StrangeTony,

Kindred's buyout of Gentiva levers one recently offered "Gentivaism":

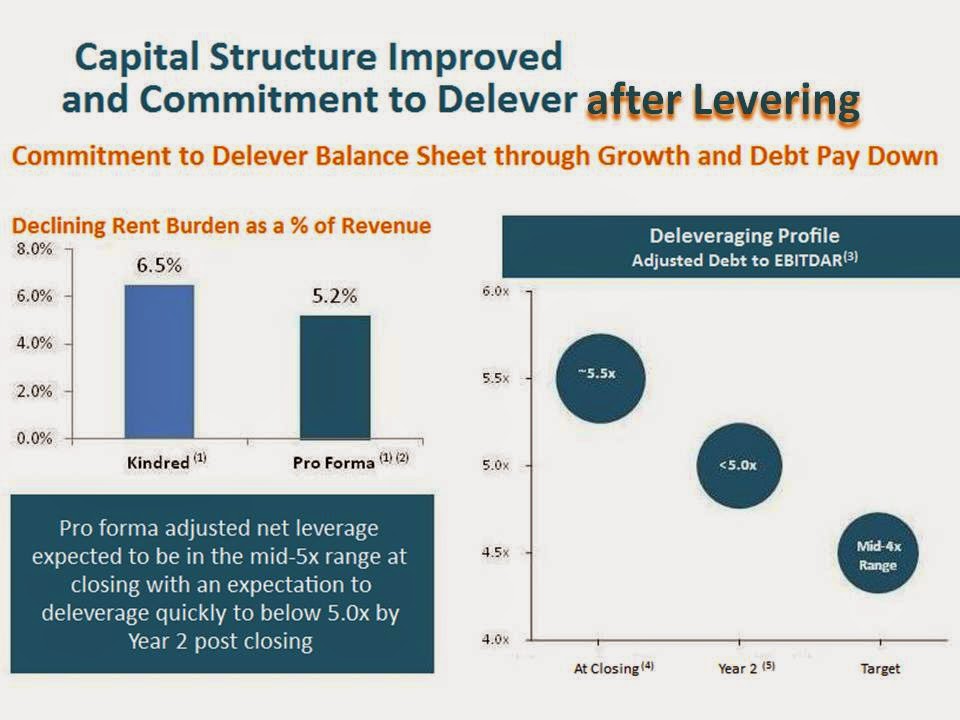

We reduce our dependence on debt by adding more.Kindred will borrow between $1.3 and $1.4 billion to buy Gentiva. Gentiva currently has just over $1 billion in debt. That's a 30 to 40% increase in debt for the company, which will be rolled into Kindred at Home. Kindred executives would not give an expected interest rate to investment analysts in their recent call. CNBC's talking heads noted financial instability would increase interest rates. Kindred projects $183 million in deal fees.

Gentiva refinanced much of its debt when it closed on Harden Healthcare's hospice, home health and community care assets. .Deal fees for Harden were $30.7 million.

Money changing (deal) fees will total over $210 million for Kindred-Gentiva and Gentiva-Harden. Kindred is already highly levered, which carries great risk in an uncertain financial environment. Add $300 to $400 million in new debt and things could get interesting.

Does anyone recall what happened to LTAC provider LifeCare? The highly levered company declared bankruptcy. It emerged from Chapter 11 earlier this year.

Add that Kindred utilizes derivatives for "protection." The financial crisis saw derivatives become massive financial obligations, not the expected insurance. Who thought healthcare companies would become a mirror of Wall Street, obsessed with financial language and employing word tricks that mask that which is actually happening.

Anonymous (from Gentiva)

P.S. - A recent SEC filings stated "Kindred has also obtained $1.7 billion in financing commitments." That's up from $1.3 to 1.4 billion. Investment banks and Kindred-Gentiva are calling the deal "Project Falcon." Borrowing $1.7 billion to finance a $1.8 billion deal is leveraging, plain and simple.

No comments:

Post a Comment