When hospice reverts to the lowest common denominator and leaders obsess about metrics, it's time to speak. Self-inflated leaders assume clinicians give until their backs break, given no raises for years. A clinical ladder is a rainbow’s pot of gold. Others have a sorrier job and must be motivated by money. Abysmal leaders dangle extrinsic rewards for admission, hiring and EDBITA targets. “Sign on” bonuses entice people into a poor work environment. Employees’ voice equals their raise, zero.

Tuesday, December 30, 2014

Gentiva Board Member's Shares Magically Grow

StrangeTony,

SEC filings show Gentiva Board member Robert Forman's stock holdings increased by roughly 28,000 shares with no declared activity. His September filing showed holdings of 43,938 shares. This rose to 71,538 shares in a December 23rd filing. How does that happen with no filing in between? Something's missing or amiss.

Anonymous (from Gentiva)

Friday, December 19, 2014

Slusser Latest to Exercise Executive Options

StrangeTony,

Gentiva Chief Financial Officer Eric Slusser exercised his stock options for a profit of $760,000. His remaining stock holdings are valued at $4.6 million. Susser's stock option sale occurred nearly two weeks after a number of Gentiva leaders. This wait cost Slusser over 25 cents per share in proceeds. He left over $22,000 on the table. How many Gentiva employees work for a year for that level of pay? I bet that number would fill a lot of buses.

Also, the buyout vote for Gentiva shareholders will occur on Thursday, January 15, 2015. It will take a Gentiva wreck for the deal to not go through.

Anonymous (from Gentiva)

Tuesday, December 16, 2014

Chairman of Fun Exercises Options

StrangeTony,

Gentiva Executive Chairman Rod Windley became the latest senior leader to exercise stock options prior to selling their company to Kindred Healthcare. Windley stands to nearly double his money given an option purchase price of $10.24 per share and a quick flip sale at $19.05. It's an 86% return at those prices.

Windley still holds over 515,000 shares of Gentiva stock worth over $9.8 million. That will buy a lot of future fun. Meanwhile the company cut its health insurance contribution for 2015. That could mean much misery for employees living on the margin.

Anonymous (from Gentiva)

Gentiva Executive Chairman Rod Windley became the latest senior leader to exercise stock options prior to selling their company to Kindred Healthcare. Windley stands to nearly double his money given an option purchase price of $10.24 per share and a quick flip sale at $19.05. It's an 86% return at those prices.

Windley still holds over 515,000 shares of Gentiva stock worth over $9.8 million. That will buy a lot of future fun. Meanwhile the company cut its health insurance contribution for 2015. That could mean much misery for employees living on the margin.

Anonymous (from Gentiva)

Friday, December 12, 2014

Kindred's December Debt Offering

Kindred's SEC filing stated the company will float unsecured debt as part of its financing of its Gentiva purchase:

Kindred Healthcare, Inc. (“Kindred” or the “Company”) (NYSE:KND) today announced that it proposes to offer, subject to market and other conditions, $1.35 billion of senior unsecured notes (the “Notes”) to qualified institutional buyers in accordance with Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and to certain non-United States persons in offshore transactions.

The actual terms of the Notes, including interest rate, principal amount and maturity, will be determined at the time of pricing. The Notes are expected initially to be issued by Kindred’s subsidiary, Kindred Escrow Corp. II.

Qualified institutional buyers, offshore transactions, Kindred Escrow Corp. II? This is high finance, levered healthcare priced at premium levels, 8% and 8.75%.

Kindred's debt is expected to be sold by December 18th, one week before Christmas. It's nearly the shortest day of the year, the one with the least light. It's fitting.

Anonymous (from Gentiva)

Thursday, December 11, 2014

Too Big to Care

StrangeTony,

The business of hospice keeps getting bigger. Bloomberg reported Kindred Healthcare shortened the maturity on $1.35 billion in junk bonds the company will use to acquire Gentiva. Higher interest rates and shorter maturities are needed to push speculative grade debt.

NASDAQ reported "The notes will be issued in two tranches of $750 million of 8.00 percent senior notes due 2020 at an issue price of 100 percent and $600 million of 8.75 percent senior notes due 2023 at an issue price of 100 percent."

That's $112.5 million in annual interest expenses for this twin set of bonds. Bloomberg did not say how the principal is paid back, in annual installments or a lump sum at maturity. Kindred will float the bonds in two parts. One will have a five year maturity and the other eight years.

Pressure on individual hospices should escalate from higher interest rates, increased overhead and cash needs, including a corporate building expansion. The Courier Journal reported "Kindred Healthcare is planning a $39.5 million expansion of its headquarters along Fourth Street at Broadway, adding up to 500 additional employees over perhaps three years.'

'Kindred officials were joined by Gov. Steve Beshear and Mayor Greg Fischer Thursday afternoon at Theater Square to announce the new jobs and the construction, after the state Economic Development Finance Authority reviewed a set of $11 million in state incentives for the expansion earlier in Frankfort."

I hope the State of Kentucky knows about Gentiva's no raises for years, benefit reductions (PTO and health insurance contributions), as well as Kindred's plans to write President Paul Diaz a $6 million check in March. Someone inside Kindred will benefit from Kentucky taxpayers' generosity. I don't expect it to trickle down.

However, we will need to fund increased overhead and the next executive incentive pay extravaganza. Doesn't it warm the cockles of your heart?

Anonymous (from Gentiva)

The business of hospice keeps getting bigger. Bloomberg reported Kindred Healthcare shortened the maturity on $1.35 billion in junk bonds the company will use to acquire Gentiva. Higher interest rates and shorter maturities are needed to push speculative grade debt.

NASDAQ reported "The notes will be issued in two tranches of $750 million of 8.00 percent senior notes due 2020 at an issue price of 100 percent and $600 million of 8.75 percent senior notes due 2023 at an issue price of 100 percent."

That's $112.5 million in annual interest expenses for this twin set of bonds. Bloomberg did not say how the principal is paid back, in annual installments or a lump sum at maturity. Kindred will float the bonds in two parts. One will have a five year maturity and the other eight years.

Pressure on individual hospices should escalate from higher interest rates, increased overhead and cash needs, including a corporate building expansion. The Courier Journal reported "Kindred Healthcare is planning a $39.5 million expansion of its headquarters along Fourth Street at Broadway, adding up to 500 additional employees over perhaps three years.'

'Kindred officials were joined by Gov. Steve Beshear and Mayor Greg Fischer Thursday afternoon at Theater Square to announce the new jobs and the construction, after the state Economic Development Finance Authority reviewed a set of $11 million in state incentives for the expansion earlier in Frankfort."

I hope the State of Kentucky knows about Gentiva's no raises for years, benefit reductions (PTO and health insurance contributions), as well as Kindred's plans to write President Paul Diaz a $6 million check in March. Someone inside Kindred will benefit from Kentucky taxpayers' generosity. I don't expect it to trickle down.

However, we will need to fund increased overhead and the next executive incentive pay extravaganza. Doesn't it warm the cockles of your heart?

