will write down $99 million to $109 million in assets, netting a $37 million future income tax benefit. Even after the tax break for selling facilities at a loss Kindred will be $34.5 million to $44.5 million in the hole on the dozen LTACs. Management can spin it as a win, but it's clearly a loss.

What does this latest financial hit mean for the lowly employee? How much worse will Kindred benefits become in order for executive pay to grow? We'll know sometime in November.

Anonymous from Optimized Kindred

Kindred sold twelve long term acute care hospitals to Curahealth for $27.5 million in an optimatization move. The company will write down $99 million to $109 million in assets, netting a $37 million future income tax benefit. Even after the tax break for selling facilities at a loss Kindred will be $34.5 million to $44.5 million in the hole on the dozen LTACs. Management can spin it as a win, but it's clearly a loss.

What does this latest financial hit mean for the lowly employee? How much worse will Kindred benefits become in order for executive pay to grow? We'll know sometime in November.

Anonymous from Optimized Kindred

Friday, September 30, 2016

Kindred Pays Record CIA Fine

StrangeTony,

Just in case you missed it. The Office of Inspector General for Health and Human Services announced:

The message from on high is to grow and there's significant pressure to admit patients. It's been that way for years, under both Gentiva and Kindred.

That level would be general inpatient care or GIP.

A higher up shared the company refunded over $1 million to Medicare. That fits with the over $3 million penalty as the government levels treble damages. So that's a $4 million hit, all of it due to bad management.

I wonder if this will impact Kindred at Home President David Causby's $1 million bonus due September 2017? He became Gentiva's COO in October 2013. That means Causby was "leading the day-to-day operations of our business" for all but ten months of the period covered in the settlement.

Meeting admission criteria and accurate billing are critical day-to-day operations. For much of the review period Causby was the accountable leader.

Anonymous (from Kindred at Home)

Just in case you missed it. The Office of Inspector General for Health and Human Services announced:

Kindred Health Care, Inc., the nation's largest provider of post-acute care, including hospice and home health services, has paid a penalty of more than $3 million for failing to comply with a corporate integrity agreement (CIA) with the Federal Government, Department of Health and Human Services' Inspector General Daniel R. Levinson announced today.

It is the largest penalty for violations of a CIA to date, the Office of Inspector General (OIG) said.

The record penalty resulted from Kindred's failure to correct improper billing practices in the fourth year of the five-year agreement. OIG made several unannounced site visits to Kindred facilities and found ongoing violations.

The message from on high is to grow and there's significant pressure to admit patients. It's been that way for years, under both Gentiva and Kindred.

CIA-required audits performed by Kindred's internal auditors in 2013, 2014, and 2015 found that the company and its predecessors had failed to implement policies and procedures required by the CIA and that poor claims submission practices had led to significant error rates and overpayments by Medicare.

Kindred was billing Medicare for hospice care for patients who were ineligible for hospice services or who were not eligible for the highest level and most highly paid category of service, OIG said.

That level would be general inpatient care or GIP.

A higher up shared the company refunded over $1 million to Medicare. That fits with the over $3 million penalty as the government levels treble damages. So that's a $4 million hit, all of it due to bad management.

I wonder if this will impact Kindred at Home President David Causby's $1 million bonus due September 2017? He became Gentiva's COO in October 2013. That means Causby was "leading the day-to-day operations of our business" for all but ten months of the period covered in the settlement.

Meeting admission criteria and accurate billing are critical day-to-day operations. For much of the review period Causby was the accountable leader.

Anonymous (from Kindred at Home)

Saturday, September 24, 2016

Yet Another Visit from Kindred VP of Some Sort

StrangeTony,

Our hospice site had another visit from a Kindred high up. I offer coaching from their recent visit, plus comments shared from other Kindred hospices.

1. "Pick up the pace" & "Close hard"

Census drives revenue, plain and simple. Any recognition of excellent service meant nothing to the hierarchy of number obsessed executives. Executive exhortations are barked out in a manner based on their unchecked assumptions. My co-workers are already working hard, doing their best, with love, care and passion. What might they feel pressured to do to meet management's numbers expectations? Executives cared not the consequences as long as patient headcount rose.

2. "Senior leaders love us the same way our nurse assistants love their patients."

Our nurse assistants don't take things away from patients, like senior executives did with PTO, health insurance and retirement benefits. All three benefits have been reduced in the last few years by Gentiva/Kindred executives. One is slated for elimination, if it hasn't already disappeared. That's the company retirement match.

I do see the love shown Gentiva COO/Kindred at Home President David Causby in his serial $1,000,000 bonus opportunities.

The company does treat us like our site treats our nurse assistants (overworked, underpaid and at best underappreciated) Local management consistently tells our NAs they are the low men/women on the totem pole.

3. "Your site makes the company a lot of money."

Never have they shared how the monstrous amount of money our site made the company comes back to those of us doing the actual revenue generating work. I assume this money ends up as bonuses for people up the chain. We, the people supposedly being "Taken Care of", aren't seeing any of our monstrous profits.

4. "Get it together folks. Census matters. Profit matters."

Apparently employees need to be motivated from above to work harder, jump higher, and recruit more patients in order to save the jobs of people sitting on either side of our chair. It was fitting that barbecue was served given our site is under performing.

I've never heard a sacrifice senior management has made to keep things going in difficult times. They show up, bark out their prized financial metrics, launch a few platitudes, rarely offer a sincere thank you, readily dispense brow-beatings, and move on. It's a relief when I can exit the building. Kindred executives have a way of using up all the oxygen.

A few never bothered to ask my actual role at our hospice. I've been called nurse and social worker and I'm neither. When Kindred executives leave breathing and sphincters can return to normal. Seeing a patient or family member is the balm for exposure to toxic leaders, as is hearing from other dedicated hospice workers. Thanks to Generic Hospice readers who e-mailed me their experiences.

Anonymous (from Causby's baby)

Thursday, September 1, 2016

Health Insurance Drivers for 2017

StrangeTony,

Chief People Officer Stephen Cunanan received 36,000 shares of Kindred stock on March 24, 2016. That same day the company awarded Kindred CEO Ben Breier 283,0000 shares. Breier recently told Wall Street analysts he feels "pretty good" about getting back to over $1 billion EBITDAR in 2017.

