Strange Tony,

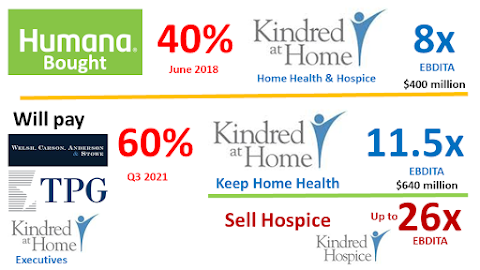

Humana will do to Kindred Hospice what it chose not to do in 2018 with Kindred Healthcare's inpatient post-acute businesses. It will buy the rest of Kindred Hospice for a multiple of 11.5 times EBDITA and then sell it for up to 26x EBDITA. HospiceNews stated:

Multiples in the hospice and home care space reached a record 26x during 2020, according to a research report by PwC’s Health Research Institute. Hospice and home health merger and acquisition activity buoyed the larger health care services sector last year, which saw a decline in transactions largely due to the fallout from the COVID-19 pandemic. Overall health care sector multiples hovered near 13.9x, up slightly from 13.8x the prior year, according to PwC.

“We expect that we will be able to capitalize on a robust market for hospice assets by divesting a majority stake in that portion of the business for what we anticipate will be an attractive valuation,” Humana CFO Brian Kane said.

Humana bought Kindred at Home alongside two financial rapscallions for an 8x EBDITA valuation. Long time employees lost money on company stock in the buyout.

How did Humana and Kindred at Home executives treat employees after the buyout? They reduced headcount from 56.000 to 43,000. They cut the number of holidays by 33% and holiday pay by 50%.

Employee harming executives will profit handsomely from Humana's buying the rest of Kindred at Home. It's not clear what multiple Kindred at Home CEO David Causby and Hospice President Larry Graham will sell their company shares. EBDITA grew from roughly $400 million to nearly $640 million, a 60% increase. On Indeed and Glassdoor Kindred at Home employees cited going years without raises.

Humana CEO Bruce Broussard once ran US Oncology, an affiliate of Welsh, Carson, Anderson and Stowe. He has bought and sold more than one WCAS owned company as Humana's chief executive. Companies once integral to Humana's strategic direction are deemed disposable. It happened to Concentra with physician clinics in 2015. It will happen again with Kindred Hospice in 2021.

It is probably for the best as CenterWell Hospice would be an extremely ill fitting name. Head's up fellow hospice employees, there could be another round of layoffs before the spinoff. It's what financial rapscallions do and Humana clearly is one.

Anonymous

Home Health PT echoed aspects of poor treatment from Humana:

ReplyDeleteWork/ Life Balance very stressful!! Lots of time off the clock/non paid spent with excessive documentation requirements, emails/ interdisciplinary communication, calls with Drs/ family, scheduling. Some flexibility as you schedule your own patients. No real incentives or areas for growth, no raise or bonus in over 2 years. Concerned what new buyout will bring with CenterWell, may mean increased productivity expectations. Hard to maintain full time caseload successfully if you have a family.

Pros

Stable caseload, decent benefits

Cons

Work/Life Balance, support from management, no raises or bonuses

https://www.indeed.com/cmp/Kindred-At-Home/reviews/stable-company-poor-work-life-balance?id=00c2d78bc6527fc5

Home Health Clinical Manager has hope that Humana will make it great again. This hope may be misplaced.

ReplyDeletePros

Inter office relationships, ability to help patients become independent.

Cons

Unfair pay practices, unspoken expectations to work beyond work hours with no overtime pay or incentives.

Advice to Management

Think about how processes will affect those executing them before implementing.

https://www.glassdoor.com/Reviews/Employee-Review-Kindred-at-Home-RVW46331279.htm

Our hospice has been repeatedly traumatized by corporate buyouts. Humana's has been by far the worst.

ReplyDeleteOur longtime social worker was diagnosed with a bad cancer. She died the day after Humana announced our hospice would be sold yet again. I wonder if she knew that another sale was in our future. We miss her terribly but it is good that she is no longer suffering. She is loved by so many.

Not one person from management attended the memorial service-life celebration of our longtime social worker. I saw lots of great people who no longer work at our hospice. Over twenty years of service and no one from management showed. Sad and indicative of heartless Humana greedership.

ReplyDeleteHumana employee called CEO Bruce Broussard a charlatan and said company cares only about almighty dollar:

ReplyDeleteHumana used to be a better company, only 10 years ago. Now, they care only about cutting costs, even if it hurts the customer. Their CEO is of the highest order of charlatans.

Pros

My schedule was fairly flexible

Cons

The pay was poor, the expectations were outrageous and unrealistic, management was abysmal

https://www.indeed.com/cmp/Humana/reviews/humana-cares-about-the-almighty-dollar-while-putting-up-a-front-of-caring-about-people?id=35cc2176d6555691

"the transaction EBITDA multiple comes out to roughly 11 times, a relative steal for a home health business of Kindred’s size,” Cory Mertz, managing partner of Mertz Taggart. “The 11x multiple was negotiated at the time they acquired Kindred back in 2018. Back then, if you looked at the home health and hospice combined, an 11x multiple was considered ‘market’ for an agency of that size. In hindsight, it was a great deal for Humana for both business lines.”

ReplyDeleteThe 2018 deal included a “built-in option” for the two private equity firms to sell their 60% stake to Humana after three years at a multiple of between 10.5x and 11.5x, reported Mertz.

https://hospicenews.com/2021/06/22/humana-set-to-make-bank-on-kindred-at-home-hospice-spin-off-sale/

About half of Kindred at Home is a hospice segment, which Humana plans to spin off as a separate company while maintaining only a minority stake.

ReplyDeleteHumana can help pay for the Kindred at Home buyout in part by having the hospice spinoff company incur debt.

https://www.wdrb.com/in-depth/humanas-biggest-deal-yet-furthers-cost-control-strategy/article_781ba0e6-a79b-11eb-afe7-ff853d2657c5.html

The man from TPG who helped ruin our hospice got promoted on this earthly plane for his misdeeds.

ReplyDeletehttps://finance.yahoo.com/news/1-private-equity-firm-tpg-170103772.html