Anonymous (from Gentiva)

Friday, December 5, 2014

Stock Option Paydirt for Gentiva Executives

StrangeTony,

Gentiva's executives continued cashing in their stock options. Here's the payday for December 4th:

Remaining holdings look like this:

The public should be aware of this public information, especially Gentiva employees who built the value Kindred found in our company.

Anonymous (from Gentiva)

Gentiva's executives continued cashing in their stock options. Here's the payday for December 4th:

Remaining holdings look like this:

The public should be aware of this public information, especially Gentiva employees who built the value Kindred found in our company.

Anonymous (from Gentiva)

Thursday, December 4, 2014

Gentiva Lawyer Cashes in Options

StrangeTony,

'Tis the season for Gentiva executives to profit in numerous ways. The first to publicly do so is Gentiva Senior Vice President and General Counsel John Camperlengo. Mr. Camperlengo exercised five of his stock options, spending just over $1.4 million for 150,000 shares. He sold two thirds of these new shares, roughly 100,000 shares at $19.22 per share. His total proceeds from the sale were over $2 million.

Camperlengo's new shares cost an average of $9.52 per share, which gave John $9.70 profit per share. That's an instant 102% profit. After his $570,000 payday Mr. Camperlengo still owns nearly 170,000 shares of Gentiva stock worth $3.2 million.

Cashing in vested options is but one financial plum on the Gentiva senior leader Christmas Tree. I expect many more financial presents, including the $10 million executive bonus.

Meanwhile, executive communications to employees have grown silent. The again, management's actions have consistently put employee relations into the afterthought category. Gentiva executives must have investment possibilities and uses for millions in cash dancing in their heads.

Anonymous (from Gentiva)

'Tis the season for Gentiva executives to profit in numerous ways. The first to publicly do so is Gentiva Senior Vice President and General Counsel John Camperlengo. Mr. Camperlengo exercised five of his stock options, spending just over $1.4 million for 150,000 shares. He sold two thirds of these new shares, roughly 100,000 shares at $19.22 per share. His total proceeds from the sale were over $2 million.

Camperlengo's new shares cost an average of $9.52 per share, which gave John $9.70 profit per share. That's an instant 102% profit. After his $570,000 payday Mr. Camperlengo still owns nearly 170,000 shares of Gentiva stock worth $3.2 million.

Cashing in vested options is but one financial plum on the Gentiva senior leader Christmas Tree. I expect many more financial presents, including the $10 million executive bonus.

Meanwhile, executive communications to employees have grown silent. The again, management's actions have consistently put employee relations into the afterthought category. Gentiva executives must have investment possibilities and uses for millions in cash dancing in their heads.

Anonymous (from Gentiva)

Friday, November 28, 2014

Top Two Gentiva Executives' Partial Windfall

StrangeTony,

Kindred Healthcare's partial windfall for Gentiva Executive Chairman Rod Windley and CEO Tony Strange will exceed $21 million. There's another $19.5 million in golden parachute money for this pair. Gentiva's top two will garner over $40 million with millions more available in bonuses, severance and performance cash awards.

The S-4 was posted on Kindred's SEC page on 11-21. It has not yet been posted on Gentiva's SEC page, even though Gentiva shareholders must vote on the deal. That fits given Gentiva's Annual Report to Security Holders has a place but no document was filed for the public to view.

Gentiva's top dogs have a massive payday coming. Rest assured this will not be communicated from the top in an executive memo. I doubt it will make Kindred's Badder Together publication.

Anonymous (from Gentiva)

Wednesday, November 26, 2014

Kindred Borrows Big for Gentiva

StrangeTony,

Kindred Healthcare raised nearly $250 million for its acquisition strategy. It issued roughly $100 million in stock and $150 million in tangible equity units. Also, the company amended its term loan facility to pay a higher interest rate in return for relaxed debt covenants. For a 0.25% interest rate increase Kindred's leverage can now be as high as 6 to 1. That's 85% debt to 15% equity for the next six quarters.

The Company intends to use the net proceeds of these offerings, combined with proceeds from additional financing transactions, to fund the previously announced acquisition of Gentiva.Debt financing will be $1.7 to 1.9 billion according to corporate documents. Gentiva's senior executives will garner huge sums via golden parachute compensation, change of control agreements, severance agreements, ordinary course bonuses, transaction bonuses of $10 million, in the money options, restricted stock, deferred stock units and performance cash awards. It looks like Gentiva executive engorgement could easily eat up $50 million. That'll be the topic of my next letter.

Anonymous (from Gentiva)

Saturday, November 22, 2014

Gentiva Cuts Health Insurance Contribution for 2015

StrangeTony,

Gentiva's senior executives failed to inform employees of a 16% reduction in the company's health insurance contributions for 2015. The health care company decreased the benefit by $25 per pay period, going from a $161 contribution in 2014 to $135 per pay period for 2015. That's $650 less per employee on an annual basis.

The Riverwood Parkway knuckle sandwich continues for Gentiva employees. Let's encapsulate the year: no raises, PTO accrual schedule reduction of 40 hours , and a 16% cut in company provided health insurance benefit. If this is the margin discipline that excited Kindred, it's an ominous sign.

Don't forget $10 million in executive bonuses are forthcoming! Employees unwillingly contributed to senior leader financial engorgement via a reduced accrual schedule for paid time off. We'll help out next year by picking up a greater chunk of health insurance.

What about any of this fits with two of Gentiva's stated values, specifically respect and teamwork? Nothing but it confirms repeated "top dog" pandering to employees. Money is the sole center of Gentiva, which makes the company soulless.

Anonymous (from Gentiva)

Wednesday, November 12, 2014

Kindred at Home's "Badder Together"

StrangeTony,

Kindred's latest missive for their home health and hospice workers rang hollow at our hospice. Our patients have noticed changes from Gentiva's return to hospice margin discipline. They're learning to wait to get service, if they receive it at all.

Opportunities for employees don't mention competitive pay for employee skills and work performed. Gentiva's eye on the bottom line meant no raises for years for most employees, regardless of how many times they pitched in to cover.

Gentiva CEO Tony Strange offered employees flowery words during quarterly earnings calls with Wall Street analysts. His words were vacuous, having no substance in reality. Kindred's off to a good start along the same lines with their regular communications. The words sound pretty, but the context in which they fall is a garbage heap where Gentiva executives divide $10 million in bonuses and Kindred increases borrowings by 80% while federal reimbursement remains flat.

The math does not say better together, but a continuation, even acceleration of Gentiva's arc of employee abuse. I propose they switch to Badder Together. That would be more honest.

Anonymous (from Gentiva)

Kindred's latest missive for their home health and hospice workers rang hollow at our hospice. Our patients have noticed changes from Gentiva's return to hospice margin discipline. They're learning to wait to get service, if they receive it at all.

Opportunities for employees don't mention competitive pay for employee skills and work performed. Gentiva's eye on the bottom line meant no raises for years for most employees, regardless of how many times they pitched in to cover.

Gentiva CEO Tony Strange offered employees flowery words during quarterly earnings calls with Wall Street analysts. His words were vacuous, having no substance in reality. Kindred's off to a good start along the same lines with their regular communications. The words sound pretty, but the context in which they fall is a garbage heap where Gentiva executives divide $10 million in bonuses and Kindred increases borrowings by 80% while federal reimbursement remains flat.