What kind of health, dental and vision insurance benefits do you think they're working to bring Kindred employees for the coming year? Expect to pay more for less coverage, especially if Mr. Cunanan wants to increase the value of his 83,500 shares of Kindred stock or if Mr. Breier desires to maximize the worth of his 678,000 shares.

The company is "still working on health benefits." Generally, their work is our pain. Consistently, executives focus on personal gain.

Anonymous

Saturday, August 27, 2016

Executives Paving Way for ?

StrangeTony,

Word has it a corporate big chief will visit our hospice site soon. No dates or names have been shared yet but we've been instructed to "clean up" for a visiting corporate dignitary. The latest update from Kindred at Home President David Causby said an opportunity exists to improve relations with senior management.

If we rarely or never see them are we in relationship? If they talk and we only listen are we in relationship? If we are relegated to a once a year survey for feedback is that relationship? What if we see no action taken on concerns shared in the last survey? Is that considered relationship?

I'd be interested in hearing from peers who've experienced recent visits from Kindred executives. What's the tone from up high? What priorities did they share? Feel free to comment or e-mail. It would be interesting and instructive to hear.

Anonymous (from Kindred)

Friday, August 5, 2016

Kindred At Home Employees Should Know

StrangeTony,

Kindred President Ben Breier shared important information for Kindred staff during today's second quarter earnings call. Seeking Alpha's call transcript had the following information from Breier.

Let me start as I usually do by extending my deep appreciation on behalf of the entire leadership team to our now more than 100,000 teammates across the country. Each day our partners of Kindred work hard to improve the lives of the more than one million patients we care for annually. The excellent care delivery and clinical outcomes we generate are the direct result of their efforts.

Kindred at Home employees should be aware of our impact on the wider company. President Breier praised us in the call.

Kindred at Home which comprises our home, health, hospice community care and home base primary care businesses now drives more than one third of our revenue and half of our consolidated earnings.

Those who came from Gentiva should know our lower health insurance and retirement benefits helped Kindred's bottom line, which we already disproportionately enhance.

We’ve done a great job in terms of continuing to as I talked earlier drive synergies of Gentiva. I think we’re getting close to the end on that we’re almost up to the $85 million level there.

In summary, Kindred at Home employees have done great work, most of us have taken it on the chin benefit wise and the company has benefited greatly financially. Surely a reward is coming to the lion's share of Kindred's 100,000 employees? Nope.

... we’re sort of at kind of a run rate on where we think labor is. I am not sure we’re going to see acceleration, it’s pretty tough and summer seems to be always the toughest part of the year, labor wise for us, also people go on vacations, people start to retire, people think about different things. So I don’t think we contemplated much of a change from our run rates into our ‘17 guidance.

Employees can sleep fitfully knowing Kindred executives see little they need to do labor wise. Former Gentiva employees may enter 2017 with no retirement match. It's not clear how much worse employer provided health insurance will become but the drop in coverage from Gentiva to Kindred was severe for many of us.

We’re still working on health benefits. And just there’s a lot of moving parts I think still. But generally those are the pieces that as we think about getting back to at least $1 billion (of EBITDAR) next year that’s how we feel pretty good about getting to that point.

If executives feel good that usually translates to lots of employees feeling bad. StrangeTony, you retired at the right time.

Mizuho Securities Sheryl Skolnick recently took Kindred to task for taking liberties with accounting adjustments. President Ben responded to her question on what's driving wide variability in quarterly earnings.

... complex site of the house if you will.

Unfortunately Breier was talking about the company's LTAC business not CFO Stephen Farber's shared driveway. Might his former house sale be part of the guidance for third quarter being lower? It depends on how things roll up.

Anonymous (from Kindred's basement)

Wednesday, August 3, 2016

Kindred Executives Sell Stock

Strange Tony,

Securities and Exchange Commission filings indicate three Kindred executives sold stock last week. Those selling include President Ben Breier who sold nearly 5,000 shares on 7-29 for $12.26 per share, leaving him with roughly 680,000 shares.

Chief People Officer Stephen Cunanan sold the next day Oddly his 3,500 shares priced at the exact same level, $12.26 per share. He holds 83,500 shares after the sale.

Executive Vice President Jon Rousseau also sold nearly 4,000 shares on 7-30 for the very same $12.26 per share. His stock holdings stand at nearly 74,000. All three executives sold under Code F, which is for "payment of exercise price or tax liability using portion of securities"

Kindred announces Q2 earnings tomorrow and Mizuho Securities' Sherly Skolnick might be on the call. She asked former Gentiva President Tony Strange challenging questions over the years. It's Ben Breier's turn to talk about what matters to executives. It's clearly their compensation.

Anonymous (under Kindredful Management)

Sunday, July 17, 2016

Watching Company Assets Go to Kindred CFO

StrangeTony,

A company's chief financial officer has financial fiduciary responsibilities. One CFO job description says:

The chief financial officer position is accountable for the administrative, financial, and risk management operations of the company, to include the development of a financial and operational strategy, metrics tied to that strategy, and the ongoing development and monitoring of control systems designed to preserve company assets and report accurate financial results.

Kindred CFO Stephen Farber is the recipient of a second relocation package which included $250,000, the purchase of his home for $2.15 million and payment of legal, design and construction of a new driveway. Louisville's WDRB says:

Minow, who co-wrote a business school textbook called Corporate Governance, said it would be hard for the company to defend paying for Farber to move once he had settled in Louisville.

“A relocation fee is supposed to be for when they move in order to take the job,” said Minow. “You’re not supposed to pay for them to move because they don’t get along with their neighbor.”

Stout, who chairs the corporate governance group at the Minneapolis law firm Fredrikson & Byron, said the money Kindred has spent on Farber’s behalf is “nickels and dimes in a multi-billion-dollar company,” but it sends the wrong message about the “company culture” to Kindred’s thousands of employees.

“Integrity starts at the top, and tone at the top is important because it sets the tone for the organization,” he said. “It’s very hard to get the employees of the company to take ethics and culture seriously if the people at the top aren’t.”

Top executives and the Board decided to mobilize significant company resources to manage their CFO's dispute with a neighbor. It took two Louisville news organizations to shed light on the situation.

“The true test of a man’s character is what he does when no one is watching.” ― John Wooden

And this test reveals what about our company and its leaders?

