Strange Tony,

The U.S. Senate will explore the impact of 60% financial rapscallion ownership of Kindred at Home now that Humana owns 100% of the company. It's like shutting the barn door after the cows got out, went onto a busy highway and numerous accidents killed many people and cows.

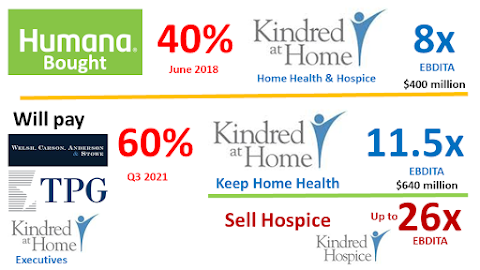

Humana was the "operating partner" since their June 2018 buyout of Kindred at Home alongside TPG Capital and WCAS. Humana recently acquired the rest of the company. The Senate should explore Humana's operation of Kindred at Home.

Financial rapscallions were along for the ride, courtesy of Humana CEO and former WCAS operating executive Bruce Broussard and a Kindred Healthcare board member from TPG Capital. The dastardly ownership trio and unethical executives Ben Breier and David Causby negotiated a low-ball $9 per share for the company.

Under Humana and financial rapscallion ownership raises were sparse to nonexistent, tens of thousands of jobs were eliminated, and nurses were switched to salaried so they could work 60-80 hour weeks and be paid for 40. Before the change the company routinely underpaid staff for hours worked and miles traveled. Compensation theft merely changed forms under Humana operation.

Humana gave us crappy, unreliable technology that lengthened the work day for the few remaining employees. It enabled management to spy on employees without their knowledge. It failed regularly leaving patients and their families with no method to reach our office.

Customer feedback plummeted and was summarily ignored. Employee feedback was most unwanted. The company used compliance complaints to target employees for elimination.

Financial rapscallions would rather pay interest on debt than fairly reward employees. Executives worked on their next king's ransom payday, as the last few buyouts did not enrich them enough.

The U.S Senate is two decades late in examining the impact of financial rapscallions on healthcare. They couldn't get their act together to reign in surprise medical billing, a grossly unfair and unethical practice started under financial rapscallion ownership.

Elected leaders allowed financial rapscallions to explode in size, scope and number. They kept preferred taxation for founders, most of whom became billionaires. Public companies imitated rapscallion practices, with outsized riches at the top and jack squat for the people actually doing the work.

Look at Humana's latest SEC filing. It reveals how much board members will be compensated for meeting 4-6 times a year:

We have hospice workers making less in one year than board members have in a charitable contribution match from Humana ($40,000). Maybe Humana board members will send some contributions to these workers. It's a nice thought that a few crumbs might fall from the king's table.

TPG and WCAS made 260% profits from a three year investment, an 86.7% annual

return. KAH management's 1.6% stake amounted to a $96 million check from Humana. It's a miserly group, not known for sharing.

Humana wants one more giant payday from spinning off our hospice. It may need to act fast, before Senate testimony starts or market conditions change.

Anonymous