Bad - adjective

1. of poor quality, inferior or defective

2. not such as to be hoped for or desired, unpleasant or unwelcome

The math does not say better together, but a continuation, even acceleration of Gentiva's arc of employee abuse. I propose they switch to Badder Together. That would be more honest.

Anonymous (from Gentiva)

Saturday, November 8, 2014

Kindred Executives on Gentiva Deal

StrangeTony,

Kindred executives made the following remarks concerning Gentiva during their Q3 earnings call. (Gentiva executives did not hold a Q3 earnings call):

Paul J. Diaz - Kindred Healthcare, Inc. - CEO

As promised, following several years of repositioning the Company, and working through significant regulatory change, the third quarter marked the commencement of the growth phase of our strategic plan. And as we announced, the signing of the definitive agreement to acquire Gentiva Healthcare Services. This transaction will solidify Kindred’s position as the nation’s premier post-acute health care service provider, with a diverse business and revenue mix.

We are encouraged by Gentiva’s strong results in the third quarter and look forward to working closely with the talented team at Gentiva to complete our combination. We will use the call today to discuss the Gentiva transaction and update you on our plans going forward.

Benjamin A. Breier - Kindred Healthcare, Inc. - President, COOMy take: Kindred was in house in Atlanta conducting due diligence when Gentiva enacted its latest expense slashing tirade. These cuts caused major disruptions in patient care at our hospice, yet Kindred executives cheered Gentiva's strong financial results. Flash back a year when Gentiva cited Harden's COO Chris Roussos as the key to successful integration. Roussos left a mere two months after the merger closed. Also, I believe it's a misnomer to call Causby a hospice expert, given his nearly exclusive home health background. Despite the company's operating practices hospice is very different from home health.

As you know then, last month we announced the agreement to acquire Gentiva. The transaction is pending various approvals, and we expect it to close in the first quarter of 2015. I’d like to illustrate some of what we believe are the compelling merits of the combination, and briefly review some of the highlights. The combination with Gentiva enhances Kindred’s industry-leading position as the nation’s premier post-acute and rehab service provider, and creates the largest and most geographically diversified home health and hospice organization in the United States.

It also expands and enhances our presence in 20 of the top MSAs in the U.S., and Kindred’s integrated markets, which will support better coordinated care with more efficient and cost-effective approach, an approach that we believe is strongly preferred by consumers and payers. The transaction diversifies Kindred’s business and revenue mix and delivers substantial cost and revenue synergies. Once the merger is complete, 50% of Kindred’s $7 billion in revenue will come from non-in-patient settings. Synergies expected to be north of $70 million at the end of year two of the transaction will be immediate — will be meaningfully accretive to our earnings.

The deal also enhances Kindred’s revenue and margin profile and margin growth profile. It increases financial flexibility, it lowers our cost of capital, it reduces our rent and CapEx as a percent of revenue, and it generates substantial free cash flows to quickly de-lever, while supporting a meaningful dividend. The Gentiva transaction combination creates significant value we believe for both shareholders of both companies through significant accretion and cash flow generation.

And so together with Gentiva we’ll have the scale, the technical capabilities and the geographic presence to provide high-quality integrated care to patients across the full continuum. We’ve been busy here and in the last few weeks we announced — since we announced the transaction, we’ve already made significant progress in planning the integration of our two companies. We have been hard at work planning our integration starting with the formation of what we call an IMO or an Integration Management Office.

Look, at the outset of this process we felt it was important to define clear operating principals that will guide our integration planning and execution, and we remain committed to our patients first and foremost, preventing disruption to their care while also focusing on protecting the targeted revenue streams, retaining key talent, meeting our reporting obligations, achieving the synergies we’ve laid out, and fully preparing for day one after the close. Our integration team comprises top talent from both organizations and we look forward to continuing to work closely with Gentiva to achieve a smooth transaction.

To that end this week, we also made an exciting announcement regarding Kindred at Home’s ongoing leadership. David Causby, currently Gentiva’s President and Chief Operating Officer, will become President of Kindred at Home upon closing of the acquisition of Gentiva. We’re thrilled to have such a strong leader with a proven expertise in home care, hospice, and community care leading this business as it goes through the transition. David’s deep understanding of Gentiva’s operations, people, and systems will be invaluable and we look forward to having him in his new role.

His presence will help to ensure a smooth transition and a successful integration and we think ultimately bring a higher level of certainty on achieving our cost and revenue synergy goals, and advancing this business going forward. Let me now turn it back to Steve and he’ll spend a few minutes discussing the financial benefits of the transaction, and our financing plans in greater detail. Stephen.

Stephen D. Farber - Kindred Healthcare, Inc. - CFO, EVP

Thanks, Ben. Under the agreement Gentiva shareholders will receive $14.50 per share in cash, and $5 of Kindred common stock, with a fixed exchange ratio of 0.257 Kindred shares per Gentiva share. The transaction is valued at approximately $1.8 billion including the assumption of debt. On a pro forma basis, the combined Company is expected to generate annual revenues of approximately $7.1 billion and $1 billion of EBITDAR including expected synergies.

The transaction is expected to be immediately and significantly accretive to Kindred’s pro forma earnings and operating cash flows exclusive of transaction and integration costs. In addition to the expected cost synergies of approximately $70 million ramping up over the two-year period post-closing, we also inspect to realize annual revenue synergies of more than $60 million over time.

I particularly want to call attention to Gentiva’s terrific operating results which they announced last night. Their performance is exactly what we had hoped for and counted on in the context of this transaction, and we have great confidence it will continue to track consistent with their guidance, which I’m sure most of you have seen they reconfirmed last night. Expecting adjusted EBITDA of $183 million to $195 million for the year, as well as revenue guidance of roughly $2 billion. This momentum bodes well for our combination and further validates and de-risks our acquisition thesis.

Together we will have $7.1 billion of pro forma revenue, $1 billion of synergized EBITDAR and roughly $640 million of synergized EBITDA, which represents an increase in EBITDA margin of roughly 150 basis points compared to Kindred’s stand-alone. I want to emphasize the extraordinary value this transaction creates for Kindred and Gentiva shareholders.

Starting with earnings, we expect this transaction to add roughly $0.40 to $0.60 of accretion to Kindred’s forward earnings on a run-rate basis, two years after the closing when the integration of Gentiva is complete. It’s important to note that that calculation already takes into account our expected increase in share count from our 64 million shares today to the expected 85 million shares post-closing. The pro forma snapshot of the combined Company is a compelling value proposition and we’re very excited about the significant accretion to our EPS and our preliminary view of the Company’s future earnings power.

