When hospice reverts to the lowest common denominator and leaders obsess about metrics, it's time to speak. Self-inflated leaders assume clinicians give until their backs break, given no raises for years. A clinical ladder is a rainbow’s pot of gold. Others have a sorrier job and must be motivated by money. Abysmal leaders dangle extrinsic rewards for admission, hiring and EDBITA targets. “Sign on” bonuses entice people into a poor work environment. Employees’ voice equals their raise, zero.

Thursday, October 30, 2014

Two Suspect Areas of Better Together

Once upon a time Human Resources ensured people were paid appropriately for their education and skills. Gentiva transferred that responsibility to employees via its complex, convoluted clinical ladder. Kindred characterized the clinical ladder as "well respected and well established." It's neither at our hospice site.

Kindred also called Gentiva's paltry investment in electronic medical records "significant." When our hospice paperwork multiplied like mice, Gentiva leaders said it was in preparation for EMR in early 2015. How will Kindred's closing on Gentiva, also in early 2015, impact this molasses paced rollout? That question was not answered in the company's latest "better together" missive.

Saturday, October 25, 2014

Managment's Weakly Commitment to Employees

StrangeTony,

On October 9, 2014 Gentiva CEO Tony Strange and COO David Causby spoke to employees about Kindred's acquiring the company. Strange said:

Kindred sees Gentiva as a key element in the post acute care delivery in the United States. We provide service in 42 states. We take care of 110,000 patients on any given night. We have 46,000 of the most dedicated, most compassionate employees in the healthcare industry. And in order to position themselves as the leader in post acute care they need a platform for home health and hospice and community care like Gentiva. So the value that has been created for shareholders through this proposal is directly attributable to the people who are on this call and that is the real value Kindred sees in Gentiva.

I promise you this. We will keep you updated as plans and more developments occur. But as I sit here today I would expect this transaction to be buttoned up sometime after the first of the year.

COO David Causby stated:

We are going to be very diligent in that process (integration) to make sure that first and foremost we protect the assets that Kindred is buying, the asset being our people and our patients. We will continue to update you on a weekly basis.Gentiva has made our great hospice a shell of its former self. The first post merger announcement plan filed with the SEC was the creation of a $10 million executive bonus pool. Gentiva senior executives will make millions in multiple ways through the sale of their company.

We need all of you to focus on taking care of our employees and being proud of this transaction.

I want to echo what Tony stated. Each of you on this call are the reason why this transaction has taken place. Your commitment, your dedication through all the things, the headwinds we've been through; you've made Gentiva a great company and each of you should be very proud of your accomplishments.

There is no pool for employees, the supposed group that created Gentiva's value. This shows what little regard do they have for their workers. Watch to see what weekly communications occur.

One thing's for sure, Gentiva's commitment to its employees is weak. Top management's commitment to self is unparalleled.

Anonymous (from Gentiva)

Thursday, October 16, 2014

New Gentiva Executive Bonus Pool

StrangeTony,

In addition to millions in proceeds from their stock holdings, huge sums from change of control and severance payments, Gentiva senior leaders will get a share of $10 million in executive bonuses:

The Company’s core management team (as determined by the Compensation Committee of the Company’s Board of Directors) will be eligible to receive bonuses from a $10 million executive bonus pool to be allocated at the sole discretion of the Compensation Committee. At least a significant minority of such bonus pool will be allocated to core management team members other than the Executive Chairman.As for employees (who created the value for which Kindred bid extra), we're to keep our head's down and slave away. There is no bonus pool for us.

In addition, subject to the sole discretion of the Compensation Committee, the Executive Chairman will receive for 2014 and 2015 bonus payments in the ordinary course (apart from the timing of payment), both of which will be payable on or before Closing. If these ordinary course bonus payments are paid to the Executive Chairman, the amounts paid will be in the discretion of the Compensation Committee but will not exceed $2 million for 2014 and $1 million for 2015.

Executives will also benefit from the acceleration of restricted stock, options and performance cash awards. Employees will receive the benefit of "being part of a stronger, larger company and the greater career and professional development opportunities created by the transaction." Yipppeeee!

Anonymous (from Gentiva)

Sunday, October 12, 2014

Value Givers: Executive Pander or Actionable Statement?

StrangeTony,

Deal fees for Kindred's purchase of Gentiva are projected at $183 million. A $4,000 bonus for every one of Gentiva's employees totals $184 million. Surely, the group that drove our company's value in Kindred's eyes, Gentiva 46,000 employees, earned the extra million.