Anonymous (from Kindrexecutive Sweet)

Saturday, July 16, 2016

Kindred's Executive Home Purchase Story Has Legs

StrangeTony,

The story behind Kindred Healthcare's strange purchase of CFO Stephen Farber's home in December 2015 continues to develop. WDRB discovered Farber had moved from the home months earlier, casting doubt over Kindred's concerns regarding Farber's personal safety. WDRB reported:

Governance expert Nell Minnow weighed in on the home purchase by Kindred:

Nell Minow is vice chair of ValueEdge Advisors which advises big investors on corporate governance issues.

I can see the company is non-responsive to more than employee needs. From pay to home purchases Kindred's new executive drive is clearly designed to benefit senior leaders.

Anonymous (from Kindred small fry)

The story behind Kindred Healthcare's strange purchase of CFO Stephen Farber's home in December 2015 continues to develop. WDRB discovered Farber had moved from the home months earlier, casting doubt over Kindred's concerns regarding Farber's personal safety. WDRB reported:

But records in a Jefferson County court case now show that Farber had already moved from the Glenview home months before he and his wife decided to sell it to Kindred in December.

The case also reveals the extent to which Kindred has committed its corporate resources to assist Farber in the ongoing dispute with his ex-neighbor, real estate investor David Fenley.

Last August, for example, it was Kindred that hired and paid the invoices of a land surveying and engineering firm that designed a new driveway on what was then Farber’s property. The driveway, now under construction by Kindred, could cost as much as $360,000 in all, according to a deposition.

Governance expert Nell Minnow weighed in on the home purchase by Kindred:

“There certainly can be no question of safety if he has already moved,” she said. “At the very least, it sounds deliberately misleading.”

Nell Minow is vice chair of ValueEdge Advisors which advises big investors on corporate governance issues.

John Stout, a Minneapolis lawyer who previously chaired the corporate governance committee of the American Bar Association, said the situation “obviously doesn’t reflect well on the company, and it doesn’t reflect well on how they explain this.”

Susan Moss, Kindred’s corporate spokeswoman, did not respond to a phone call and a set of emailed questions from WDRB. Moss has not responded to inquiries about the Farber home purchase since January.

Jan West, an attorney representing Kindred and Farber in the ongoing litigation over the driveway, also did not respond to a request for comment.

I can see the company is non-responsive to more than employee needs. From pay to home purchases Kindred's new executive drive is clearly designed to benefit senior leaders.

Anonymous (from Kindred small fry)

Saturday, July 2, 2016

Bad Dream: Kindred to Centralize More Functions for Greater Sinergy?

StrangeTony,

I dreamt Kindred at Home President David Causby met with senior hospice leaders in search of savings for the remainder of 2016 and 2017. This came despite Gentiva's extraordinary contribution to Kindred's financial health:

My dream visioned how hospice functions might be centralized to drive cost savings and raise margins. I saw a new CBO, Centralized Bereavement Office, where the bereaved can call for help with their grief?

I heard the company's phone response to a calling griever:

When I hung up my smart phone spoke to me:

I told CORE that I did not need a social worker She replied:

I told CORE we have five talented social workers and I would not need her service She said:

I needed someone to talk to so I called our Chaplain on call. Instead of my dear, wise friend I got:

I was not having a great day at all. I just needed someone to talk with, someone who I knew and cared. Surely, one of our big hearted, giving volunteers was around. Our Volunteer Coordinator's office had large chains on the door. The sign said to go to www.KindredatHomeHopsiceVolunteerbyDroneservice.com.

What the ...? Kindred leaders instituted a Volunteer by Drone service.

Their website read:

When I awoke I was sure Causby and company had their thinking caps on as to how to reduce heads, the employee kind, while centralizing critical functions. I venture they want Kindred at Home Hospice employees gathered en masse for potential leadership interventions. Proximity makes it easier to apply management attention, which expressly excludes compensation increases or any form of sincere thank you. It's a corral and control function.

Cost savings, also known as sinergies, are needed to drive executive pay. Sinergies will arrive a multitude of ways, most poorly planned and woefully executed. It's Kindred where "Executive Pay Matters." The rest, not so much.

Anonymous (wishing Kindred was just a bad dream)

I dreamt Kindred at Home President David Causby met with senior hospice leaders in search of savings for the remainder of 2016 and 2017. This came despite Gentiva's extraordinary contribution to Kindred's financial health:

Gentiva currently makes up about half of the company’s earnings before interest, taxes, depreciation and amortization “which is pretty significant.”

My dream visioned how hospice functions might be centralized to drive cost savings and raise margins. I saw a new CBO, Centralized Bereavement Office, where the bereaved can call for help with their grief?

I heard the company's phone response to a calling griever:

You've reached Kindred at Home Hospice's Centralized Bereavement Office. Our hours are 8:00 am to 5:00 pm Central Louisville time. Please listen to the following options as our menu has changed. If you are grieving the death of a spouse in English, press 1. Para Espanol, marque Dos. For Cajun, shout "TREE." If your loved one died before you signed the mandatory arbitration clause for dispute resolution - Kindred at Home Hospice bereavement services are not available to you at this time. Thank you and have a great day!"

When I hung up my smart phone spoke to me:

"Hello, I'm CORE (pronounced CORRIE). I'm your hospice social worker."

I told CORE that I did not need a social worker She replied:

"God forbid you ever need hospice, but should you, I'll be glad to help with your social service needs."

I told CORE we have five talented social workers and I would not need her service She said:

There are no longer five social workers at your site. I am the exclusive social worker for all Kindred at Home-formerly Gentiva Hospices. Once our re-branding is complete someone will update this message."

I rushed to our site to find five empty offices. The name posted next to each door was CORE BITDAR.

I needed someone to talk to so I called our Chaplain on call. Instead of my dear, wise friend I got:

Hello. Welcome to Kindred's Chaplain by Phone line. God is closer to you than the phone you are holding to your ear. If you are using a microphone and earbud please adjust accordingly. If what you've heard thus far has not provided you comfort please remain on the line and a person of faith will be with you shortly.

Your call will be answered in the order it was received. Kindred at Home Hospice's spiritual care coordinators specialize in providing customized spiritual support at key junctures in the dying process. Please answer a few questions that will help our staff better meet your needs. Press 1 if you believe in God, 2 if you believe there is no God and 3 if you are agnostic.