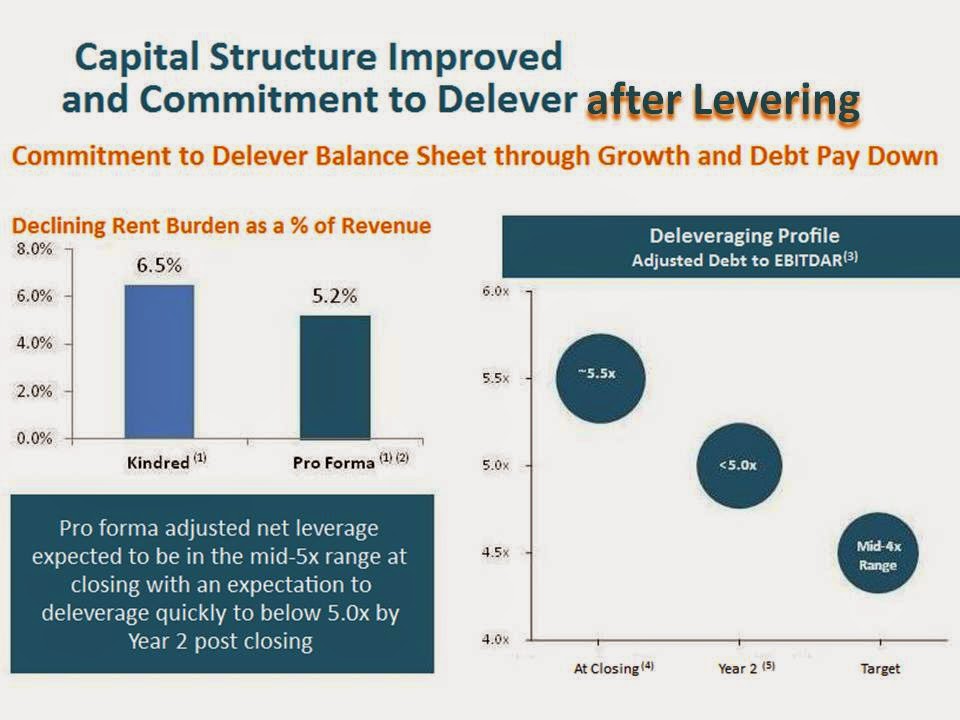

We have obtained a fully committed bridge loan back stop from Citi and J.P. Morgan, and subject to market and other conditions intend to finance the deal by issuing $200 to $300 million in total of some mix of common stock and mandatorily convertible equity securities, issuing roughly $1.3 to $1.4 billion worth of bonds, and by drawing on our existing line of credit to fund the remaining amount. I would like to emphasize again our commitment to maintaining a moderate leverage profile. As we’ve said before we expect leverage at closing to be roughly 5.5 times adjusted debt to EBITDAR. We expect over two years to reduce leverage to the 5.0 times area or somewhat below, and we maintain our long-term leverage goal of leverage in the mid four times range going up or down a bit depending on opportunities within the business. And with that I will turn it back to Paul.

Paul J. Diaz - Kindred Healthcare, Inc. - CEO

Together with Gentiva we expect to deliver a 60 basis point improvement in revenue growth headed into 2015, and expand our EBITDA margins to 9% from 7.4% on a stand alone basis. We have also made significant improvement in our capital structure. Reducing capitalized lease obligations with more flexible debt and equity, positioning us for future growth with lower risk. Looking ahead, we are committed to grow and deliver — de-lever over time.

The combination of reduced lease exposure and improved cash flow as a combined company, puts us in a great position to generate free cash flow to accomplish both and return cash to shareholders through our recurring dividend. We expect to maintain, as Stephen said, net adjusted leverage of approximately 5.5% — 5.5 at closing, and de-lever quickly over the next two years to 5.0 or below. Finally, despite a difficult operating environment that featured sequential years of reimbursement cuts and change and a wholesale restructuring of our Company and capital structure we have continued to grow. And heading into the fourth quarter of 2014 are very excited about our future.

My take: The obsession with purely financial measures was a common theme on the call. Leverage as a percent would be 550%, not 5.5% as stated by Diaz. The aim is growth, something Gentiva employees know well. Kindred's priorities are the same as Gentiva's: profitability first and foremost. The rest takes a back seat. This bodes poorly for dedicated employees and increases the risk of job reduction or outright loss. Interest and executives need to be paid. Kindred CEO Paul Diaz will be the $6 million man after the Ides of March in 2015. The dark trajectory remains as Kindred-Gentiva lowers the hospice bar yet again.

Friday, November 7, 2014

Kindred Selects Gentiva COO for "At Home" Division

StrangeTony,

The latest reports from Kindred suggest more pain for our hospice. Borrowings are now projected at $1.8 billion with a mere $200 million in equity. That's 90% debt and 10% equity. The $200 million in equity will cover deal (money changer) fees of $183 million with $17 million to spare.

As for Q3 earnings Gentiva presented possibly the sparsest financial information I've seen from a public company. Internally, senior executives prioritized hospice margin discipline over patient care and customer service.

My hopes for the slightest shift in priorities fell when Kindred announced Gentiva COO David Causby will become President of Kindred At Home. The Kindred buyout looks to continue our heart breaking arc with two primary drivers, rising interest expense amidst flat federal reimbursement and no change in top hospice leadership.

It's going to be a great year for Gentiva and Kindred's top dogs and money changers. Kindred CEO Paul Diaz will receive over $6 million in March 2015. The rest of us likely face no raises (yet again) and fear of job loss. Also, no word yet on those long promised hospice computers. Diaz' $6 million payout is six months of Gentiva's capital expenditures in 2014.

We shall see what crumbs fall from the executive table. I'll venture very few.

Anonymous (from Gentiva)

Tuesday, November 4, 2014

Bounty for Bagging Gentiva?

StrangeTony,

Kindred reported in an SEC filing that Kindred President Paul Diaz will get kicked further upstairs, placing him in Rod Windley territory as Executive Vice Chairman of Kindred's Board. The company spelled out the arrangement which includes:

I view this as a commission or bounty for bagging a reluctant Gentiva. Diaz' $6 million payday equals six months of capital expenditures for Gentiva.

Recall Medicare just released its home health payment update for 2015 with an overall 0.3% reduction. Hospice received a 1.4% increase effective October 1. There's not much to trickle down between payouts to the big boys and greatly increased borrowings, which should cause interest expense to rise dramatically.

It's hard to believe Kindred could be worse than Gentiva's false-faced executives, but the structural nature of the combination could continue our hospice's pain.

Anonymous (from Gentiva)

Kindred reported in an SEC filing that Kindred President Paul Diaz will get kicked further upstairs, placing him in Rod Windley territory as Executive Vice Chairman of Kindred's Board. The company spelled out the arrangement which includes:

Within 14 days following March 31, 2015, the Company shall pay Diaz a cash payment in the amount of $6,011,244.

I view this as a commission or bounty for bagging a reluctant Gentiva. Diaz' $6 million payday equals six months of capital expenditures for Gentiva.

Recall Medicare just released its home health payment update for 2015 with an overall 0.3% reduction. Hospice received a 1.4% increase effective October 1. There's not much to trickle down between payouts to the big boys and greatly increased borrowings, which should cause interest expense to rise dramatically.

It's hard to believe Kindred could be worse than Gentiva's false-faced executives, but the structural nature of the combination could continue our hospice's pain.