It's time for Gentiva's senior leaders to put action behind their words. If they mean it, top executives should quit pandering and compensate. If they don't mean it, is anyone really surprised?

Anonymous (from Gentiva)

Saturday, October 11, 2014

Kindred Fulfills Debt Gentivaism

StrangeTony,

Kindred's buyout of Gentiva levers one recently offered "Gentivaism":

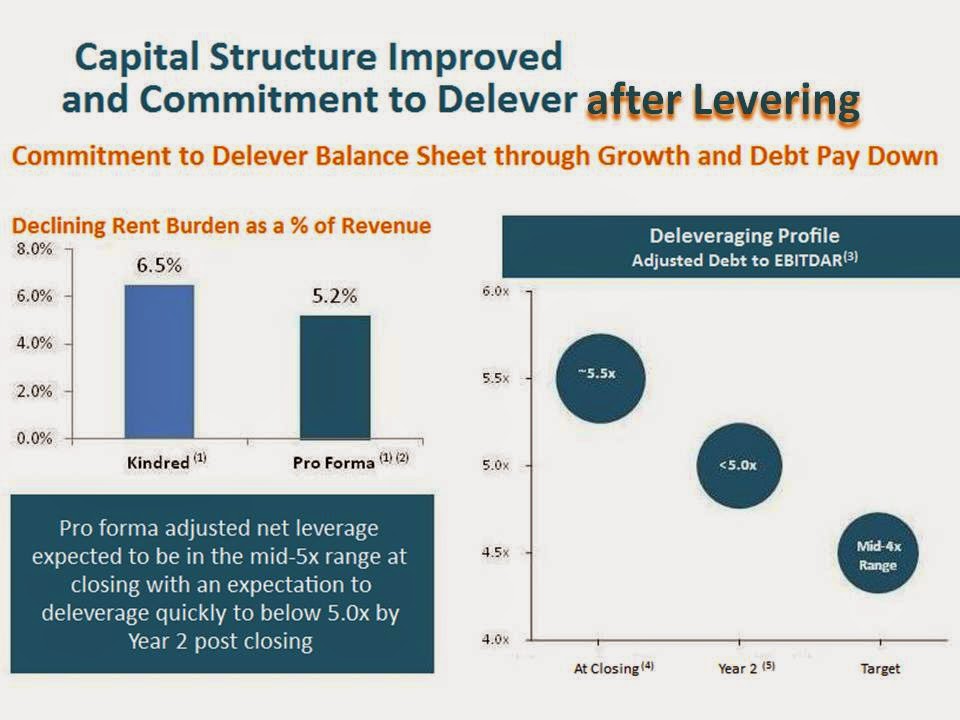

We reduce our dependence on debt by adding more.Kindred will borrow between $1.3 and $1.4 billion to buy Gentiva. Gentiva currently has just over $1 billion in debt. That's a 30 to 40% increase in debt for the company, which will be rolled into Kindred at Home. Kindred executives would not give an expected interest rate to investment analysts in their recent call. CNBC's talking heads noted financial instability would increase interest rates. Kindred projects $183 million in deal fees.

Gentiva refinanced much of its debt when it closed on Harden Healthcare's hospice, home health and community care assets. .Deal fees for Harden were $30.7 million.

Money changing (deal) fees will total over $210 million for Kindred-Gentiva and Gentiva-Harden. Kindred is already highly levered, which carries great risk in an uncertain financial environment. Add $300 to $400 million in new debt and things could get interesting.

Does anyone recall what happened to LTAC provider LifeCare? The highly levered company declared bankruptcy. It emerged from Chapter 11 earlier this year.

Add that Kindred utilizes derivatives for "protection." The financial crisis saw derivatives become massive financial obligations, not the expected insurance. Who thought healthcare companies would become a mirror of Wall Street, obsessed with financial language and employing word tricks that mask that which is actually happening.

Anonymous (from Gentiva)

P.S. - A recent SEC filings stated "Kindred has also obtained $1.7 billion in financing commitments." That's up from $1.3 to 1.4 billion. Investment banks and Kindred-Gentiva are calling the deal "Project Falcon." Borrowing $1.7 billion to finance a $1.8 billion deal is leveraging, plain and simple.

Thursday, October 9, 2014

Gentiva Sold: Kindred Wins!

StrangeTony,

Gentiva's stock roared, up nearly three dollars on the day as the company announced it would sell 100% of its shares to Kindred Healthcare. Gentiva shareholders will receive $14.50 in cash and $5 in Kindred stock in the buyout.