Beep. Your expected wait time to be served is ____ minutes. There are _____ people (believers, atheists or ignoramuses) ahead of you in the Kindred at Home Hospice bereavement queue.

Kindred at Home Hospice believes matters of faith are individual and personal. That's why we set up Kindred at Home Hospice's 24 hour a day Chaplain by Phone service. If you are a struggling griever please hang up and call the Kindred at Home Hospice Centralized Bereavement Office. Your courtesy in this regard will enable our chaplains to serve patients and families yet to experience the tragic loss of their beloved. Thank you and have a great day!

I was not having a great day at all. I just needed someone to talk with, someone who I knew and cared. Surely, one of our big hearted, giving volunteers was around. Our Volunteer Coordinator's office had large chains on the door. The sign said to go to www.KindredatHomeHopsiceVolunteerbyDroneservice.com.

What the ...? Kindred leaders instituted a Volunteer by Drone service.

Their website read:

Drones currently provide most of the tasks historically performed by a human volunteer. A drone can hover in a patient's living room providing an extra set of Kindred eyes for reassurance (Note: drone recharging times may vary).

Should you or your loved one live in a high crime area Kindred offers the option of an armed drone. Kindred's trained staff would have the sole ability to engage the drone's security features.

This Kindred at Home Hospice - Personal Home Drone Security Service (KAHH-PHDSS) is provided for an extra fee as it is not a core part of Medicare's hospice benefit.

When I awoke I was sure Causby and company had their thinking caps on as to how to reduce heads, the employee kind, while centralizing critical functions. I venture they want Kindred at Home Hospice employees gathered en masse for potential leadership interventions. Proximity makes it easier to apply management attention, which expressly excludes compensation increases or any form of sincere thank you. It's a corral and control function.

Cost savings, also known as sinergies, are needed to drive executive pay. Sinergies will arrive a multitude of ways, most poorly planned and woefully executed. It's Kindred where "Executive Pay Matters." The rest, not so much.

Anonymous (wishing Kindred was just a bad dream)

Saturday, June 25, 2016

Causby's Next $1 Million Bonus to Come from Showing Up

StrangeTony,

On March 30, 2016 Kindred Healthcare added another employment agreement for Kindred at Home CEO David Causby. For staying 16 months with the company Causby will earn another $1,000,000. Causby merely has to make it to August 1, 2017 and his work must be satisfactory.

During this time former Gentiva employees will lose their retirement match from Kindred at Home. It's slated to end December 31, 2016. Causby should have a great 2017 as his pay soars on the backs of those delivering care.

How many Gentiva employees knew about Causby's retention bonus? How many know about the stepped down 401k match for former Gentiva employees? How many know when the company will make good on the match?

Gentiva employees are providing Kindred's synergistic cost savings through greatly reduced benefit contributions from the company. What Kindred pocketed in 2016 should grow exponentially in 2017. That's when the 401k match evaporates completely.

Cauby's agreement was executed by Kindred's Stephen Cunanananan, Chief Peephole Officer. Former Gentiva employees would recognize Cunanananan's role as Vice President for Human Abuse. We're now part of Kindred, where the executive mantra is "My Pay Matters."

Anonymous (from Kindredful)

On March 30, 2016 Kindred Healthcare added another employment agreement for Kindred at Home CEO David Causby. For staying 16 months with the company Causby will earn another $1,000,000. Causby merely has to make it to August 1, 2017 and his work must be satisfactory.

During this time former Gentiva employees will lose their retirement match from Kindred at Home. It's slated to end December 31, 2016. Causby should have a great 2017 as his pay soars on the backs of those delivering care.

How many Gentiva employees knew about Causby's retention bonus? How many know about the stepped down 401k match for former Gentiva employees? How many know when the company will make good on the match?

Gentiva employees are providing Kindred's synergistic cost savings through greatly reduced benefit contributions from the company. What Kindred pocketed in 2016 should grow exponentially in 2017. That's when the 401k match evaporates completely.

Cauby's agreement was executed by Kindred's Stephen Cunanananan, Chief Peephole Officer. Former Gentiva employees would recognize Cunanananan's role as Vice President for Human Abuse. We're now part of Kindred, where the executive mantra is "My Pay Matters."

Anonymous (from Kindredful)

Wednesday, June 22, 2016

Kindred Pays $39 million for Arkansas at Home

StrangeTony

Kindred Healthcare plans to purchase the State of Arkansas' home health, hospice and personal care agencies in an announced $39 million deal. This deal is 18 times larger than Kindred's last buyout, the $2.15 million purchase of CFO Stephen Farber's personal home.

Kindred intends to keep the Arkansas agencies, yet plans to sell the multi-million dollar Louisville estate. When will it be listed?

Anonymous (from Kindredful)

Kindred Healthcare plans to purchase the State of Arkansas' home health, hospice and personal care agencies in an announced $39 million deal. This deal is 18 times larger than Kindred's last buyout, the $2.15 million purchase of CFO Stephen Farber's personal home.

Kindred intends to keep the Arkansas agencies, yet plans to sell the multi-million dollar Louisville estate. When will it be listed?

Anonymous (from Kindredful)

Thursday, June 16, 2016

Kindred's Low Bar Investor Presentation

StrangeTony,

Kindred Healthcare President spoke to the Bank of America Merrill Lynch Healthcare Conference in Las Vegas. An early remark expressed regret at keeping attendees away from the bar. Then he moved on:.

"God forbid you need hospice."

Many of our hospice patients spent their life bellying up to the bar. There is a price to pay for habitually seeking solace in things incapable of providing it.

Kindred at Home has 38,340 caregivers. How would they take his comment?

Eventually our hospice may need hospice due to high financial leverage and poor health choices.. Our President might recommend another drink or smoke to relieve anxiety.