Anonymous (from Gentiva)

Sunday, November 2, 2014

Ruining Hospice One Management Interaction at a Time

Anonymous (from Gentiva),

Who turned hospice into a mere shadow of its former self? Who twisted the love and caring of volunteer clinicians into massive profit oriented enterprises, where the greatest returns come from closing hospice sites or selling out completely? This toxicity sprouted Generic Hospice blog with my heading:

When hospice reverts to the lowest common denominator and leaders obsess about metrics, it's time to speak. Self-inflated leaders assume clinicians give until their backs break, given no raises for years. A clinical ladder is a rainbow’s pot of gold. Others have a sorrier job and must be motivated by money. Abysmal leaders dangle extrinsic rewards for admission, hiring and EDBITA targets. “Sign on” bonuses entice people into a poor work environment. Employees’ voice equals their raise, zero.Hospice became a business. Mission and service became words on paper, nothing more. You informed me of Gentiva CEO Tony Strange's confession earlier this year, before inking the deal that will make him over $50 million.

We all hope that will subside over time and we'll get back to focusing on the patient need, patient care and the industry will start to climb again.

Hospice owners-investors include Kohlberg & company, Clearview Capital, Wellspring Capital Management, Pouschine Cook Capital Management, KKR, Fulcrum Equity Partners, GTCR, Sentinel Capital Partners, Summit Partners, GE Capital and Cressey & company. The Wall Street Journal reported:

Investments in home health and hospice services have been going through a phase of consolidation that saw the merging of operators and closing of branches that have lower profitability.Law and lobbying firm McGuire Woods wrote in a white paper:

Private equity investors have continued interest in the hospice sector, shifting the industry from nonprofit control to for-profit dominance. Between 2000 and 2009, 80 percent of new hospices that began participating in Medicare were for-profit. In 2011, more than 1.2 million Medicare beneficiaries received hospice services from more than 3,500 providers, and Medicare expenditures totaled around $13.8 billion. See MedPAC Report to Congress 2013 . Further, in 2011, 45.2 percent of Medicare beneficiaries who died that year used hospice services. See MedPAC Report to Congress 2013 . The hospice sector is benefiting from an aging population and remains ripe for consolidation, creating opportunity for investors to gain market share and make profits as the demand for hospice services increases. However, the significant increase in Medicare spending on hospice services caused t he OIG to focus on activities relating to hospice services in 2013, namely inspection of hospices’ marketing materials, practices and financial relationships with nursing homes. See Office of Inspector General, Work Plan Fiscal Year 2013 . Additionally, while there has been a steady increase in the percentage of Medicare beneficiaries who receive hospice services, the rate of increase has slowed. Among private equity funds, the number of mergers and acquisitions for hospice providers declined in the first ha lf of 2012 after seeing a substantial increase in 2009 - 2011. See MedPAC Report to Congress 2013 . Investment in hospice was present but slow in 2013. For example, Summit Partners, a private equity firm, acquired a minority interest in Heart to Heart Hospice in March 2013. We expect investment in hospice to continue at a steady pace, but it will likely not have the significant growth we expect to see in other sectors.The language of hospice today is that of Wall Street. Hospice pioneers and founders, those still living, must be appalled at the complete distortion of their vision and rue the deformation of the service they birthed. Plain and simple, hospice itself is on hospice. Teamwork has been replaced with autocracy. Genuine caring goes unrecognized. Surface level imagery is all that matters. Management offers flowery and fluffy language, but scratch the surface and staff hear leaders shouting shallow, hollow and contradictory messages.

Hospice is actively dying. For that, so many of us grieve.

StrangeTony

Thursday, October 30, 2014

Two Suspect Areas of Better Together

Once upon a time Human Resources ensured people were paid appropriately for their education and skills. Gentiva transferred that responsibility to employees via its complex, convoluted clinical ladder. Kindred characterized the clinical ladder as "well respected and well established." It's neither at our hospice site.

Kindred also called Gentiva's paltry investment in electronic medical records "significant." When our hospice paperwork multiplied like mice, Gentiva leaders said it was in preparation for EMR in early 2015. How will Kindred's closing on Gentiva, also in early 2015, impact this molasses paced rollout? That question was not answered in the company's latest "better together" missive.

Saturday, October 25, 2014

Managment's Weakly Commitment to Employees

StrangeTony,

On October 9, 2014 Gentiva CEO Tony Strange and COO David Causby spoke to employees about Kindred's acquiring the company. Strange said:

Kindred sees Gentiva as a key element in the post acute care delivery in the United States. We provide service in 42 states. We take care of 110,000 patients on any given night. We have 46,000 of the most dedicated, most compassionate employees in the healthcare industry. And in order to position themselves as the leader in post acute care they need a platform for home health and hospice and community care like Gentiva. So the value that has been created for shareholders through this proposal is directly attributable to the people who are on this call and that is the real value Kindred sees in Gentiva.

I promise you this. We will keep you updated as plans and more developments occur. But as I sit here today I would expect this transaction to be buttoned up sometime after the first of the year.

COO David Causby stated:

We are going to be very diligent in that process (integration) to make sure that first and foremost we protect the assets that Kindred is buying, the asset being our people and our patients. We will continue to update you on a weekly basis.Gentiva has made our great hospice a shell of its former self. The first post merger announcement plan filed with the SEC was the creation of a $10 million executive bonus pool. Gentiva senior executives will make millions in multiple ways through the sale of their company.

We need all of you to focus on taking care of our employees and being proud of this transaction.

I want to echo what Tony stated. Each of you on this call are the reason why this transaction has taken place. Your commitment, your dedication through all the things, the headwinds we've been through; you've made Gentiva a great company and each of you should be very proud of your accomplishments.

There is no pool for employees, the supposed group that created Gentiva's value. This shows what little regard do they have for their workers. Watch to see what weekly communications occur.

One thing's for sure, Gentiva's commitment to its employees is weak. Top management's commitment to self is unparalleled.

Anonymous (from Gentiva)

Thursday, October 16, 2014

New Gentiva Executive Bonus Pool

StrangeTony,

In addition to millions in proceeds from their stock holdings, huge sums from change of control and severance payments, Gentiva senior leaders will get a share of $10 million in executive bonuses:

The Company’s core management team (as determined by the Compensation Committee of the Company’s Board of Directors) will be eligible to receive bonuses from a $10 million executive bonus pool to be allocated at the sole discretion of the Compensation Committee. At least a significant minority of such bonus pool will be allocated to core management team members other than the Executive Chairman.As for employees (who created the value for which Kindred bid extra), we're to keep our head's down and slave away. There is no bonus pool for us.

In addition, subject to the sole discretion of the Compensation Committee, the Executive Chairman will receive for 2014 and 2015 bonus payments in the ordinary course (apart from the timing of payment), both of which will be payable on or before Closing. If these ordinary course bonus payments are paid to the Executive Chairman, the amounts paid will be in the discretion of the Compensation Committee but will not exceed $2 million for 2014 and $1 million for 2015.

Executives will also benefit from the acceleration of restricted stock, options and performance cash awards. Employees will receive the benefit of "being part of a stronger, larger company and the greater career and professional development opportunities created by the transaction." Yipppeeee!

Anonymous (from Gentiva)

Sunday, October 12, 2014

Value Givers: Executive Pander or Actionable Statement?