It was fascinating to hear Gentiva executives describe the deal to employees. Senior leaders pressed hard to get the bid up to $18.50 and eventually the agreed upon $19.50. They will endeavor to ensure that benefits remain as planned, although employees' 2015 health insurance surprise is yet to be revealed.

Kindred does not need two executive suites and the acquirer calls the shots on who remains. Kindred expects $70 million in annual cost savings after year one, so Gentiva's top layer could soon be gone.

Kindred's investor call occurred at 9:00 am. Due diligence gave Kindred confidence in Gentiva as an operator, in the company's financial performance and its accomplishments via the OneGentiva initiative.

From my view OneGentiva aligned employees in ensuring the company's senior leaders are personally enriched. Patient care is a clear afterthought. Who can forget senior leaders declaring earlier this year:

We've had some rocky years. In this industry there's been a negative environment that's been out there in both the home health and hospice. We all hope that will subside over time and we'll get back to focusing on the patient need, patient care and the industry will start to climb again.

Gentiva's employee call came at 3:30 pm. Leaders stated Gentiva employees did the work that enabled executives to return this incredible deal. Which set of Gentiva employees deserve the credit? Is it the 47,000 cited in CEO Tony Strange's December 2013 investor presentation or the 46,000 referred to in sellout documents. How will the 1,000 employees who lost jobs be rewarded in Gentiva's incredible deal? How will the current 46,000 actually benefit?

Gentiva leaders have three months to put their words into action. Will they share the tiniest bit of over $40 million in cash flow the last quarter? How much did that grow in the just ended third quarter? This crew is not know for sharing. In my tenure with the company there has been one year of raises and it was paltry.

The handful at the top will be richly rewarded. This is the gross value of their stock holdings.

The number does not include stock issued between now and the deal's close, nor does it include change of control or severance obligations, also known as golden parachutes.

It's hard on the ego to go from running a company to heading up a division. Gentiva's hospice, home health and community care operations will end up in the Kindred at Home division.

Gentiva's 46,000 employees should keep their heads up between now and the deal's close. Kindred's slides show Gentiva with 39,500 caregivers as of June 30, 2014. What happened to 6,500 Gentiva workers? Have they been whittled during the due diligence process or is more pain to come?

Unfortunately, no Wall Street analyst honed in on the discrepancy between buyer and seller on total employment. It's our burden to experience.

Kindred CEO Paul Diaz said the deal is immediately accretive, i.e. will have a positive impact on the company's financials. This portends a continuation of Gentiva's low to no raise wage practices. Diaz' effusiveness as to Gentiva's operations focused mostly on financial measures. This is another bad sign.

Yes, Gentiva employees should wait for concrete action by Kindred's integration teams. Kindred is free to offer more substantial language in its aims toward Gentiva employees. Nothing prevents leadership from offering an overall human resource strategy to employees joining the Kindred family.

I asked a longtime physician how many healthcare mergers/acquisitions improved care in his time practicing. Only one out of ten did. That merger occurred in a time when leadership had balance between the various management disciplines. That era is long gone.

There is a limit as to how much people can give a company. I've seen Gentiva push beyond that numerous times and pay the price via turnover. Kindred's integration teams should be wary of making the same mistake.

Anonymous (from Gentiva)

P.S. - The 2015 surprise is a 15% reduction in employer health insurance contributions

Saturday, October 4, 2014

Gentiva: Trick or Treat?

StrangeTony,

September passed without a deal announcement. It's now an October event. Recent instability in the stock market could spill into the debt arena. This would not concern Kindred, given it raised over $200 million in cash from a June secondary offering:

Kindred Healthcare Inc (NYSE: KND) priced a 9,000,000 share secondary stock offering at $23.75 per share. Buyers in that offering made a considerable investment into the company, expecting that their investment would go up over the course of time.Kindred stock closed at $20.04 on Friday, down $3.71 a share from the secondary.

The unnamed suitor, Kindred's competitor, would likely need to borrow a significant amount to close any deal priced at $17.25 a share or higher.

Recent trading in Gentiva has been at a discount to this announced price. The stock closed yesterday at $16.74 per share, a 51 cents discount to the last publicly shared offer. This means there is some uncertainty as to a deal being completed at the $17.25 offer.

Employees know that costs are being mircro-managed, which means people are as well. Many survived the Ides of September. How many will get through Shock-tober?

Anonymous (from Gentiva).

Subscribe to:

Posts (Atom)