Anonymous (from Kin-forbid)

Friday, May 13, 2016

Ben Breier's Hospice Tale

StrangeTony,

Kindred held their earnings call last Thursday and President Ben Breier was effusive in his praise. He said:

In the hospice segment our team has made terrific progress on the challenging reorganization we've undertaken over the past three years. We have seen significant stabilization over the back half of 2015 and this quarter we saw the first quarter of year-over-year census growth since our acquisition of Gentiva with patient days increasing 2.9% year-over-year.Not said: Patient days actually fell from Q4 2015This growth comes despite average length of stay decreasing by three days and branch network consolidation reducing the number of hospice sites from 193, at the beginning of 2015, to 175 at the beginning of 2016.Not said: Admissions increased by 70 from Q1 2015 With 177 hospice sites that's an increase of 0.4 of an admission per site. Average daily census rose by 223 for the hospice segment or an additional 1.25 patients per day census wise for each site.

Average hospice revenue per branch grew more than 8% between the first quarter of 2015 and the first quarter of 2016.Not said: Less branches and stable revenues will do that. Hospice revenues decreased by $1.8 million from Q4 and are the lowest full quarter since Kindred bought Gentiva.We expect to see continued hospice growth driven by demographics as well as expected enhanced hospice utilization rates. We also look to expand our hospice presence with tuck-in acquisitions in markets not yet adequately covered by our existing branch network.So far this year we have acquired hospice operations in North Carolina, Ohio and Florida. We're pleased with the margin improvement in our home health and hospice businesses as they each provided on a year-over-year basis up by nearly 1% when last year's quarter is appropriately adjusted on a pro forma basis to include January.Not said: Part of that Q1 margin improvement came from health care and retirement benefit reductions for former Gentiva employees.

I am glad to do my part to make our hospice more successful in care delivery. My hospice co-workers and I don't want to personally sacrifice to enrich senior executives. Q1 included $38 million in incentive payments to Kindred at Home executives and a relative handful of other employees. Their bonuses alone ate up 21.5% of our first quarter hospice revenue. That is evidence of the distortion from above. It can't be called leadership. It's far too selfish.

Anonymous (From Kindred where revenue declines are growth)

Anonymous (From Kindred where revenue declines are growth)

Tuesday, May 10, 2016

Kindred Bought CFO's House for $2.15 Million

StrangeTony,

WDRB reported on the lawsuit saga for three neighbors who fought over a shared driveway, amongst other things. The three share a historic property just outside Louisville, Kentucky. All were relatively new owner of their respective properties, which included a permanent access easement for the shared driveway.

Mr. Fenley's lawsuit expressed a number of concerns with Mr. Farber's contractors which caused him to offer to build a separate drive for his neighbors. Fenley and Haynes prevailed in stopping the building of a new driveway. Their legal stance expressed a number of concerns about Fenley's proposal, including increased difficulty with stormwater control, the removal of large mature trees that were part of a former owner's landscape design and the loss of an aesthetically pleasing entrance.

On December 1, 2015 the parties attempted to mediate their conflict without success. Oddly, Mr. Farber's employer Kindred Healthcare had their in house attorney attend the personal mediation. The Fenley amended complaint stated Kindred had plats and survey drawings of all three properties drawn up. That's a high amount of employer involvement in an executive's personal dispute

This mediation occurred less than a week after Kindred Healthcare gave Mr. Farber an additional $250,000 for "moving expenses." (Generic Hospice reported on this development November 26, 2015.)

On December 18, 2015 a division of Kindred Healthcare purchased Mr. Farber's home for $2.15 milion. Farber paid $1.7 million for the home before embarking on a $200,000 + renovation which upset his neighbor.

On December 30, 2015 Kindred began removing the very trees Farber argued to preserve the historic landscape design. Mr. Fenley asserts in doing so, Kindred damaged his property.

The Fenley complaint has a number of tidbits that color the deterioration of neighborly relations. It reads of strong willed people wanting to have their way. There is little evidence of civility or the ability to come to conflict resolution in a neighborly manner. They could not come to resolution with highly paid mediation lawyers.

Yet, Kindred's Board of Directors chose to take two highly unusual acts. First, they gave Farber $250,000, on top of the original $110,000 in moving expenses for 2014. Second, the board bought his house for a premium price then took an action that Farber legally fought against with the aid and support of Kindred's legal counsel and contractors.

One Kindred employee received $360,000 in moving expenses in twenty one months. We have hospice employees who it will take nearly fifteen years to make in wages Farber's Kindred moving benefit.

It's good WDRB reported on the story. It's sad priorities are skewed for executives lacking the basic skills to resolve conflict. Frankly, we see the same distortions at our local hospice site.

Anonymous (from Kindredview Avenue)

Tuesday, April 5, 2016

Kindred's Shameless Executive Compensation Made Public

President Ben Breier received nearly $5.5 million in executive pay.

Kindred at Home President David Causby's pay, fueled by his second $1 million event under Kindred, got over $4.4 million. His first $1 million event came in lump sum cash, the second $1 million was bonus money.

However the oddest compensation went to Kindred CFO Stephen Farber who needed $2.15 million to flee a dangerous neighborhood of millionaires incapable of sharing a driveway. Kindred's board did not call the police, but instead wrote a check for nearly $500,000 more than Farber paid for the house, throwing in an additional $250,000 in moving expenses (on top of the $110,000 for moving expenses in 2014).

Kindred executives look out after their own. The other 101,500 employees aren't so lucky.

Kindred at Home President David Causby's pay, fueled by his second $1 million event under Kindred, got over $4.4 million. His first $1 million event came in lump sum cash, the second $1 million was bonus money.

However the oddest compensation went to Kindred CFO Stephen Farber who needed $2.15 million to flee a dangerous neighborhood of millionaires incapable of sharing a driveway. Kindred's board did not call the police, but instead wrote a check for nearly $500,000 more than Farber paid for the house, throwing in an additional $250,000 in moving expenses (on top of the $110,000 for moving expenses in 2014).

Kindred executives look out after their own. The other 101,500 employees aren't so lucky.

Saturday, April 2, 2016

No April Fools: Breier Gets $3.5 million in Restricted Stock

StrangeTony

Kindred CEO Ben Breier received 283,203 shares of restricted stock on March 24, 2016. Kindred's stock closed at $12.57 per share on April 1 giving Breier $3.5 million from one portion of his executive compensation package. That's no April Fool's joke but a sad reflection of misplaced priorities.

Hospice roots are antithetical to leadership greed which spread like a cancer in the last ten to fifteen years. Ethically our hospice site is dead, rotting from the head down. Fortunately, we still have a few people who live and breath the origins of the hospice movement. When they leave or retire the stink will spread.