StrangeTony,

Deal fees for Kindred's purchase of Gentiva are projected at $183 million. A $4,000 bonus for every one of Gentiva's employees totals $184 million. Surely, the group that drove our company's value in Kindred's eyes, Gentiva 46,000 employees, earned the extra million.

It's time for Gentiva's senior leaders to put action behind their words. If they mean it, top executives should quit pandering and compensate. If they don't mean it, is anyone really surprised?

Anonymous (from Gentiva)

Saturday, October 11, 2014

Kindred Fulfills Debt Gentivaism

StrangeTony,

Kindred's buyout of Gentiva levers one recently offered "Gentivaism":

We reduce our dependence on debt by adding more.Kindred will borrow between $1.3 and $1.4 billion to buy Gentiva. Gentiva currently has just over $1 billion in debt. That's a 30 to 40% increase in debt for the company, which will be rolled into Kindred at Home. Kindred executives would not give an expected interest rate to investment analysts in their recent call. CNBC's talking heads noted financial instability would increase interest rates. Kindred projects $183 million in deal fees.

Gentiva refinanced much of its debt when it closed on Harden Healthcare's hospice, home health and community care assets. .Deal fees for Harden were $30.7 million.

Money changing (deal) fees will total over $210 million for Kindred-Gentiva and Gentiva-Harden. Kindred is already highly levered, which carries great risk in an uncertain financial environment. Add $300 to $400 million in new debt and things could get interesting.

Does anyone recall what happened to LTAC provider LifeCare? The highly levered company declared bankruptcy. It emerged from Chapter 11 earlier this year.

Add that Kindred utilizes derivatives for "protection." The financial crisis saw derivatives become massive financial obligations, not the expected insurance. Who thought healthcare companies would become a mirror of Wall Street, obsessed with financial language and employing word tricks that mask that which is actually happening.

Anonymous (from Gentiva)

P.S. - A recent SEC filings stated "Kindred has also obtained $1.7 billion in financing commitments." That's up from $1.3 to 1.4 billion. Investment banks and Kindred-Gentiva are calling the deal "Project Falcon." Borrowing $1.7 billion to finance a $1.8 billion deal is leveraging, plain and simple.

Thursday, October 9, 2014

Gentiva Sold: Kindred Wins!

StrangeTony,

Gentiva's stock roared, up nearly three dollars on the day as the company announced it would sell 100% of its shares to Kindred Healthcare. Gentiva shareholders will receive $14.50 in cash and $5 in Kindred stock in the buyout.

It was fascinating to hear Gentiva executives describe the deal to employees. Senior leaders pressed hard to get the bid up to $18.50 and eventually the agreed upon $19.50. They will endeavor to ensure that benefits remain as planned, although employees' 2015 health insurance surprise is yet to be revealed.

Kindred does not need two executive suites and the acquirer calls the shots on who remains. Kindred expects $70 million in annual cost savings after year one, so Gentiva's top layer could soon be gone.

Kindred's investor call occurred at 9:00 am. Due diligence gave Kindred confidence in Gentiva as an operator, in the company's financial performance and its accomplishments via the OneGentiva initiative.

From my view OneGentiva aligned employees in ensuring the company's senior leaders are personally enriched. Patient care is a clear afterthought. Who can forget senior leaders declaring earlier this year:

We've had some rocky years. In this industry there's been a negative environment that's been out there in both the home health and hospice. We all hope that will subside over time and we'll get back to focusing on the patient need, patient care and the industry will start to climb again.

Gentiva's employee call came at 3:30 pm. Leaders stated Gentiva employees did the work that enabled executives to return this incredible deal. Which set of Gentiva employees deserve the credit? Is it the 47,000 cited in CEO Tony Strange's December 2013 investor presentation or the 46,000 referred to in sellout documents. How will the 1,000 employees who lost jobs be rewarded in Gentiva's incredible deal? How will the current 46,000 actually benefit?

Gentiva leaders have three months to put their words into action. Will they share the tiniest bit of over $40 million in cash flow the last quarter? How much did that grow in the just ended third quarter? This crew is not know for sharing. In my tenure with the company there has been one year of raises and it was paltry.

The handful at the top will be richly rewarded. This is the gross value of their stock holdings.

The number does not include stock issued between now and the deal's close, nor does it include change of control or severance obligations, also known as golden parachutes.

It's hard on the ego to go from running a company to heading up a division. Gentiva's hospice, home health and community care operations will end up in the Kindred at Home division.

Gentiva's 46,000 employees should keep their heads up between now and the deal's close. Kindred's slides show Gentiva with 39,500 caregivers as of June 30, 2014. What happened to 6,500 Gentiva workers? Have they been whittled during the due diligence process or is more pain to come?

Unfortunately, no Wall Street analyst honed in on the discrepancy between buyer and seller on total employment. It's our burden to experience.

Kindred CEO Paul Diaz said the deal is immediately accretive, i.e. will have a positive impact on the company's financials. This portends a continuation of Gentiva's low to no raise wage practices. Diaz' effusiveness as to Gentiva's operations focused mostly on financial measures. This is another bad sign.

Yes, Gentiva employees should wait for concrete action by Kindred's integration teams. Kindred is free to offer more substantial language in its aims toward Gentiva employees. Nothing prevents leadership from offering an overall human resource strategy to employees joining the Kindred family.

I asked a longtime physician how many healthcare mergers/acquisitions improved care in his time practicing. Only one out of ten did. That merger occurred in a time when leadership had balance between the various management disciplines. That era is long gone.

There is a limit as to how much people can give a company. I've seen Gentiva push beyond that numerous times and pay the price via turnover. Kindred's integration teams should be wary of making the same mistake.

Anonymous (from Gentiva)

P.S. - The 2015 surprise is a 15% reduction in employer health insurance contributions

Saturday, October 4, 2014

Gentiva: Trick or Treat?

StrangeTony,

September passed without a deal announcement. It's now an October event. Recent instability in the stock market could spill into the debt arena. This would not concern Kindred, given it raised over $200 million in cash from a June secondary offering:

Kindred Healthcare Inc (NYSE: KND) priced a 9,000,000 share secondary stock offering at $23.75 per share. Buyers in that offering made a considerable investment into the company, expecting that their investment would go up over the course of time.Kindred stock closed at $20.04 on Friday, down $3.71 a share from the secondary.

The unnamed suitor, Kindred's competitor, would likely need to borrow a significant amount to close any deal priced at $17.25 a share or higher.

Recent trading in Gentiva has been at a discount to this announced price. The stock closed yesterday at $16.74 per share, a 51 cents discount to the last publicly shared offer. This means there is some uncertainty as to a deal being completed at the $17.25 offer.

Employees know that costs are being mircro-managed, which means people are as well. Many survived the Ides of September. How many will get through Shock-tober?

Anonymous (from Gentiva).

Tuesday, September 30, 2014

Gentiva Polishing Financials Prior to Sale Hurts Real People

StrangeTony,

Gentiva CEO Tony Strange was effusive in his praise for senior leaders in the company's last earnings call:

I think they have done yeoman's work in getting out ahead of the costs on the cost side of One Gentiva. So I think from a cost perspective, I would tell you that we are where we expected to be or even further along from where we expected to be.

Those on the inside know One Gentiva cost cutting did not slow in the third quarter. In fact it accelerated. The company decimated our site, a serious blow given the ongoing trauma inflicted by our Branch Manager. We no longer give exceptionally good care and for that I grieve.

Due diligence is the period where reductions are made so the new owner doesn't look like the bad guy. It puts the company in a position to pay higher interest expenses on an ongoing basis, assuming revenues don't drop.

Think of it like a new home where the buyer takes on a bigger mortgage. Without more income something has to be cut to fund the increased house payment. It could be food, electricity, clothing, whatever. In Gentiva's case it's anything and everything. Leaders are cutting expenses willy-nilly.

One Gentiva continues to shed employees, some completely while others face hour reductions. The company expects savings.

Any employee wanting to put a dent in those savings and help themselves at the same time should explore unemployment benefits. It varies by state but consider this advice from 2009:

Karin Patrick of Roseville works for a small non-profit agency and it's not doing well. Patrick's hours were cut from five days a week to three. A colleague, however, was laid off.

So, Patrick decided to see what the state could offer her if she eventually gets laid off too. What she found was that she didn't have to wait, she could apply for benefits right now.

"That was a big surprise," she said. "I'd never heard that."

Lee Nelson of the state's Department of Employment and Economic Development - or DEED - said placards in workplaces describing unemployment benefits clearly say that you can get state help if your hours are reduced.

"I don't think in anyway it's hidden from people. You won't find it on a billboard anywhere," he said.

Gentiva buys unemployment insurance and the more people that use it, the more Gentiva will pay in the future. This may be an option for those who've been laid off or had their hours reduced. Think about it if you've been harmed in the latest round of cuts. You could help yourself and thumb corporate chiefs simultaneously. That's not a bad bargain.

Q3 ends in a few hours. How will this nefarious crew torment employees in Q4?

Anonymous (from Gentiva)

Thursday, September 25, 2014

Hollow Commitments to Date

StrangeTony,

Nearly five months ago Gentiva executives spoke with employees about Kindred's public offer to buy our company for $14 per share.

"I can't predict what they will do next. Um, but what I will commit to is that we will keep you informed. We will, um, uh, keep uh communication going through these types of calls, we'll keep communication coming in the form of um written updates, matter of fact uh, by the time we finish this call there will be a written update, uh, that'll go out to the whole company afterwards. So, with all that said, um, I'm, I'm feeling good about where we are, I'm feeling good about our results, I feel good about where we're headed. I feel best of all about the care we're providing to 110,000 patients tonight."--CEO Tony Strange 5-15-14

"We want to be transparent with our employees and communicate, keep you informed of exactly what's happening inside the company."--Executive Vice President & COO David Causby

The silence from Atlanta is deafening. Our site moved from the gold standard to silver, then copper. Due diligence turned us into lead under Tony Strange and David Causby. As usual they paid lip service to employees at the end of the call.

"(With One Gentiva) we focused on putting our patients and employees in the center of what we do every day."--Executive Vice President & COO David Causby

Who knew "what we do" would be a bulls eye? Silence, no raises, job cuts and hour reductions show their true commitment. It's to their and Wall Street's pocketbooks.

Anonymous (from Gentiva)

Sunday, September 14, 2014

Kindred Talks Gentiva in NYC

StrangeTony,

Kindred CEO Paul Diaz spoke on September 10 at the Morgan Stanley Global Healthcare Conference. He had this to say about his firm's pursuit of Gentiva:

I can't obviously comment on the Gentiva transaction specifically, other than that we continue to do our work and the Gentiva management team has been, you know, really good and forthcoming. They've obviously make a lot of progress here in the last couple of quarters, so that excites us and sort of reinforces the investment thesis as we see it. But, whether the investment thesis is through a Gentiva transaction or through other opportunities in the marketplace, as I referred to before, we just see tremendous opportunities to extend the recovery period, prevent re-hospitalizations and to get on the front side of care for the most critically ill patients in America, chronic patients. Those patients joining the Medicare program each day through home based models, through medical homes if you will. And there's an enormous opportunity also as we have a better dialogue about end of life care and the opportunities for palliative care through hospice and palliative care services. So a logical extension of our service continuum is home based care and home based care models.Gentiva is "just one path" in Paul Diaz's strategic and financially accretive future.

We view Gentiva and the other acquisitions in our pipeline today, you know as a great opportunity to really more aggressively grow.

It's about growth, capital deployment. And we see lots of opportunities in addition to Gentiva to grow, you know over the next several years.

Kindred has $100 to $300 million to put to work in buying home health and hospice providers. Diaz is excited about Gentiva, but can pivot. It's but one way for Kindred to grow.

The Ides of September near and with it a Gentiva board decision on the winning bidder looms. Will debt markets hold for the deal to close? The Morgan Stanley representative did not speak to that.

Anonymous (from Gentiva)

Wednesday, September 10, 2014

Gentivaisms

StrangeTony,

At Gentiva:

This leads to the famous quote by Astronomer Carl Sagan:

My site is deep in the bamboozle with layers of charlatan's imposing their distorted will. I don't think this will end with a buyout. Charlatans will have new executives/investors to bamboozle. Meanwhile, due diligence is killing us.

Anonymous (from Gentiva)

At Gentiva:

1. We grow by shrinking.

2. We listen to our employees by not asking for their opinion, ignoring their words when offered anyway and by firing anyone who dares to speak out.

3. We invest in people who turn over quickly.

4. We show our value of staff by cutting positions and reducing hours.

5. We support employees dealing with stressful work by cutting the rate employees earn paid time off, hiding it deep in series of policy updates.

6. Our employees, our most valuable asset, get no raises most years

7. We take a long term approach by selling out to the highest bidder

8. We manage by whim & impulse, delegating blame when things go poorly.

9. We focus on the big picture by micromanaging.

10. We prioritize image management over substance.

11. Our Human Abuse Department is unparalleled and leaves high marks.

12. We provide exceptional service which is a best mediocre.

This leads to the famous quote by Astronomer Carl Sagan:

"One of the saddest lessons of history is this: If we’ve been bamboozled long enough, we tend to reject any evidence of the bamboozle. We’re no longer interested in finding out the truth. The bamboozle has captured us. It’s simply too painful to acknowledge, even to ourselves, that we’ve been taken. Once you give a charlatan power over you, you almost never get it back.”

My site is deep in the bamboozle with layers of charlatan's imposing their distorted will. I don't think this will end with a buyout. Charlatans will have new executives/investors to bamboozle. Meanwhile, due diligence is killing us.

Anonymous (from Gentiva)

Sunday, September 7, 2014

Gentiva Insiders to Sell All at Once?

StrangeTony,

The looming sale of Gentiva to Kindred or an anonymous investor will give insiders the chance to profit handsomely from their stock holdings. Investors expect the impending deal to come in higher than $17,25 per share, the last publicly shared bid by both parties.

Kindred would jettison much of Gentiva's senior management team to achieve cost savings, which explains the cold shoulder CEO Tony Strange and the board have given Kindred since its first paltry offer of $13. I assume the anonymous investor would keep Gentiva's management team in place. For this reason insiders are cheering for the white knight.