The question is how much Ben Breier will have earned in total compensation by then. We'll get a peek at his 2015 pay soon enough. The executive money trough is full and overflowing. I bet the pigs don't even need calling.

Anonymous (from Dredkin)

Thursday, March 17, 2016

Kindred's Obsession with Numbers to Grow Exponentially

StrangeTony,

A Kindred executive once told me data is the only thing that matters, that staff achieve the targeted numbers or they're gone. That person used intimidation and fear without any understanding that bullying distorted the accuracy of the very data they'd received.

Rather than remove the fear and intimidation, such that people can gain a common understanding of what's happening, this Machiavellian leader's solution to data distortion was to automate data collection as much as possible. Removing the worker from the data generation chain, then beating them up for unfavorable outcomes is a form of dehumanization.

Kindred is doubling down on their numbers obsession strategy with a new effort.

Our hospice has a new predictive service index score for each patient. I asked an experienced hospice nurse about the PSI score. They said, "That number is useless."

It feels like management wants to play with numbers rather than talk to hospice clinicians. The number enables managers to order quantifiable amounts of specific disciplines from the hospice team. It does not feel like a tool for decision making or resource allocation. It's a buffer or bumper from having to talk with real hospice professionals about what is going on and what the patient and caregivers truly need.

The "likelihood of future outcomes" is probability which is based on a number of theoretical distributions that rarely exist in the real world. It reaffirms my belief that Kindred executives, like their Gentiva brethren before them, live in their own world. It rarely makes contact with the world our hospice team works in.

Anonymous (from Dredkin)

A Kindred executive once told me data is the only thing that matters, that staff achieve the targeted numbers or they're gone. That person used intimidation and fear without any understanding that bullying distorted the accuracy of the very data they'd received.

Rather than remove the fear and intimidation, such that people can gain a common understanding of what's happening, this Machiavellian leader's solution to data distortion was to automate data collection as much as possible. Removing the worker from the data generation chain, then beating them up for unfavorable outcomes is a form of dehumanization.

Kindred is doubling down on their numbers obsession strategy with a new effort.

Predictive analytics is the use of data, statistical algorithms and machine-learning techniques to identify the likelihood of future outcomes based on historical data.

Our hospice has a new predictive service index score for each patient. I asked an experienced hospice nurse about the PSI score. They said, "That number is useless."

It feels like management wants to play with numbers rather than talk to hospice clinicians. The number enables managers to order quantifiable amounts of specific disciplines from the hospice team. It does not feel like a tool for decision making or resource allocation. It's a buffer or bumper from having to talk with real hospice professionals about what is going on and what the patient and caregivers truly need.

The "likelihood of future outcomes" is probability which is based on a number of theoretical distributions that rarely exist in the real world. It reaffirms my belief that Kindred executives, like their Gentiva brethren before them, live in their own world. It rarely makes contact with the world our hospice team works in.

Anonymous (from Dredkin)

Thursday, March 3, 2016

Kindred Eliminates Employee Turnover Statistic

StrangeTony,

Kindred's recent annual report filing, known as a 10-K, omitted a key statistic for a company that "takes care of its people." The annualized employee turnover number was missing.

Oddly Kindred President Ben Breier said little about employees, other than his opening pander, in the February 26 earnings call. He failed to mention information about employees included in Kindred's 10-K.

Employees

As of December 31, 2015, we had approximately 53,600 full-time and 48,400 part-time and per diem employees. We had approximately 2,900 unionized employees at 25 of our facilities as of December 31, 2015.

The market for qualified nurses, therapists, physicians, clinical associates, home health and hospice employees, and other healthcare professionals is highly competitive. We, like other healthcare providers, have experienced difficulties in attracting and retaining qualified personnel such as nurses, certified nurse’s assistants, nurse’s aides, therapists, home health and hospice employees and other providers of healthcare services. Our hospitals and nursing centers are particularly dependent on nurses for patient care. Our Kindred at Home and Kindred Rehabilitation Services divisions continue to seek qualified home health and hospice employees and therapists, respectively, to fill open positions. The difficulty we have experienced in hiring and retaining qualified personnel has increased our average wage rates and may force us to increase our use of contract personnel. We expect to continue to experience increases in our labor costs primarily due to higher wages and greater benefits required to attract and retain qualified healthcare personnel. Salaries, wages, and benefits were approximately 64% of our consolidated revenues for the year ended December 31, 2015. Our ability to manage labor costs will significantly affect our future operating results.

Gentiva employees represent 40% of Kindred's total. The recent earnings call had Kindred President Ben Breier say:

While Kindred at Home now represents about one-third of our revenues, it's approaching half of our consolidated EBIT.

As I mentioned a moment ago, with its capital light profile, Kindred at Home's contribution to the enterprise is approaching half of our consolidated EBIT with the strongest EBIT margin profile among our divisions.

At no point in the report did Kindred cite rising labor costs in home health and hospice. Here's what the company said:

Home Health

Operating margins increased in 2015 primarily as a result of the Gentiva Merger and related operating efficiencies.

Hospice

Operating margins increased in 2015 primarily as a result of the Gentiva Merger and related operating efficiencies.

Gentiva employees know what we experienced in 2016 with Kindred's far worse health insurance coverage and more expensive dental and vision insurance. The company removed employee's prior ability to see the company's contribution to the portion each of us pays for benefits. Gentiva employees know Kindred eliminated the 401(k) match in 2012 but aren't sure the status of any match for 2016..

The turnover stat disappeared just like the hospice division's policy to pay people fairly and equitably, internally and externally. This leadership group is committed to former Gentiva employees like a parasite on a host. They said it: One third the revenue produces nearly half the EBIT.

Monday, February 29, 2016

Who Do Kindred Execs Appreciate?

StrangeTony,

Kindred CEO Ben Breier opened yesterday's earnings call with:

"Let me start as I usually do by extending my deep appreciation on behalf of the entire leadership team to our more than 100,000 teammates across the country. Each day our partners at Kindred work hard to improve the lives of more the 1 million patients we care for annually. The excellent care delivery and clinical outcomes we generate are the direct results of their efforts."The 40,000 from Gentiva don't feel the least bit appreciated by the leadership team if they've encountered our benefit reductions for 2016. I'd be shocked if the other 60,000 feel appreciated given Kindred eliminated their retirement match in 2012.

Recent actions show who the leadership team appreciated.

Kindred's Chief People Officer has not been clear at all with former Gentiva associates on reductions in healthcare, retirement and sick leave benefits. Kindred recently removed a hospice policy that committed to paying people equitably on an internal and external basis.

CEO Ben Breier talked repeatedly about Kindred's over $300 million in cash flow. Surely a portion of that could return a 2% retirement match, provide health insurance employees can afford to use and ensure employees are paid fairly and equitably for the work they perform for the company. It's clear they'd rather pay themselves.

Anonymous (from Kindredful)

Saturday, February 20, 2016

Kindred's Best Practices Involve Paper and Multiple Levels of Approval

StrangeTony,

Gentiva's integration with Kindred nears completion and it feels like a walk back in time. Many processes, especially those involving human resources, have become more complex and time consuming as Kindred eliminates systems that allowed employees to update their basic payroll, benefit and retirement information. What used to be done with the click of a mouse and typing a few keys now requires completing multiple paper forms, submitting those in triplicate and waiting for several layers of corporate people to deign their approval.

Kindred's integration has generated 8-10 hours of work per week for me that did not exist under Gentiva. This clearly is bureaucratic and not value added. A Kindred executive told our site last week that the human resource integration has been horrific, botched, butchered. That's exactly what I felt trying to navigate the hazy benefit maze last fall, attempting to complete the myriad of requirements for the wellness incentive (to avoid a health insurance penalty) and working to understand our actual vs. fictional benefits in 2016.

Retirement and sick leave are two of the more puzzling ones for Gentiva folks to understand. My coworkers and I can't get anyone to give us real answers in either category. Calls to the contracted out benefit line result in transfers to additional contractors. Neither group has been able to clarify what should be clear and apparent. What is the retirement match, if any, and how can staff actually use sick leave for an illness that goes past the first two days of PTO? Tertiary contractor representatives from T. Rowe Price and UNUM have answered staff questions with "the company has not given us that information."

I said long ago human resources turned into the human abuse department, apparently for strategic purposes. A Kindred executive finally agreed with me. I wonder if the "hub" is short for hubris.

Anonymous (from Kindredful)

Sunday, February 7, 2016

Anniversary Celebration: Causby Collects, Wallace and Riedman Sell

StrangeTony,

The anniversary date of Gentiva's buyout by Kindred Healthcare went without a party. There was no celebration at our hospice site over joining Kindred. I don't think one person mentioned it. We were too busy doing things by paper that used be done by computer, trying to understand what actual benefits remain from our Gentiva days and wondering how to get points to keep our company discount for new health insurance, which pales in comparison to the old and many cannot afford to use.

Meanwhile Kindred at Home President David Causby collected the first part of his stock grant of 53,077 shares. He received 17,693 shares of Kindred stock. On February 2, 2015 Kindred's stock closed at $18.22. A year later it closed at $9.49, down $8.73 per share. That's a 48% decline in stock performance.

Oddly, Kindred's new Chief Operating Office sold over 5,700 shares from his monster stock grant for the same $9.49 per share. Days earlier General Counsel Suzanne Riedman sold over 12,000 shares for $9.66 a share.

These executives may have enjoyed Kindred's anniversary of acquiring Gentiva, especially with the proceeds from their stock grants and subsequent sales. For the rest of us there was little to celebrate.

Anonymous (from Gindred)

The anniversary date of Gentiva's buyout by Kindred Healthcare went without a party. There was no celebration at our hospice site over joining Kindred. I don't think one person mentioned it. We were too busy doing things by paper that used be done by computer, trying to understand what actual benefits remain from our Gentiva days and wondering how to get points to keep our company discount for new health insurance, which pales in comparison to the old and many cannot afford to use.

Meanwhile Kindred at Home President David Causby collected the first part of his stock grant of 53,077 shares. He received 17,693 shares of Kindred stock. On February 2, 2015 Kindred's stock closed at $18.22. A year later it closed at $9.49, down $8.73 per share. That's a 48% decline in stock performance.

Oddly, Kindred's new Chief Operating Office sold over 5,700 shares from his monster stock grant for the same $9.49 per share. Days earlier General Counsel Suzanne Riedman sold over 12,000 shares for $9.66 a share.

These executives may have enjoyed Kindred's anniversary of acquiring Gentiva, especially with the proceeds from their stock grants and subsequent sales. For the rest of us there was little to celebrate.

Anonymous (from Gindred)

Sunday, January 31, 2016

Executive Message on Kindred Jobs

StrangeTony,

A Kindred employment banner states "Not all jobs are created equal." That sums it up for many Gentiva folks, who've seen benefits deteriorate and pay continue to stagnate. Cash flow is off to a good start under the combined companies and employees can see who is getting much of the proceeds. Senior management spoke truth with their jobs statement. It's fitting caregivers are pictured as unequal. We couldn't be more lowly in their eyes.

Anonymous (from Kindred, where executives make themselves at home)

Monday, January 25, 2016

Kindred Covers CFO Conflict with Money Shower

StrangeTony,

A division of Kindred recently purchased the home from CFO Stephen Farber due to conflicts with his neighbors over a shared driveway. A Louisville newspaper chronicled the series of skirmishes.

In a dispute that eight attorneys from three law firms have been unable to resolve, three business titans in Glenview, one of America’s richest cities, have fought over a driveway that for decades had been peaceably shared.The biggest casualty of the Battle of Glenview Avenue is a grove of majestic trees that were cut down and bulldozed last month, to the chagrin of neighbors, who say about 40 trees and 2,000 years of growth were destroyed.“At a time in which Louisville is trying to amplify its tree canopy, this kind of evisceration is sad and upsetting,” said Jay McGowan, the president of Bellarmine University, who lives next door in a mansion donated to the school.“You would hope that adults could do better,” he added.

On Dec. 18, the Farbers sold their house and property for $2.15 million to a company owned by his employer, Kindred.

Eleven days later, the trees came down at the company’s direction.Kindred and its spokeswoman, Susan Moss, declined to respond to emails, but the company apparently decided it had to build a new drive to the home so it could be sold to a future purchaser.