In this scenario senior leaders and board members could roll their equity into the deal, effectively becoming part owners with the anonymous investor. If not, they'll have a big payday, get to keep their jobs and have a chance to earn an equity stake in the new company, which I assume will be private.

Gentiva is already highly leveraged, having overpaid and over borrowed for both Odyssey and Harden. "Due diligence" means conversations with senior management on making the deal work for the buyer. How much additional debt will Gentiva be saddled with? How much will the company's interest expense increase? Will the buyer charge the company millions in deal fees and annual management fees?

Money to pay interest and fees will need to come from somewhere. That means more operational cuts for home health agencies and hospices (as if there already hadn't been enough). Anyone hurt by Gentiva leaders' polishing the company for maximum sale price should give our leaders the feedback they deserve. Comments anyone on the state of leadership at Gentiva?

Anonymous (from Gentiva)

The looming sale of Gentiva to Kindred or an anonymous investor will give insiders the chance to profit handsomely from their stock holdings. Investors expect the impending deal to come in higher than $17,25 per share, the last publicly shared bid by both parties.

Kindred would jettison much of Gentiva's senior management team to achieve cost savings, which explains the cold shoulder CEO Tony Strange and the board have given Kindred since its first paltry offer of $13. I assume the anonymous investor would keep Gentiva's management team in place. For this reason insiders are cheering for the white knight.

In this scenario senior leaders and board members could roll their equity into the deal, effectively becoming part owners with the anonymous investor. If not, they'll have a big payday, get to keep their jobs and have a chance to earn an equity stake in the new company, which I assume will be private.

Gentiva is already highly leveraged, having overpaid and over borrowed for both Odyssey and Harden. "Due diligence" means conversations with senior management on making the deal work for the buyer. How much additional debt will Gentiva be saddled with? How much will the company's interest expense increase? Will the buyer charge the company millions in deal fees and annual management fees?

Money to pay interest and fees will need to come from somewhere. That means more operational cuts for home health agencies and hospices (as if there already hadn't been enough). Anyone hurt by Gentiva leaders' polishing the company for maximum sale price should give our leaders the feedback they deserve. Comments anyone on the state of leadership at Gentiva?

Anonymous (from Gentiva)

Thursday, August 28, 2014

Gentiva's Labor Day

StrangeTony,

Thought your readers might enjoy these in honor of the upcoming Labor Day weekend. Gentiva's overall rating on Glassdoor fell by 12% from six months ago, The Employee Relations bar continues its free fall at Gentiva. Then again, these could be Human Abuse stretch goals. How many employees were laid on the rack this week?

Anonymous (from Gentiva)

Monday, August 25, 2014

Fawning over Tony

StrangeTony,

The Gentiva Board of Directors, the group that will decide who wins the company, said this a few months ago:

In nominating Mr. (Tony) Strange for re-election as a director, our Board of Directors focused on his leadership and execution as our chief executive officer in growing Gentiva, his driving and integrating significant acquisitions by Gentiva and his setting and communicating the proper cultural and behavioral tone as important attributes and experience for his continuing to serve as one of our directors.

It's hard to see how Tony grew hospice. He finally confessed to Wall Street analysts he didn't have the key to unlock hospice marketing. The Harden acquisition resulted in many hospices closing via a "branch rationalization."

The proper cultural and behavioral tone flowed down to the site level where we experienced no raises for years, until the paltriest crumb fell from the executive table. However, we're back to no raises again. Apparently we did not show enough gratitude for the morsel senior leaders tossed our way.

Strange does thank employees at the end of each investor call for what we do on a daily basis to enrich him and those who will decide our fate in the buyout. I imagine all 42,000 Gentiva employees saying in unison, "Our pleasure!"

Everything about Gentiva is exceptional and it starts at the top. I frequently take exception to them and their myopic actions. Our leaders are unusual, uncommon, atypical and abnormal. I'll add another "a word", abysmal. It's the outcome of a health care world with the absolute wrong priorities.

Anonymous (from Gentiva)

Thursday, August 21, 2014

Gentiva Winner Should be Revealed by Ides of September

StrangeTony,

Two bidders remain for Gentiva, Kindred and an unnamed investment firm. They are in due diligence at the moment sharpening their pencils for a possible higher bid. Benzinga reports that Kindred may have the upper hand.

They suggest the unnamed investment firm is Formation Capital. owner of long term care provider Genesis. Genesis is in the process of merging with Skilled Healthcare in a stock only deal. Benzinga's story believes this stock deal would consume Formation Capital's time and resources, making it more likely Kindred will win Gentiva.

A stock for stock deal doesn't seem complex. It does not require arranging any debt to fund the combination. It's more like a merger than an acquisition.

Formation Capital has five unrealized affiliates, all in the post acute health care space. Formation does not need to combine Gentiva with Genesis. It could acquire Gentiva and keep it a stand alone company. It could roll in its existing hospice and home health companies, LifeChoice Hospice (seven hospices) and Millenium Home Health (twelve home healths), which have nothing to do with Genesis.

Gentiva considered calling its higher interest debt in September 2014 and arranging lower rate financing. It wanted to acquire other businesses in the hospice, home health and community care space. Conceivably, Gentiva could remain a wholly owned Formation affiliate and fulfill this previously stated vision.

What if the unnamed investment firm is not Alpharetta based Formation Capital? That means its back to the bidder with the deepest pocketbook and ability to raise debt.

Gentiva senior leaders would love to be acquired by an investor that believes in them and their vision. That sole criteria would give the unnamed investor an upper hand in the Gentiva boardroom. The Ides of September should reveal Gentiva's winner. Expect lots of silence until then.

Anonymous (from Gentiva)

Thursday, August 14, 2014

Gentiva Under Justice Department Investigation

StrangeTony,

Gentiva made the financial news:

I wasn't sure there were any Harden Hospices left, given Gentiva acquired 69 then closed 50. At least two remain and those are being investigated.

Anonymous (from Gentiva)

Gentiva made the financial news:

On or about June 19, 2014, the Company received a Civil Investigative Demand from the U.S. Department of Justice, Western District of Missouri, under the federal False Claims Act requesting complete medical records for 14 hospice patients and other documents of Hospice Care of the Midwest, L.L.C., a subsidiary of Harden Healthcare Holdings, LLC (“Harden Holdings”), for the period from January 1, 2009 through June 19, 2014. The Company is in the process of complying with the demand for documents and is cooperating with the investigation.What a difference ten days made in the telling of a prior story:

On or about June 9, 2014, Iowa Hospice, L.L.C., a subsidiary of Harden Holdings, received a Subpoena Duces Tecum (“Subpoena”) from the Office of Investigations, Kansas City Regional Office of the Office of Inspector General of the Department of Health and Human Services. The Subpoena requests complete medical records for 17 hospice patients and other documents of Iowa Hospice, L.L.C. for the period from January 1, 2007 through June 9, 2014. Harden Holdings is in the process of complying with the Subpoena and is cooperating with the investigation.

I wasn't sure there were any Harden Hospices left, given Gentiva acquired 69 then closed 50. At least two remain and those are being investigated.

Anonymous (from Gentiva)

Subscribe to:

Comments (Atom)