The article described Farber as "the $910,000-a-year executive vice president and chief financial officer of Kindred Healthcare." It also cited "massive” renovation of the Farbers' $1.7 million home." Zillow indicated the home last sold for $1.7 million on April 1st, 2014. A building permit indicated a $150,000 renovation for 2,100 square feet of the 6,000 square foot home.

A Kindred company paid $300,000 more than $1.85 million Farber spent to buy and renovate their home. The purchase came in December, after Kindred gave Farber a one time $250,000 payment to aid in his relocation. There was no SEC filing on the company buying his house at a significant premium just weeks later.

Apparently boards finance multiple moves as Farber, the recipient of nearly $1.9 in executive pay in 2014, received $110,000 of that amount for relocation expenses.

Did this topic arise in the question and answer session at J. P. Morgan's recent healthcare conference. If so, did any analysts ask how much Kindred got for the lumber?

Did this topic arise in the question and answer session at J. P. Morgan's recent healthcare conference. If so, did any analysts ask how much Kindred got for the lumber?

Anonymous (from Kindredful)

Friday, January 22, 2016

Kindred Best Practice: Executive Enrichment at Employee Expense

StrangeTony,

Thought you might be interested in Kindred's recent presentation at the J.P. Morgan Healthcare Conference. Kindred President Ben Breier began with an overview of the company. In that segment he said, "We now have over 100,000 teammates across the country, most of those are front line caregivers." He said these caregivers and Kindred's culture focuses on caring for patients, providers, referral sources and family

Kindred's capital structure is strong with over $300 million in operating cash flow and $150 million in free cash flow. You might think this is great news for employees, many of whom have gone years without raises.

Nope. It's hard to believe Kindred's executives could take more from employees than Gentiva's mendacious lot. Kindred's Chief Peephole Officer promised a robust choice of health insurance plans to legacy Gentiva employees. He failed to mention not one plan had a physician co-pay benefit. There was no coaching from Kindred leaders on how employees should plan to keep seeing any specialty physicians.

I'll venture most Legacy Gentiva employees have no idea what is happening with their 401(k) other than it shifted from Milliman to T. Rowe Price. Apparently Kindred's harmonizing of benefits involves treating the information as if it belongs in Fort Knox. Kindred does not talk about reductions in health insurance or retirement benefits for acquired Gentiva employees. Workers have to stumble over it when they try to get healthcare or struggle to set aside money for retirement.

Contrast Kindred's practice of not being up front with benefit changes and why they are needed with this:

Kindred's benefit cuts and corresponding silence don't fit with admiration. It feels like dishonesty with a dash of condescension.

The presentation listed a Q&A session, often held in a different room at the event site. The replay lacked this often critical and informative piece. So we don't know if any analysts asked about the Justice Department settlement. I'm sure none of them asked how Kindred takes care of its people.

Kindred pursues the lowest bar in its treatment of legacy Gentiva employees. We endured the unjust enrichment of Gentiva's senior leaders as former CEO Tony Strange praised "employees for creating the company's value." Kindred's crop of C-Suiters wants to ride us harder.

Kindred senior leaders behave much like the sorry Gentiva lot. Breier failed to mention how employees should respond to questions about Kindred's recent $125 million settlement with the Justice Department for improper therapy billing through its RehabCare division.

When Kindred bought out Gentiva proforma revenues for the combined company stood at $7.2 billion. That's now down to $7.1 billion (estimated for 2015). Actual 2015 revenue ended up $7.05 billion. It brings back Gentiva's revenue destructing integration of Harden.

Big bonuses for under-performing: It's a mutual best practice for leaders no longer admired.

Anonymous (from Gendred)

Thought you might be interested in Kindred's recent presentation at the J.P. Morgan Healthcare Conference. Kindred President Ben Breier began with an overview of the company. In that segment he said, "We now have over 100,000 teammates across the country, most of those are front line caregivers." He said these caregivers and Kindred's culture focuses on caring for patients, providers, referral sources and family

Kindred's capital structure is strong with over $300 million in operating cash flow and $150 million in free cash flow. You might think this is great news for employees, many of whom have gone years without raises.

Nope. It's hard to believe Kindred's executives could take more from employees than Gentiva's mendacious lot. Kindred's Chief Peephole Officer promised a robust choice of health insurance plans to legacy Gentiva employees. He failed to mention not one plan had a physician co-pay benefit. There was no coaching from Kindred leaders on how employees should plan to keep seeing any specialty physicians.

I'll venture most Legacy Gentiva employees have no idea what is happening with their 401(k) other than it shifted from Milliman to T. Rowe Price. Apparently Kindred's harmonizing of benefits involves treating the information as if it belongs in Fort Knox. Kindred does not talk about reductions in health insurance or retirement benefits for acquired Gentiva employees. Workers have to stumble over it when they try to get healthcare or struggle to set aside money for retirement.

Contrast Kindred's practice of not being up front with benefit changes and why they are needed with this:

"We admire the hard work and dedication you have put into making Gentiva an outstanding organization and want to share our mutual best practices as we become an even stronger organization."

Kindred's benefit cuts and corresponding silence don't fit with admiration. It feels like dishonesty with a dash of condescension.

The presentation listed a Q&A session, often held in a different room at the event site. The replay lacked this often critical and informative piece. So we don't know if any analysts asked about the Justice Department settlement. I'm sure none of them asked how Kindred takes care of its people.

Kindred pursues the lowest bar in its treatment of legacy Gentiva employees. We endured the unjust enrichment of Gentiva's senior leaders as former CEO Tony Strange praised "employees for creating the company's value." Kindred's crop of C-Suiters wants to ride us harder.

Kindred senior leaders behave much like the sorry Gentiva lot. Breier failed to mention how employees should respond to questions about Kindred's recent $125 million settlement with the Justice Department for improper therapy billing through its RehabCare division.

When Kindred bought out Gentiva proforma revenues for the combined company stood at $7.2 billion. That's now down to $7.1 billion (estimated for 2015). Actual 2015 revenue ended up $7.05 billion. It brings back Gentiva's revenue destructing integration of Harden.

Big bonuses for under-performing: It's a mutual best practice for leaders no longer admired.

Anonymous (from Gendred)

Subscribe to:

Posts (Atom)